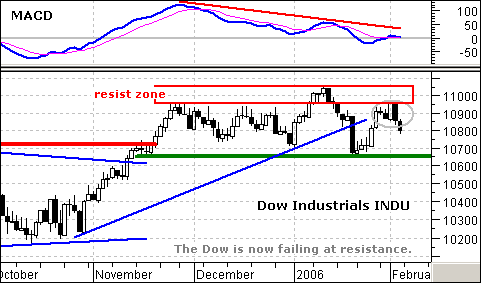

The Dow is meeting staunch resistance around 11000, a level that turned the Average back in December and January. February is getting off to the same start with a big black candlestick on Thursday and 11500 remains the level to beat. In addition to a failure at resistance, MACD has a large negative divergence working and is poised to dip into negative territory for the second time this year. Things are looking bleak for the Dow.

We also have a non-confirmation with the Dow Transports in January. The Dow Transports moved to a new reaction high in late January, but the Dow Industrials failed to exceed its early January high and formed a lower high. Despite strength in BA and UTX, the Dow Industrials is not as strong as the Dow Transports. This is a Dow Theory non-confirmation and a move below the January lows (both Averages) would provide a Dow Theory sell signal. Also notice that RSI formed a large negative divergence over the last few months and upside momentum is waning for the Dow Transports.