The current technology "malaise" has run for all intents and purposes for the past six months; however, the recent earnings and guidance "misses" have put it on the front burner as expectations for difficult 2H 2004 comparisons have come one quarter early. The question is whether this is warranted from both a fundamental and/or technical perspective - we believe the answer is yes.

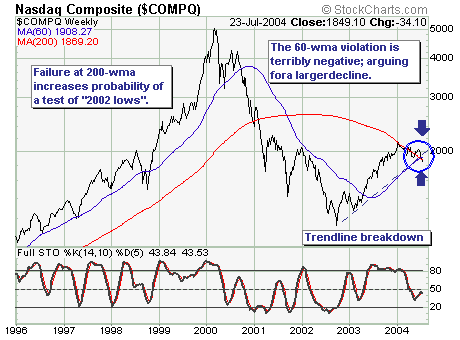

However, rather than go into the fundamental challenges; we will simply focus upon price action...which on a longer-term basis is just beginning to deteriorate. To explain, the 200-week moving average has "capped" price movement repeatedly, which has applied sufficient pressure to lead prices below trendline and 60-week moving average support levels. These simple negative breakdowns should be given enormous consideration when seeking to be a buyer of technology, as one must define one's time horizon. But for our money...we will simply seek to sell all rallies back into breakdown resistance levels as the longer-term trend has clearly changed to bearish.