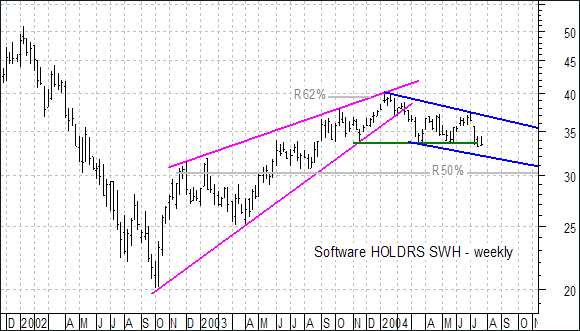

With the peak at 45.78 in January 2004, the Semiconductor HOLDRS (SMH) came relatively close to its high at 50.19. However, the Software HOLDRS (SWH) peaked at 40.20 and fell well short of its 2002 high at 50.91. SWH only retraced 62% of its prior decline and formed a classic rising wedge (magenta trendlines). Not only did SWH underpeform SMH, but the retracement and the pattern are also typical for bear market rallies. This suggest that the current decline is impulsive and SWH is headed lower.

At the very least, the current outlook is decidedly bearish and the stock appears headed for a bout with support around 30. This support level is confirmed by broken resistance (turned support), the 50% retracement mark and the lower trendline extension of a falling price channel (blue trendlines). It would take a move above the upper price channel trendline (37.5) to start thinking bull again.