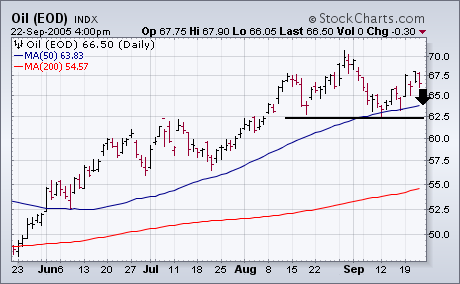

Today's selloff in oil of more than two dollars may be completing a right shoulder in a short-term head and shoulders top in the key commodity. The September bounce has fallen well short of the late-August peak (the head) and is about equal to the early August peak (left shoulder). It's now challenging its 50-day average and may be headed for a test of the neckline near 62.50. A close beneath that support line would turn the short-term trend down. That would weaken energy stocks even further. I'm not suggesting that the long-term bull market in energy is over. I am suggesting that it's come too far and is need of some correcting. I also believe that the price spikes from the two recent hurricanes have probably been overdone. What better time to take some energy money off the table when TV stations are talking about nothing else. One TV station showed a chart of the XLE yesterday and said it was a good thing to buy when oil prices are rising. That's the "kiss of death" in any rally.