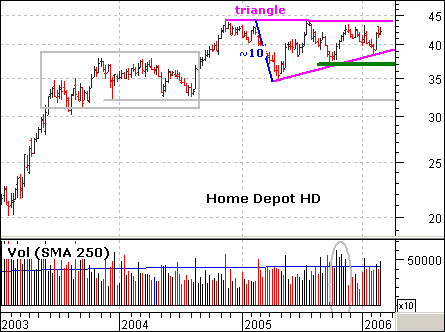

HD is no stranger to long consolidations. The stock surged in 2003 and then consolidated for a year (gray box). The advance continued with a surge in 2004 and the stock consolidated over the last 12 months with a large triangle. The gains from 2003 and 2004 are largely holding and the ability to maintain high prices is bullish.

The next big move, however, is dependant on the direction of the consolidation breakout. A move below 37 would break key support and be most bearish. A move above 44 would break the upper trendline and 2005 high. This would forge a 52-week high and project a move to the mid 50s. I found this target by adding the width of the triangle to the breakout point (44 + 10 = 54). Such a move would be bullish for the stock, the retail group, the Consumer Discretionary sector and the overall market.

Volume and broad market strength favor a break to the upside. First, the broader market is strong right now. The Dow recently broke to a 4 1/2 year highs and the S&P 500 is holding its November breakout. Second, upside volume (black volume bars) in Home Depot has been outpacing downside volume (red volume bars). The Oct-Nov surge featured good volume (gray oval) and upside volume has been higher than downside volume in 2006. Volume often precedes price and this points to an upside breakout.