ChartWatchers August 20, 2005 at 10:04 PM

There is growing evidence that a bull market top is finally in place, but not all the evidence supports that scenario... Read More

ChartWatchers August 20, 2005 at 10:03 PM

The current broader market decline has brought the Housing Index ($HGX) into clear focus; magazine after newspaper after TV show are talking about whether housing is overvalued and ready for a decline... Read More

ChartWatchers August 20, 2005 at 10:02 PM

- After a week off, John's back at his perch, watching the markets like a hawk and reporting the technical developments to his subscribers... Read More

ChartWatchers August 20, 2005 at 10:01 PM

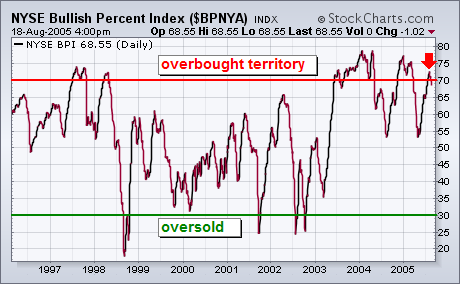

One of the ways to determine if the stock market is in a long-term overbought or oversold area is to chart the NYSE Bullish Percent Index which is shown in the chart below. The BPNYA measures the percent of stocks that are on point & figure buy signals... Read More

ChartWatchers August 20, 2005 at 10:00 PM

The Dow continues to oscillate around 10,600 without much direction right now - sometimes getting near 10,700 - other times falling as low as 10,500... Read More

ChartWatchers August 06, 2005 at 10:05 PM

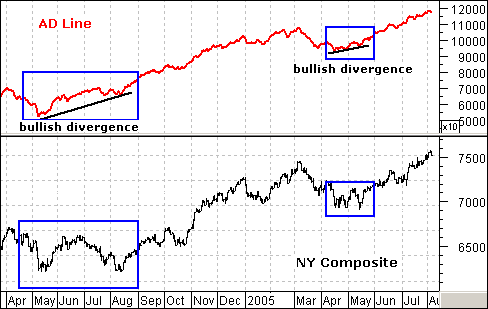

Bullish and bearish divergences in the AD Line often precede significant bottoms and tops. Even though reversals are certainly possible when the AD Line is keeping pace, they are the exception rather than the rule... Read More

ChartWatchers August 06, 2005 at 10:04 PM

Generally speaking, gold and the dollar have an inverse relationship -- a rising dollar causes the price of gold to decline and vice versa; however, supply and demand pressures also influence the price of gold, but it is often difficult to see them... Read More

ChartWatchers August 06, 2005 at 10:02 PM

John is taking a well-deserved break this week. Watch for updates from other respected StockCharts commentators during John's absence... Read More

ChartWatchers August 06, 2005 at 10:01 PM

The market's short-term picture continues to weaken. Yesterday I wrote about the MACD lines for the S&P 500 being on the verge of turning negative. They did that today for the S&P and several other major market averages... Read More

ChartWatchers August 06, 2005 at 10:00 PM

Having cracked the 10,600 resistance level, the Dow immediately ran into problems at 10,700 and then Friday's session ended in a disappointing close back below 10,600. Volume has remained relatively light... Read More