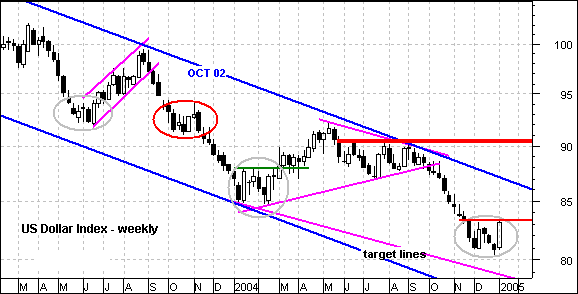

The Dollar may be giving us something to talk about.... and possibly even worthy of a short-term play. The US Dollar Index has consolidated for 4-5 weeks and formed long white candlesticks twice. These show strong buying pressure and, at the very least, reinforce support just above 80.

Notice that the index reversed course twice before with similar consolidations (gray ovals) and failed once (red oval). A move above 83.5 would be the bullish trigger and open the door to 87-88. Resistance at 83.5 is marked by the highs of the two long white candlesticks. As long 83.50 holds, the bears rule and this may keep from falling.

Even though a breakout would be quite positive, it would still be within the confines of a larger down trend. At this point, the long-term onus is on the bulls to prove the bears otherwise. This would take a trendline break and move above key resistance at 90.51. Therefore, the most we can expect currently is a corrective rally within a larger down trend.