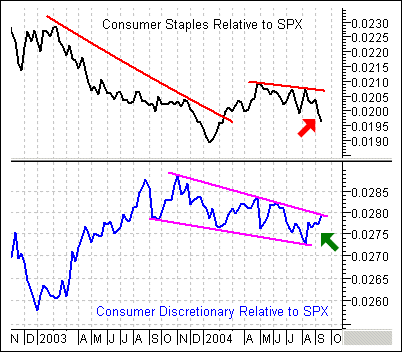

There is a most interesting development between the Consumer Discretionary SPDR (XLY) and the Consumer Staple SPDR (XLP). Relative to the S&P 500, Consumer Discretionary stocks (cyclicals) surged (green arrow) over the last few weeks while Consumer Staple stocks declined (red arrow). Weakness in staples and strength in cyclicals bodes well for the market and the economy overall. In addition, the pattern looks like a large falling wedge and it would take a move above the June high to turn bullish on cyclicals again.

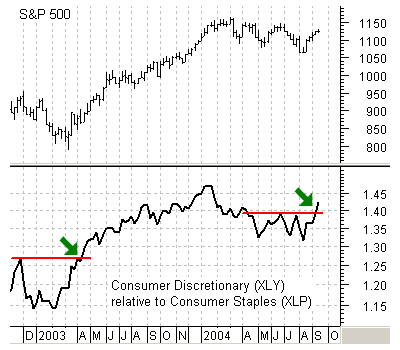

Taking this relationship one step further, we can see that Consumer Discretionary shares have recently started outperforming Consumer Staples shares. This price relative shows the Consumer Discretionary SPDR (XLY) relative to the Consumer Staple SPDR (XLP). Notice that XLY outperformed XLP from Feb-03 to Jan-04 and this coincided with stock market strength. In addition, XLY underperformed from Jan-04 to Aug-04 and this coincided with stock market weakness. Also notice the breakout in Apr-03 and the recent breakout in Sep-04. If this relationship is any guide, outperformance by XLY bodes well for the overall stock market.