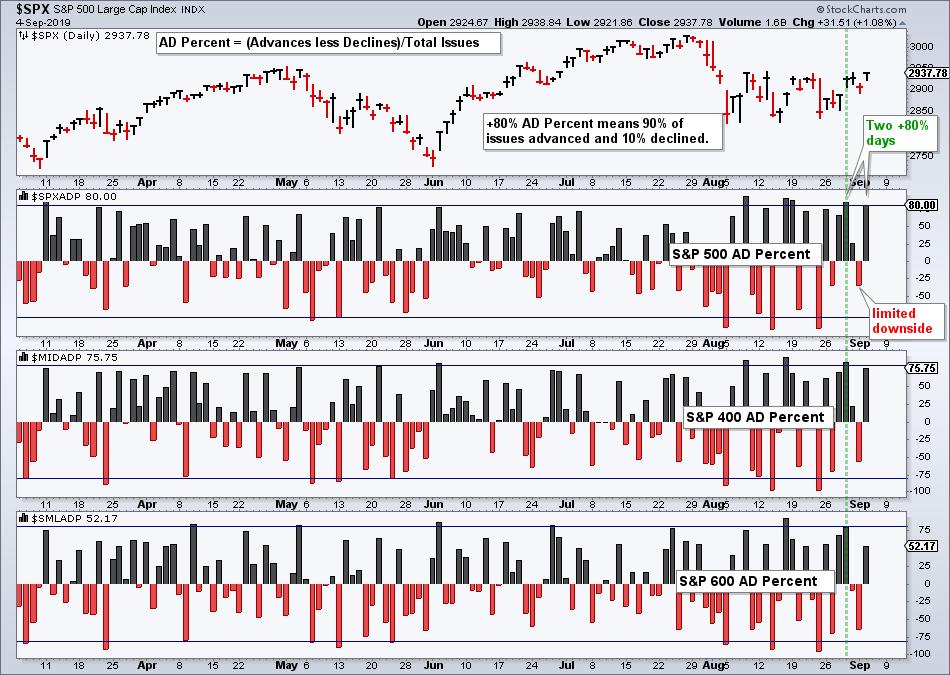

The S&P 500 and SPY are challenging their August highs again and large-cap breadth is stronger than breadth in mid-caps and small-caps. Since we seem to be on a day-to-day situation with the S&P 500 and this trading range, I will provide another short-term breadth update. After a mild decline on Tuesday, stocks recovered on Wednesday with strong upside breadth in the S&P 500. Upside breadth was modestly strong in the S&P Mid-Cap 400 and weak in the S&P Small-Cap 600. What else is new!

The chart above shows S&P 500 AD Percent ($SPXADP) hitting +80% for its second bullish breadth thrust in four days. S&P MidCap AD Percent ($MIDADP) fell just short of the +80% threshold with +75.75% and S&P SmallCap AD Percent ($SMLADP) barely cleared midfield with a +52.17% reading. Once again, large-caps are still the place to be.

------------------------------------------------------------

Adding Volume to the Mix

The next chart shows Up/Down Volume% for these same indexes. All three exceeded -80% on August 23rd for a triple 80% down day, and this was the last double/triple signal. The red lines mark double or triple 80% down days, while the green lines mark double or triple 80% up days. I prefer Up/Down Volume% over total volume because the former quantifies the "net" in-flows. Up volume represents buying pressure (accumulation), while down volume represent selling pressure (distribution).

Notice that S&P MidCap Up/Down Volume% ($MIDUDP) exceeded +80% last Thursday, but S&P 500 Up/Down Volume% ($SPXUDP) fell short (+79.5%). $SPXUDP exceeded +80% yesterday, but $MIDUDP and $SMLUDP fell well short. Again, large-caps are leading when it comes to net in-flows or accumulation.

------------------------------------------------------------

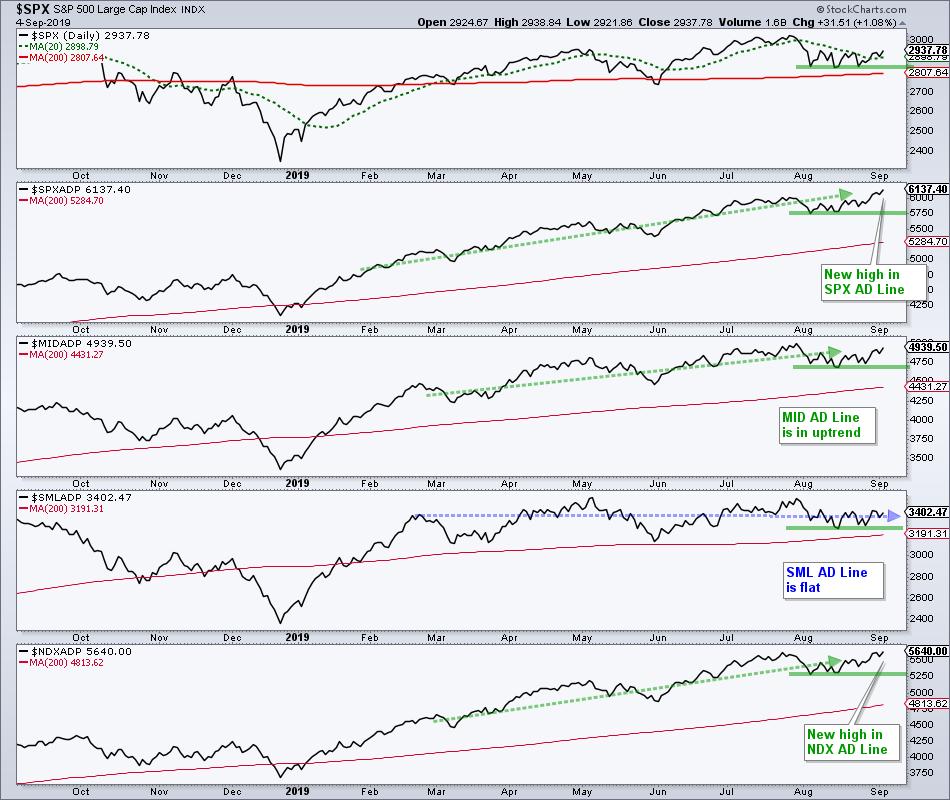

$SPX AD Line Hits New Highs

We can also plot the AD Line, which is a cumulative measure of AD Percent. This line rises when AD Percent is positive (advances>declines) and falls when AD Percent is negative (advances<declines). This indicator measures participation within each index and is a true "breadth" indicator.

The AD Lines for the S&P 500 and Nasdaq 100 hit new highs in late August and early September. The mid-cap AD Line is close to a new high and the S&P Small-Cap 600 AD Line is range bound. The solid green lines mark the August lows and the trouble starts if/when these AD Lines start breaking these lows.

------------------------------------------------------------

Up/Down Volume Lines are Mixed

The Up/Down Volume Lines for the S&P 500 and Nasdaq 100 remain strong and are near new highs, but are lagging for the S&P Mid-Cap 400 and S&P Small-Cap 600. The Up/Down Volume Lines are cumulative measures of daily accumulation and distribution. An accumulation day occurs when Up/Down Volume% is positive and the Up/Down Volume Line rises, while a distribution day occurs when Up/Down Volume% is negative and the Up/Down Volume Line falls.

As the chart above shows, accumulation days are winning the battle in the S&P 500 and Nasdaq 100 because their Up/Down Volume Lines are rising. Distribution is winning in the S&P Mid-Cap 400 and S&P Small-Cap 600 because their Up/Down Volume Lines have been falling since April and are below their 200-day SMAs. Again, the solid green lines mark the August lows for the Nasdaq 100 and S&P 500 AD Volume Lines. The bulls have a clear edge until distribution is strong enough to push the AD Volume Lines below their August lows.

------------------------------------------------------------

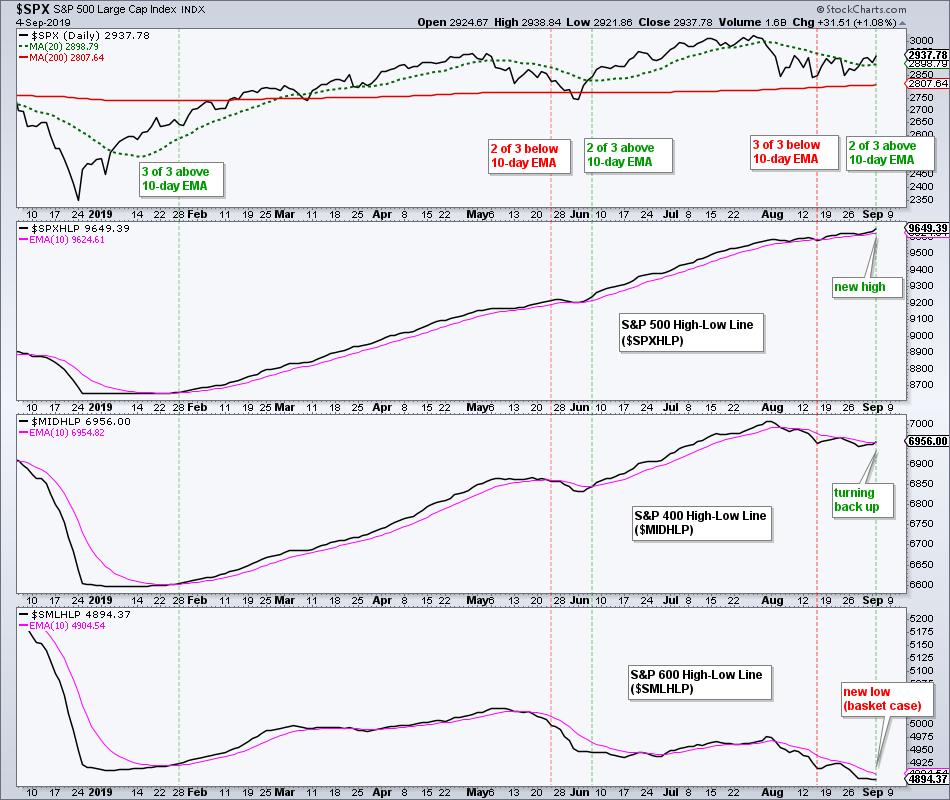

Mid-cap High-Low Line Turns Up

The High-Low Lines round out this breadth line overview for the major indexes. High-Low Percent equals new highs less new lows divided by total issues. New highs represent stocks in unequivocally strong uptrends, while new lows represent stocks in unmistakably strong downtrends. The High-Low Line is a cumulative measure of High-Low Percent. It rises when new highs outpace new lows and falls when new lows outnumber new highs.

The chart above shows the S&P 500 High-Low Line turning up in mid August and moving above its 10-day EMA. It also hit a new high yesterday. Again, no problem with large-caps. The S&P Mid-Cap 400 High-Low Line moved lower in August, but turned back up over the last few days and moved above its 10-day EMA. Two of the three are above their 10-day EMAs now (net bullish). The S&P Small-Cap 600 High-Low Line is another case, and a basket case at that.

------------------------------------------------------------

Putting it All Together

We have three line-based breadth indicators for three indexes: AD Line, Up/Down Volume Line. High-Low Line, S&P 500, S&P Mid-Cap 400 and S&P Small-Cap 600. I included the Nasdaq 100 with the AD Line and Up/Down Volume Line charts, but usually do not include it for my broad market assessment because 85 Nasdaq 100 stocks can also be found in the S&P 500. This would be double counting.

The S&P 500 is bullish and in good shape. The AD Line started hitting new highs in January and hit another new high this week (strong upside participation). The Up/Down Volume Line is also in an uptrend and near a new high (strong accumulation). The High-Low Line turned up again in mid August and hit a new high (strong uptrends>strong downtrends).

The S&P Mid-Cap 400 is mixed, but looking better this week. The AD Line is trending higher and near a new high, but the Up/Down Volume Line is trending lower and shows distribution. The High-Low Line is the tie-breaker here and it just turned up. While my Index Breadth Model remains net bearish for S&P Mid-Cap 400, further improvement in High-Low Percent could reverse that signal.

The S&P Small-Cap 600 remains bearish. The AD Line has been above its 200-day SMA since late January, but rangebound since May. The Up/Down Volume Line is trending lower and shows distribution. The High-Low Line hit a new low as new lows continue to outpace new highs.

------------------------------------------------------------

Art's Charts ChartList

Interested in breadth charts? All the charts above, and more, can be found in the Art's Charts ChartList (here). You can open these charts to see the settings, copy them to one of your ChartList or simply scroll through all 24 breadth charts.

------------------------------------------------------------

Choose a Strategy, Develop a Plan and Follow a Process

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Author, Define the Trend and Trade the Trend

Want to stay up to date with Arthur's latest market insights?

– Follow @ArthurHill on Twitter