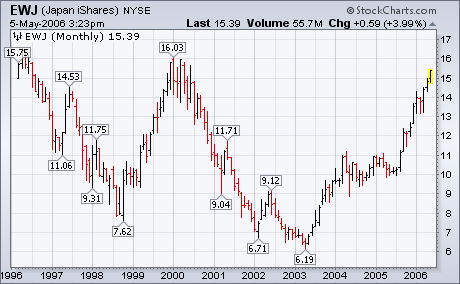

The first chart below shows why I believe Japan to be one of the best global values. While most other global markets are at or near record highs, the Nikkei 225 has recovered barely a third of its losses from 1990 to 2003. The Nikkei is still down 55% from its 1990 peak at 39,000. During that same time span, the S&P 500 has risen over 300%. What I also like about Japan is that it's been poorly correlated with other global markets over the last fifteen years. That makes it an excellent global diversification vehicle. This isn't a new view. Those of you who have followed by writing know that I was saying the same thing last summer when the Nikkei was just breaking out of a base at 12K. There is a short-term warning, however, that you should know about. The chart of the Nikkei shows the next upside resistance barrier at its early 2000 peak just over 20K. That's still 18% away from current prices. Chart 2, however, shows that resistance level to be 16.03 in the the Japan iShares (EWJ). Today's trade at 15.39 puts the EWJ within 4% of that resistance barrier. While I remain bullish on Japan, you should know that the EWJ may run into some interim resistance around that 16.00 level.