- QQQ Leads with New High.

- IJR Firms Near Broken Resistance.

- 3 Biotechs To Watch.

...QQQ Leads with New High

...QQQ Leads with New High

...The Nasdaq 100 ETF (QQQ) advanced to a new high on Monday and continues to show upside leadership. Note that QQQ has been leading pretty much all year now and is up some 20% this year. This tells us that large-cap techs are leading and this is still an area to look for bullish setups.

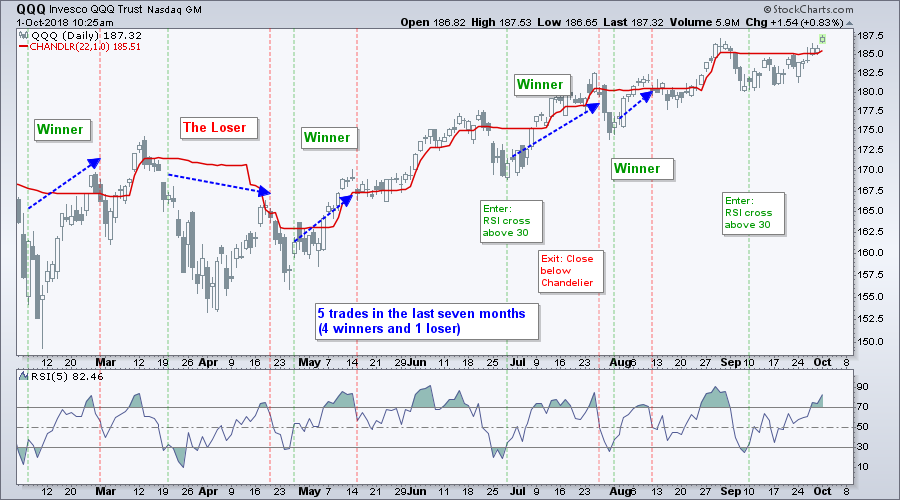

The chart below shows QQQ becoming short-term oversold in early September when RSI moved below 30. This condition did not last long as RSI moved back above 30 to trigger a mean-reversion signal on September 10th. QQQ moved above the Chandelier Exit (22,1) last week and hit a new high today.

According to the mean-reversion system covered over the last two years, a close below the Chandelier Exit would trigger an exit signal. As we have seen over the last two years, dips are opportunities, not threats. I have no idea when the long-term uptrend will reverse and I will continue to treat short-term oversold conditions as mean-reversion opportunities until the bigger uptrend reverses.

IJR Firms Near Broken Resistance

While QQQ moves to a new high, the S&P SmallCap iShares (IJR) is still struggling and within a four week downtrend. The ETF hit a new high in late August and then declined around 4% with a move below 87 last week. Don’t feel too sorry for small-caps because the long-term trend is up and IJR is still up 14.5% year-to-date. In addition, the ETF advanced 9% from late June to late August and was entitled to a correction. The four week correction is extending longer than I thought as RSI dipped back below 30 last week. Not all mean-reversion signals work out right away or at all (some are losers). At this point, a move above the Chandelier Exit (22,1) is still needed to activate an exit setup. From a classical charting standpoint, IJR is attempting to firm near broken resistance, which turns support.

3 Biotechs To Watch

I covered the Biotech iShares (IBB) on Friday because it is showing renewed leadership and the ETF hit a new high on Monday. Also note the healthcare sector is one of the leading sectors as both the Health Care SPDR (XLV) and EW Healthcare ETF (RYH) hit new highs on Monday. Trading individual biotech names always carries added risk, but I will highlight three with bullish looking charts.

The first chart shows BioMarin (BMRN) with a new high in August and a pullback into early September. This pullback formed a channel and could be like a falling flag. The stock broke out with a surge in mid-September, but fell back after this breakout attempt. I am encouraged because the stock found support above the early September low last week and bounced over the last four days.

The next chart shows Biogen (BIIB) with a gap and surge to new highs in July. The stock was quite overbought after this move and digested these gains with a consolidation into mid September. Even though I drew a triangle, I am not sure how "robust" the pattern is because of the volatile move in July and the steepness of the upper line. Nevertheless, the stock broke the triangle line in mid September and is now attempting to break above the late August high.

Celgene (CELG) is normally a stock I would skip and it is not at the top of my list for biotech plays. The stock hit a 52-week low in May and the 50-day EMA is below the 200-day EMA, but a bullish reversal pattern could be taking shape. Note that I only point this out because the sector and the industry group are showing leadership. A large inverse head-and-shoulders is taking shape and the stock turned up the last five days. A move above 95 would break neckline resistance and the 200-day EMA.

Questions, Comments or Feedback?

I cannot promise to response to all correspondence, but I will read it and take into under consideration. I greatly appreciate all feedback because it helps me improve the commentary and provides ideas for the future. Sorry, I do not take symbol requests.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill