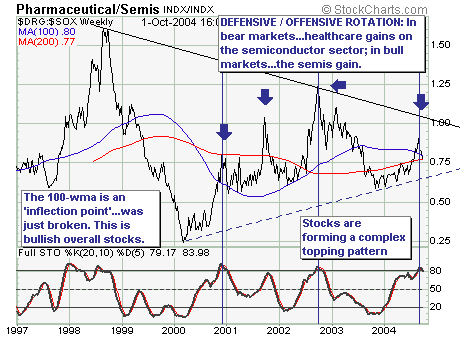

Our comments will be quite short and to the point: In bull markets the more �aggressive' semiconductor sector leads the more �defensive' healthcare sector as market participants favor stocks with higher �betas' in order to increase performance. Over the past several weeks, that is exactly what has started to happen as many hedge fund managers have quite a bit of performance to make up between now and the end of the year.

Looking at the technicals, the Drug/Semis ratio moved back below its 100-week moving average this week (see chart below). Given that development, we must consider last week's trading action to be bullish for equities. While we are uncomfortable with this viewpoint given the major structural issues at hand, the current market environment demands that we listen to the technicals and thus we are closing out selective short positions and putting on selected long positions.