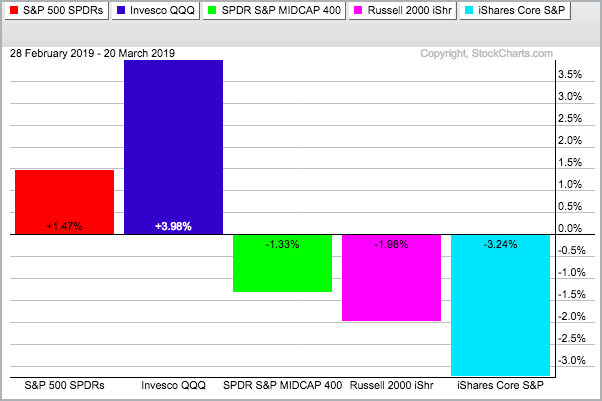

The Russell 2000 iShares (IWM) is not only lagging the S&P 500 SPDR (SPY) and the Nasdaq 100 ETF (QQQ) in March, but it is also under selling pressure and down month-to-date. Typically, I am not concerned with relative weakness in small-caps when they are simple up less than large-caps. However, we are seeing absolute weakness in small and mid caps, and a large performance discrepancy the last three weeks. IWM is down around 2% and the S&P SmallCap iShares (IJR) is down over 3% this month. In comparison, SPY is up around 1.5% and QQQ is up a whopping 4%. For those keeping score at home, the S&P MidCap SPDR (MDY) down around 1.33%.

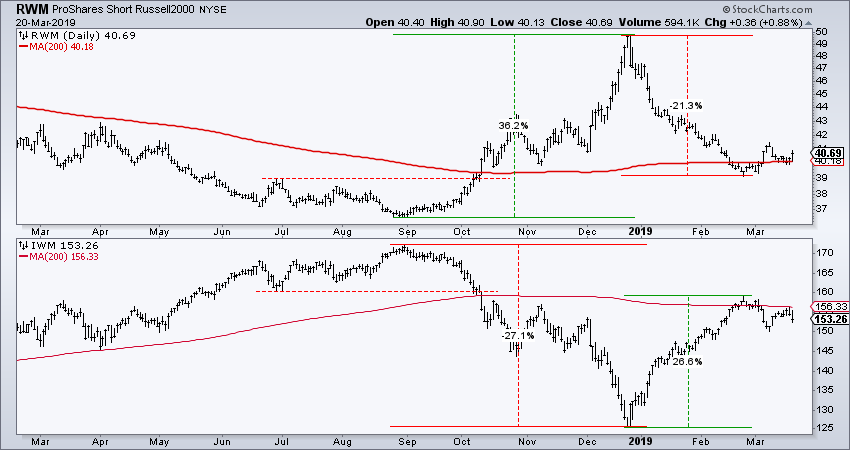

In general, I am not a big fan of shorting stocks or playing the downside. The stock market has a long-term bullish bias and the bulk of the evidence for the S&P 500 remains bullish. Having said/written that, I am seeing a bearish setup in IWM. The ETF broke down with a sharp decline in early March, returned to broke support with a 61.8% retracement and reversed lower the last two days. This signals a continuation of the early March decline with a first target in the 147 are (38% retracement)

I am going to add the Proshares Short Russell 2000 ETF (RWM) to the Art's Charts ChartList with a re-evaluation on close below 40. (IWM close above 155.5).

I am going to add the Proshares Short Russell 2000 ETF (RWM) to the Art's Charts ChartList with a re-evaluation on close below 40. (IWM close above 155.5).

On Trend on StockCharts TV

Thursday 21-March at 10:30 and 11 AM ET

- Three Big Sectors Weaken in March

- Housing, Retail and Banks Turn Down

- A Bearish Setup for IWM (comparing RWM)

- Bond Market Leads the Fed

- Dynamic Yield Curve

- Click here to watch

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill