Archived News

RRG Charts8mo ago

It's Been a Long Time Mr Bear, Where Have You Been?

And then .. all of a sudden.. things are heating up. Lots of (downside) market action in the past week. Let's see what sector rotation and RRGs can tell us. The RRG at the top is a daily RRG, as recent price action has significantly impacted near-term rotations Read More

Art's Charts8mo ago

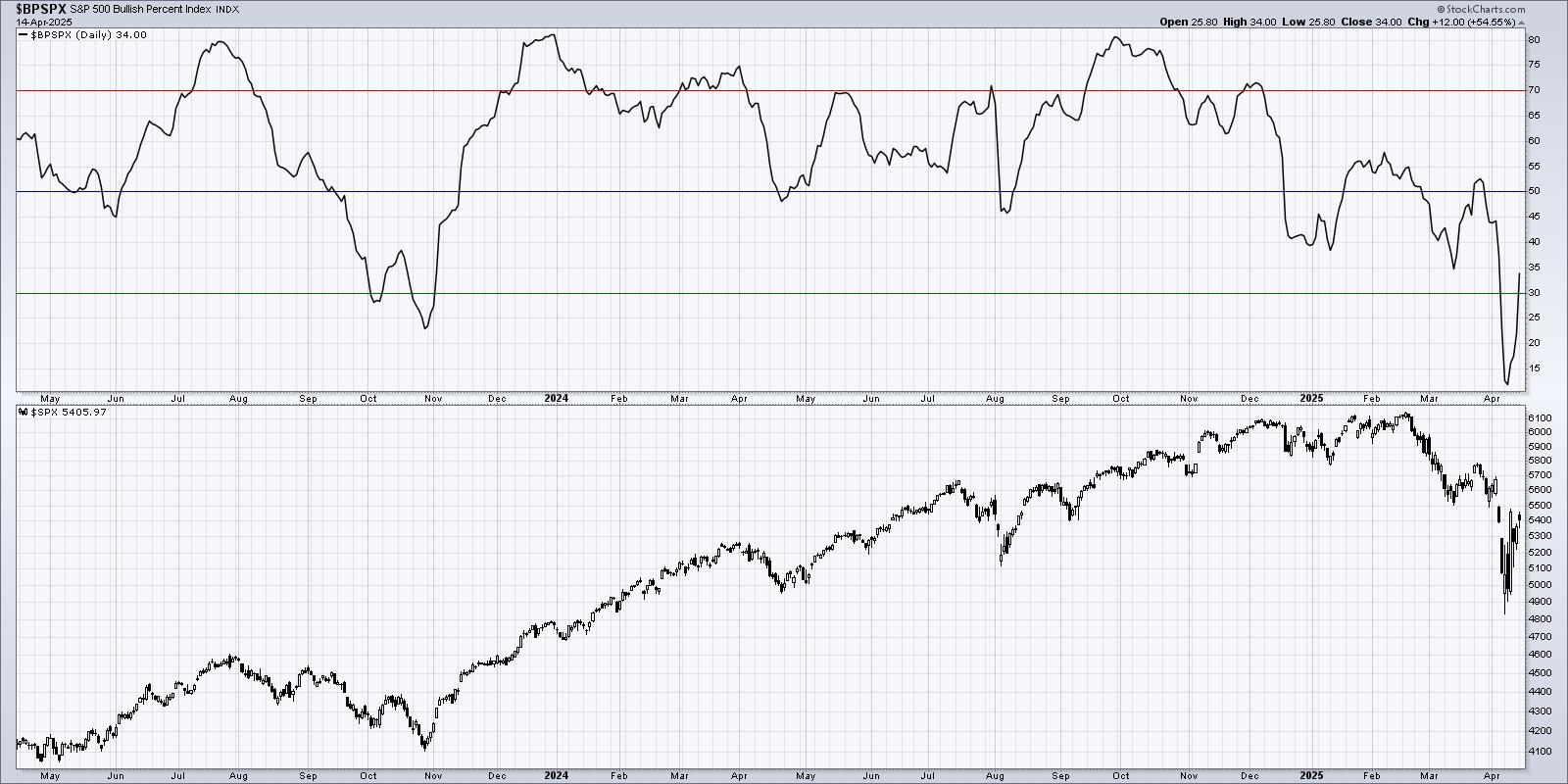

This Breadth Indicator Points to More Downside and a Potential Opportunity

The broad market and the group are big drivers for stock performance. Recently, the Nasdaq 100 ETF (QQQ) led the market lower with sizable declines over the last five weeks Read More

Don't Ignore This Chart!8mo ago

Small Caps Poised to Soar: Is Now the Time To Buy IWM?

In July alone, the iShares Russell 2000 ETF jumped upwards of 12%, outpacing the S&P 500, before retracing half that distance Read More

Trading Places with Tom Bowley8mo ago

Unbelievable! The Fed Creating Its Own Nightmare And We're The Puppets

This Fed has got to go. It's time. You've overstayed your welcome, Fed Chief Powell. I literally was just shaking my head after reading the changes to the Fed's policy statement Read More

Members Only

Larry Williams Focus On Stocks8mo ago

Bonds To Get Beat Up? | Focus on Stocks: August 2024

Don't Ignore This Chart!8mo ago

Semiconductors Are Down: Is Now the Time to Buy SMH?

Nvidia (NVDA) was perhaps the most outstanding semiconductor trade of 2024. While some people might have missed out, there are still plenty of chances to get in. But it's also wise to look for a diversified alternative Read More

ChartWatchers8mo ago

Big Tech Earnings, Fed Meeting, Jobs Report: Will They Add More Pressure to the Stock Market?

Last week, there was a noticeable change in investor sentiment. We have so much data coming out this week, and much will rest on how the trading week ends. The S&P 500 index ($SPX) broke the uptrend, and on Tuesday, it closed at the 50-day simple moving average (SMA) Read More

Wyckoff Power Charting8mo ago

S&P 500 Equal Weight ETF Gains Strength

The S&P 500 index ($SPX) is a capitalization-weighted stock index. Many lesser capitalization blue-chip stocks that compose these 500 companies have been performance laggards. Though smaller companies in the index, these corporations are among the bluest of the blue-chip stocks Read More

Members Only

Martin Pring's Market Roundup8mo ago

Is the Bond Market About To Make a Big Move?

The bond market experienced a secular bear between 1981 and the spring of 2020. Chart 1 offers three reasons why it has since reversed and given way to a secular uptrend or possibly multi-year trading range Read More

DecisionPoint8mo ago

DP Trading Room: Spotlight on Mega-Cap Earnings

This week we have four Magnificent Seven stocks reporting earnings. We also take a look at McDonalds (MCD) and Ford (F) going into earnings. How are the chart technicals setup on the precipice of earnings? Carl and Erin give you there thoughts Read More

GoNoGo Charts8mo ago

Equities Struggle As More Sectors Try To Keep the Trend Afloat

Good morning, and welcome to this week's Flight Path. Equities had another tough week last week, and we saw an amber "Go Fish" bar for the first time since this latest "Go" trend began Read More

The Mindful Investor8mo ago

Will the S&P 500 Break 5000 by September?

This week saw the major equity averages continue a confirmed pullback phase, with some of the biggest gainers in the first half of 2024 logging some major losses Read More

ChartWatchers8mo ago

Recovery Rally In Stock Market Offers Hope: What You Need To Watch

Major equity indexes rose on Friday after a selloff that hit the Technology sector especially hard. But this doesn't necessarily mean that everything is OK going into next week. Wall Street seems to be in whiplash land, veering from one market area to another Read More

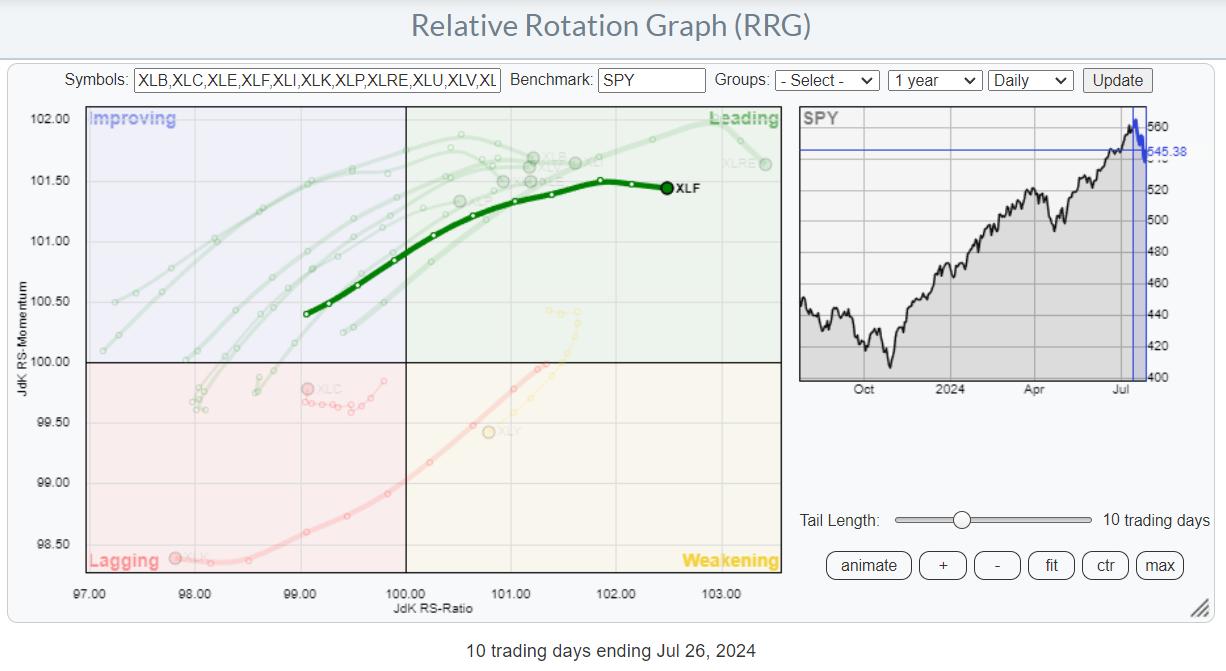

RRG Charts8mo ago

Flying Financials. Will It Be Enough?

Flying Financials In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move. On the RRG above, I have highlighted the (daily) tail for XLF to show how it stands out from the other sectors Read More

Trading Places with Tom Bowley8mo ago

New Highs Coming or Will We Collapse? What Say You, Fed Chief Powell?

This will be one of the most interesting quarters in recent memory. The Fed has got to choose its poison Read More

Art's Charts8mo ago

Nvidia Breaks the 50-day SMA: Is This a Threat or an Opportunity?

After a big run this year, Nvidia (NVDA) fell over 15% from its high and broke its 50-day simple moving average (SMA). On the face of it, a break below this "key" moving average seems like a short-term bearish signal Read More

Don't Ignore This Chart!9mo ago

Missed the Gilead Surge? Here's What You Need to Know About the Big Move

In late June, Gilead Sciences (GILD) stock surged following positive results of a late-stage trial for its latest HIV drug. The big market buzz was that Gilead was on the verge of something huge, and investors were not about to wait around for proof Read More

ChartWatchers9mo ago

After the Tech Bloodbath: Ways to Strategize Your Portfolio

Wednesday's price action in the stock market indicated that fear is back. The Cboe Volatility Index ($VIX) closed up by over 22%, the biggest percentage move for the year Read More

The Final Bar9mo ago

S&P 500 Breaks Key Trendline as Growth Stocks Plunge

In this edition of StockCharts TV's The Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators Read More

Stock Talk with Joe Rabil9mo ago

1-2-3 Reversal Pattern: What It Is and How to Use It

In this exclusive StockCharts TV video, Joe explains the 1-2-3 reversal pattern, its criteria, and what it will take for QQQ to complete the pattern. He also discusses how the pattern is not always as clean as we would like Read More

The Final Bar9mo ago

Small Caps Surge, Markets React to TSLA & GOOGL Earnings

In this edition of StockCharts TV's The Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators Read More

Don't Ignore This Chart!9mo ago

CrowdStrike's Epic Fail: Here are the Critical Trading Levels to Watch Now!

Almost everyone felt the ground shake on July 19 when security vendor CrowdStrike (CRWD) initiated a faulty software update that caused a Windows systems failure worldwide, and millions of screens displaying the infamous blue screen of death (a.k.a. BSOD) Read More

RRG Charts9mo ago

Can Small and Mid-Caps Save the Market?

In this video from StockCharts TV, Julius takes a look at the markets through the lens of the "market factors" panel you can find on your StockCharts dashboard Read More

Trading Places with Tom Bowley9mo ago

Have We Bottomed? Here Are 3 Charts To Watch

Tops and bottoms are so much fun to predict, but key signals are not always accurate. That's where a healthy dose of skepticism comes in. At EarningsBeats.com, we try to put as many signals together as possible, looking for corroboration Read More

The Final Bar9mo ago

The Stock Market is Bracing for Earnings IMPACT!

In this edition of StockCharts TV's The Final Bar, Dave breaks down today's upside recovery day for stocks, then shares the charts of TSLA, NVDA, and more Read More

DecisionPoint9mo ago

DP Trading Room: Behind the Scenes: CrowdStrike (CRWD)

Friday was a bad day for CrowdStrike Holdings (CRWD) as a bug was pushed out that disrupted Windows machines worldwide. The trouble for CRWD is the follow-up lawsuits etc that will likely plague the stock for some time to come Read More

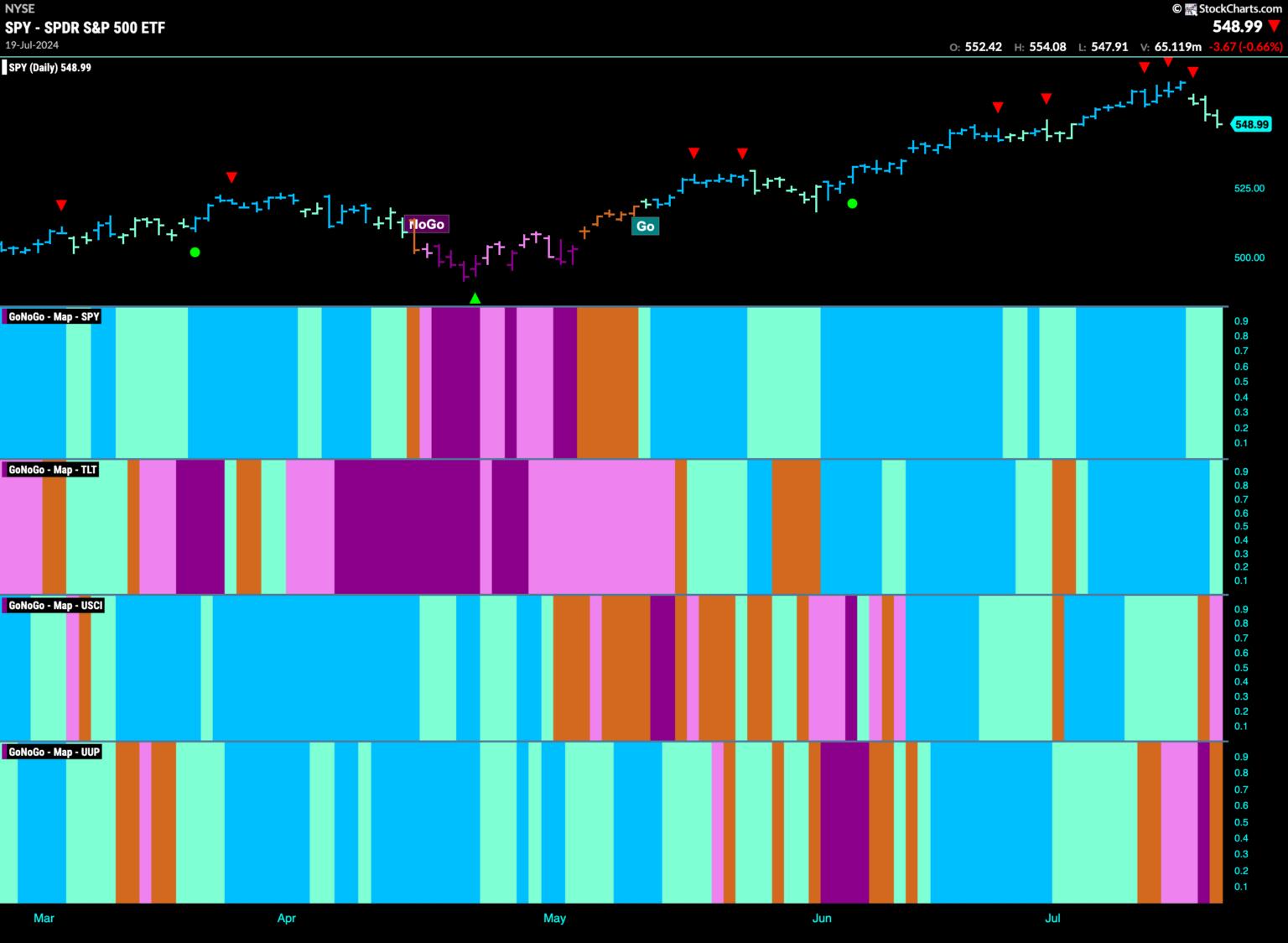

GoNoGo Charts9mo ago

FINANCIALS BEGIN TO OUTPERFORM AS EQUITY "GO" TREND WEAKENS

Good morning and welcome to this week's Flight Path. We saw a lot of weakness this week but so far the "Go" trend has held in U.S. equities. GoNoGo Trend has reflected the weakness with a couple of aqua "Go" bars late in the week Read More

Members Only

Martin Pring's Market Roundup9mo ago

Time for a Pause That Refreshes Stocks and Gold?

Most weekends, I run through a chart list featuring weekly bars and candlesticks of bonds, stocks and commodities to see if any one or two bar patterns or candlestick formations have developed Read More

DecisionPoint9mo ago

CrowdStrike: Did On-Balance Volume See the "Largest IT Outage In History" Coming?

Friday's CrowdStrike software disaster has been described as "the largest IT outage in history," and it brought home just how vulnerable the planet is to itty-bitty coding errors Read More

The MEM Edge9mo ago

Is It Game Over for Growth Stocks?

In this StockCharts TV video, Mary Ellen examines which areas of the market have moved into favor amid the S&P 500 pullback. She compares value vs. growth stocks and the merits of both, and highlights the move away from technology stocks Read More

ChartWatchers9mo ago

Important Market Breadth Indicators to Watch: Making Sense of Three Consecutive Down Days

Seasonally, the first two weeks of July have been great for the stock market. Now that the first two weeks of July are behind us, will the stock market take a breather until September? After how the market acted this week, it certainly feels that way Read More

The Final Bar9mo ago

Hindenburg Omen: The Truth, Effects, and Duration

In this edition of StockCharts TV's The Final Bar, Dave answers viewer questions on the best time frames for viewing charts, insights on using Vanguard ETFs for sector rotation, the duration and effect of the Hindenburg Omen indicator, how stocks are indexed in Dow Jones Groups o Read More

The Mindful Investor9mo ago

What Does a Market Top Look Like?

The S&P 500 remains in a primary uptrend, as confirmed by a fairly consistent pattern of higher highs and higher lows Read More

Art's Charts9mo ago

Small-caps Break Out and Lead - Now What?

Small-caps took the lead over the last two weeks with the S&P SmallCap 600 SPDR (IJR) surging over 10% in five days and hitting a new high. IJR also broke out of a long consolidation and this breakout is bullish. There are now three possibilities going forward Read More

The Final Bar9mo ago

VIX SPIKES! Is a Market Correction Coming?

In this edition of StockCharts TV's The Final Bar, Dave shares a market update including key levels to watch for the S&P 500 index, what a VIX above 15 means for a possible market correction, the improvement in value-oriented sectors, and why DPZ may be the world's most perfect i Read More

DecisionPoint9mo ago

Double Top on Semiconductors (SMH)

(This is an excerpt from the subscriber-only DecisionPoint Alert) We noticed a double top on the Semiconductor industry group (SMH) that looks very much like the NVIDIA (NVDA) chart Read More

RRG Charts9mo ago

Will This Sector Rotation Be the Start of Something Bigger?

Strong Rotations on Daily RRG This daily RRG shows the sector rotation over the last five days. With only one more trading day to go (Friday, 7/19), the emerging trends are becoming clearer Read More

Don't Ignore This Chart!9mo ago

Why Homebuilder Stocks are on Fire Right Now!

Homebuilder stocks are experiencing a significant rally as markets anticipate a rate cut in September, and possibly more before the end of 2024. What Triggered the Bullish Turn? Earlier this week, Fed Chair Jerome Powell hinted at rate cuts later this year Read More

Members Only

Larry Williams Focus On Stocks9mo ago