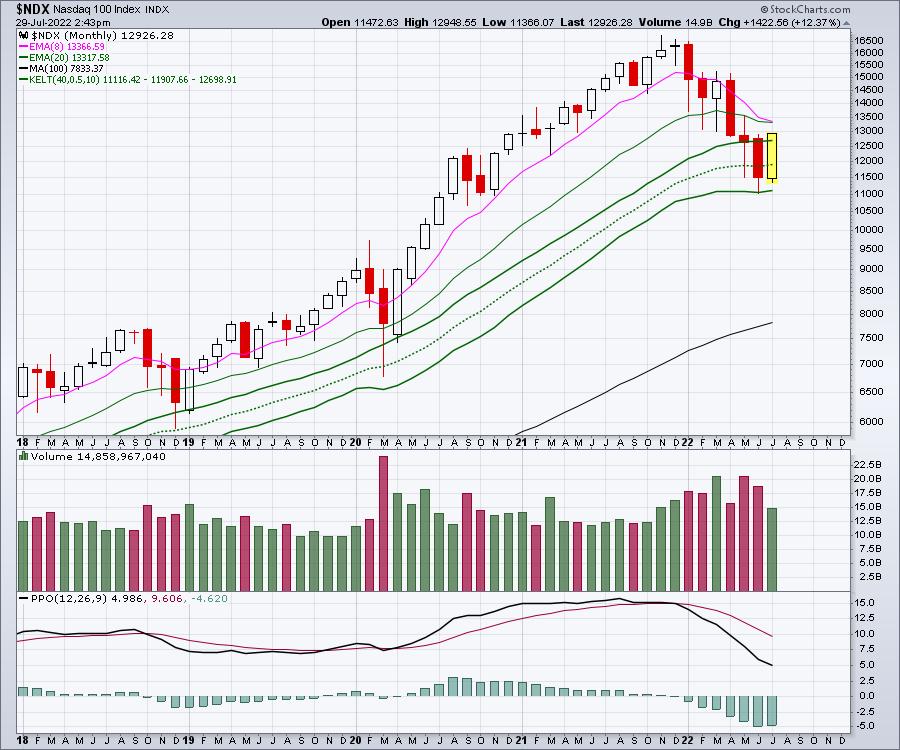

The Canadian Technician July 29, 2022 at 03:33 PM

After a choppy period between the June Fed low and the recent Fed meeting, we finally got a market resolving to the upside. While everyone has flipped to bullish, with Apple, Amazon and Microsoft pushing the indexes up, let's check our work... Read More

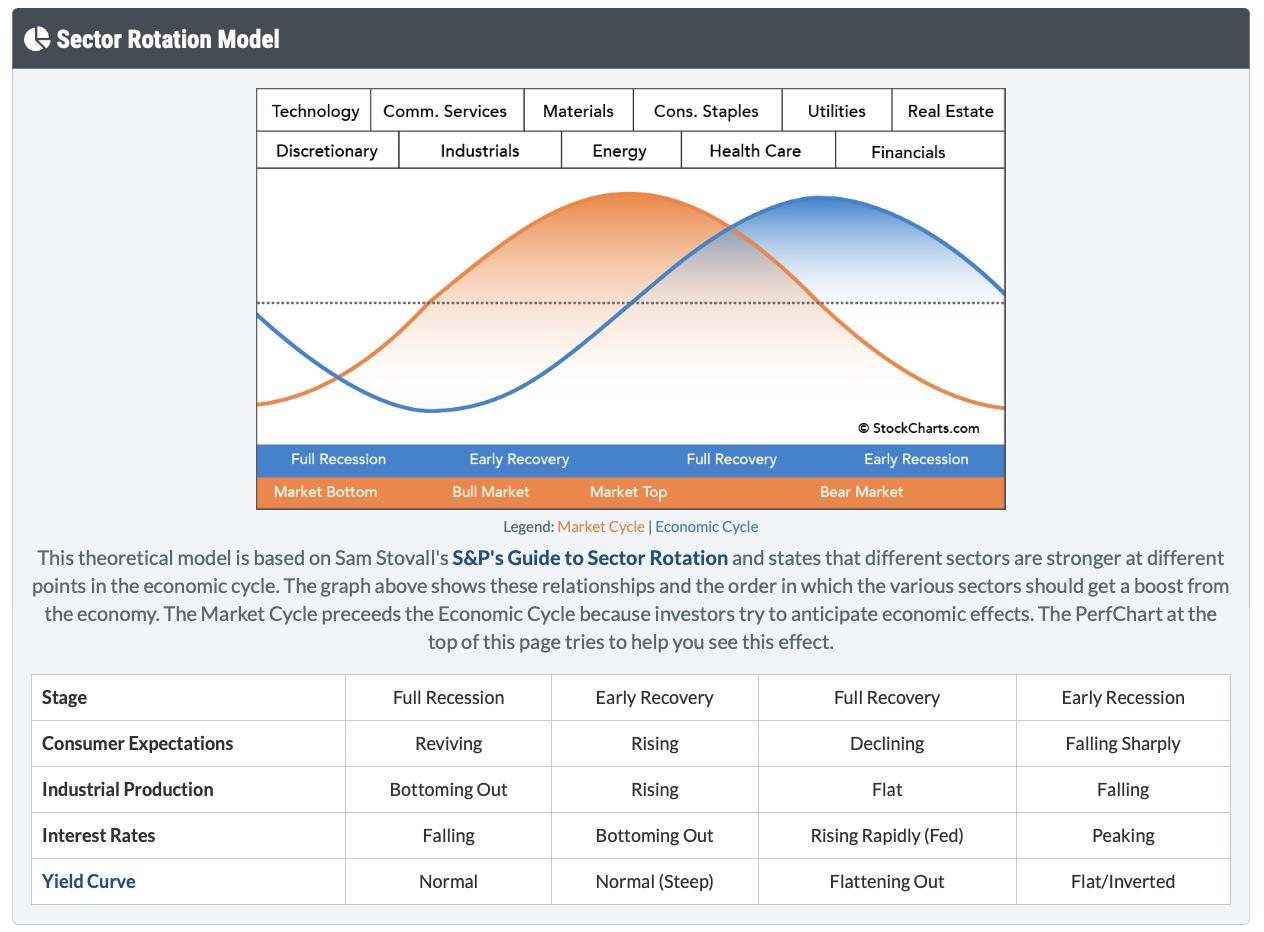

The Canadian Technician July 22, 2022 at 01:13 PM

The market is a moving target, where something new is starting to run and something that was working starts to fail. It's very frustrating for the buy and hold investor, but, for the technical world using risk management techniques, it is a continuously morphing event... Read More

The Canadian Technician July 15, 2022 at 12:50 PM

One area that has sold off extremely hard is energy, but many of the stocks are holding near their 200-DMA. If this was a long-term rally, with a deep low down at the 200-DMA, this is where we would expect a bounce. Here's an example of the oil chart on the 60-minute time frame... Read More

The Canadian Technician July 08, 2022 at 11:26 AM

Previously, I discussed the "follow-through day" concept. The problem we had was the strong pullback on June 28th cancelled the follow-through day. However, we are working our way higher as the market continues to make progress, climbing off the lows of last week... Read More

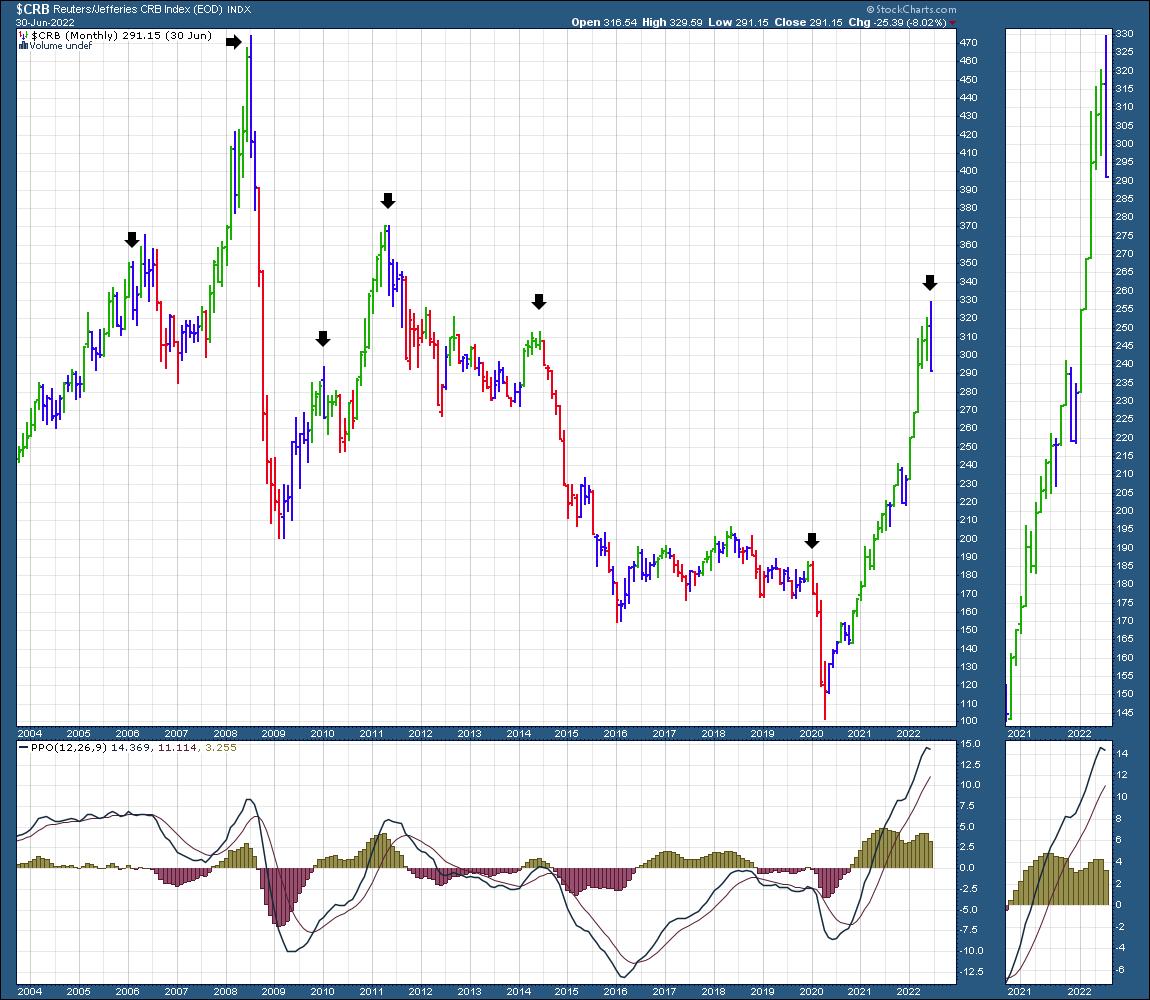

The Canadian Technician July 01, 2022 at 11:17 AM

Commodities have been a standout for two full years since the COVID lows. However, the charts faced some significant hurdles this month. This article presents a new look to the commodity charts that could help equities... Read More