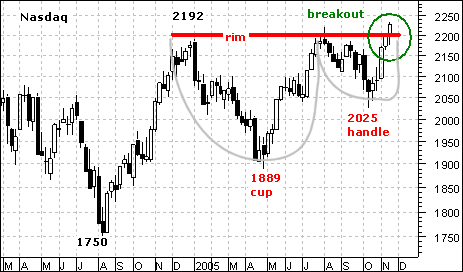

The Nasdaq's breakout at 2200 confirms a bullish cup-with-handle pattern and targets a move to around 2500. Until there is evidence to the contrary, this is the dominant chart pattern and further gains should be expected.

William O'Neil of Investor's Business Daily (IBD) developed the cup-with-handle pattern. It is a bullish continuation pattern that marks a corrective period followed by a minor pullback and a breakout. Looking at the Nasdaq chart, I think the characteristics of a bullish cup-with-handle are present. First, there was a sharp advance from 1750 to 2192. This established the uptrend. Second, there was a decline to 1889 and then another move to resistance around 2200. This correction formed the cup and established rim resistance. Third, the index pulled back to 2025, formed a higher low and then surged above resistance at 2200 over the last few weeks. This mild correction formed the handle and the breakout confirmed the pattern. The depth of the cup is added to the breakout for an upside projection. This breakout is bullish and should be treated as such until proven otherwise.

What would it take to prove this breakout otherwise? The breakout should hold and a move back below 2200 would be negative. However, I would not give up on the pattern on the first sign of weakness. It would take a failure at resistance AND a break below the handle low at 2025 to fully reverse the current uptrend and turn bearish.