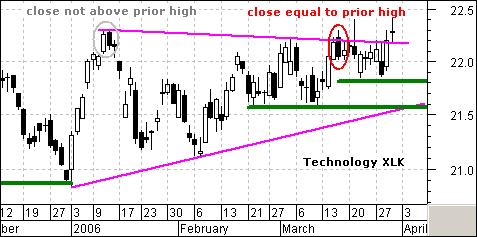

In my previous column, I featured the Information Technology SPDR (XLK) with a pair of Dark Cloud Cover reversal patterns. Greg Morris, who wrote Candlestick Charting Explained, informed me that the Dark Cloud Cover pattern is one of the few that uses the previous days high as part of its criteria. I was erroneously using the previous days close. The Dark Cloud Cover forms when the open is above the previous days HIGH and the close is below the mid point of the body of the previous day.

In early January, the XLK open was above the previous days close, but below the prior high. In mid March, the open was equal to the previous days high. Close, but still no cigar. Using the high for the previous day makes this pattern an even more dramatic reversal. It takes a bigger surge to open above the previous days high and a bigger failure to then close below the mid point of the previous days body. This price action shows that buying pressure continued with a strong open, but the bears took control and forced a relatively weak close.

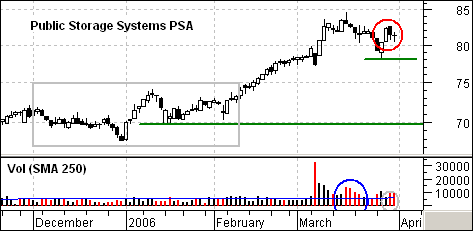

Interest rate sensitive stocks had a rough week and I noticed that Public Storage (PSA) formed a Dark Cloud Cover on Thursday. This stock is part of the REIT group and has enjoyed a nice run up over the last few months. Things could be about to change as the stock declined on above average volume in mid March and then formed a Dark Cloud on above average volume Thursday. A move below 78 would break support from the prior low and confirm the Dark Cloud Cover pattern. My downside target would then be to the support zone around 70.