- Is the Dollar Strong or the Euro Weak?

- Yen Bounces as Euro Falls.

- A Big Surge for Treasuries.

- Gold is Oversold in an Uptrend.

- Italy and Spain Lead Europe Lower.

- Looking for International Indexes?

- On Trend: Tuesdays at 10:30 AM ET.

Dollar Strength or Euro Weakness? ...

Dollar Strength or Euro Weakness? ...

I am starting out with the US Dollar ETF (UUP) because it is up over 6% over the last four months. This is a big move for a currency and currency markets don't always appreciate big moves. Currency markets like stability. A price shock in the currency market can signal trouble elsewhere and ripple to other markets. Yes, we are going to get a bit macro today.

Currencies trade in pairs and move like a seesaw. A rise in one currency means a fall in the currency on the other side of that pair. For example, a rise in the Dollar implies a fall in the Euro.

The Euro is the single biggest holding in the US Dollar ETF (UUP) and this makes it “the one to watch”. First, let's look at UUP. The chart below shows the ETF falling with a big wedge and reversing near the 61.8% retracement. Isn't hindsight great! Even if I am working on a little hindsight, the breakout and surge are clearly bullish for the greenback. At this point, I would not call this a currency "shock", but it is something to keep an eye on moving forward.

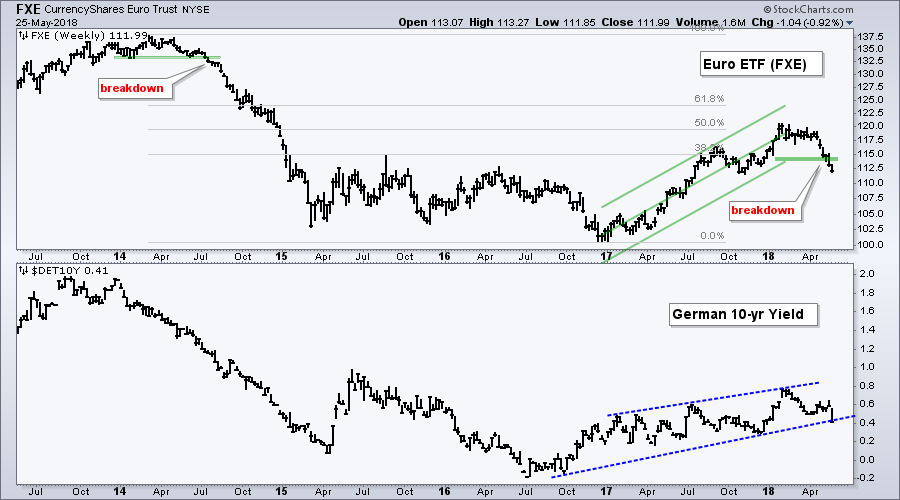

Euro Breaks Down

The next chart shows the Euro ETF (FXE) breaking down with a sharp decline over the last five weeks. Notice that the ETF reversed near the 50% retracement and broke the lower line of the Raff Regression Channel. It looks like the bigger downtrend is taking over and I would expect a test of the prior lows.

The lower window shows the German 10-yr Yield ($DET10Y) breaking the wedge line. This rising wedge is a bearish continuation pattern and the line break is the first sign that the bigger downtrend is resuming. A decline in the German 10-year yield is NOT a vote of confidence for Europe.

Yen Bounces as Euro Falls

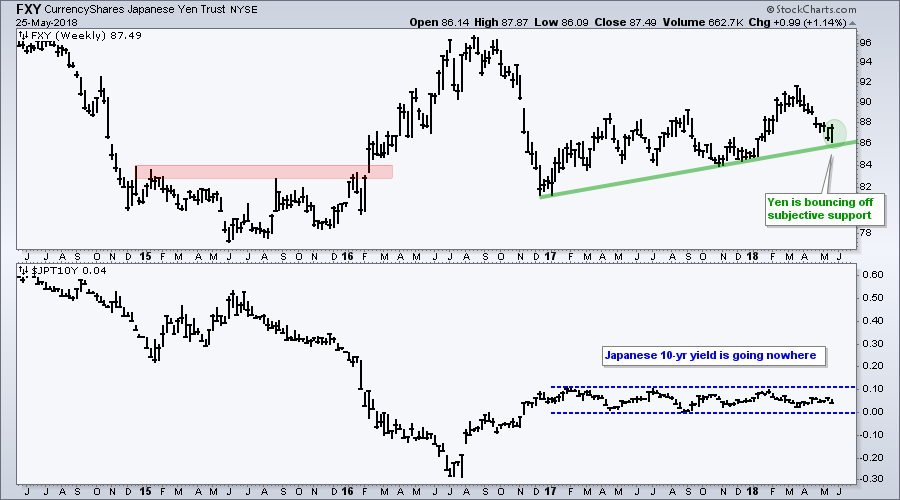

The next chart shows the Yen ETF (FXY) moving higher last week (green oval). Also notice that the Yen is bouncing off “subjective” support. Trend lines are pretty subjective and so is support based on a trend line. Regardless of subjectivity, a higher low could be forming. Why is this important? The Yen is the go-to currency when the markets turn risk averse. Thus, this bounce signals some risk aversion in the financial markets.

A Big Surge for TLT

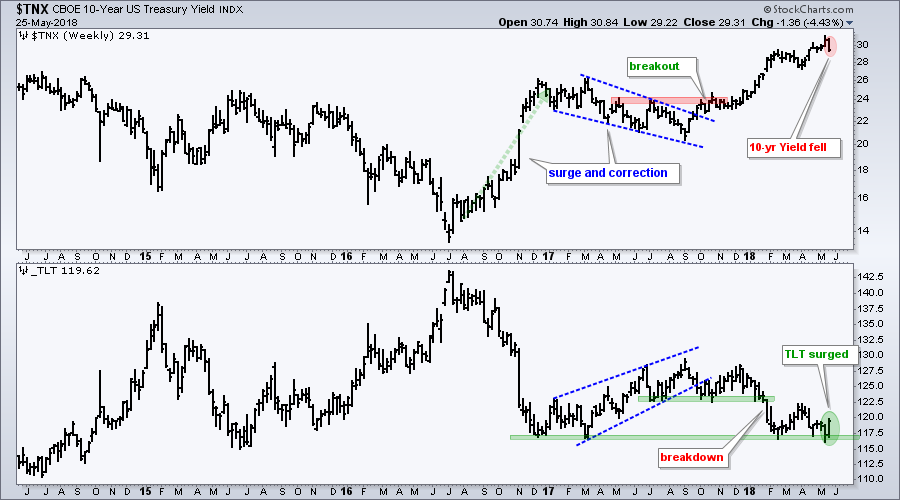

In addition to a bounce in the Yen, we also saw the 10-yr T-Yield ($TNX) fall and the 20+ YR T-Bond ETF (TLT) surge last week. The chart below shows the 10-yr T-Yield in a strong uptrend since the October breakout. The yield hit 3% (30) and then fell back sharply last week. This decline is not enough to affect the bigger uptrend, but it does reflect a move into Treasury bonds.

The lower window shows the 20+ YR T-Bond ETF (TLT) hitting support in the 117 area and bouncing with the biggest weekly move since October. Treasuries represent the ultimate flight to safety and this surge reflects risk aversion in the markets. Further strength in TLT could be positive for utilities and REITs, but negative for banks.

Gold is Oversold in an Uptrend

Normally, a strong uptrend in the Dollar would be bearish for gold. However, note that both gold and the Dollar moved higher last week. These two are negatively correlated for the most part and it is unusual to see them rise together.

The chart below shows the Gold SPDR (GLD) with an uptrend since December 2016 (higher highs and higher lows). The ETF fell sharply the last five weeks and RSI dipped below 30 in mid May. Hmm....this means gold is oversold within a bigger uptrend. Thus, the dip may represent more of an opportunity than a threat.

Italy and Spain Lead Europe Lower

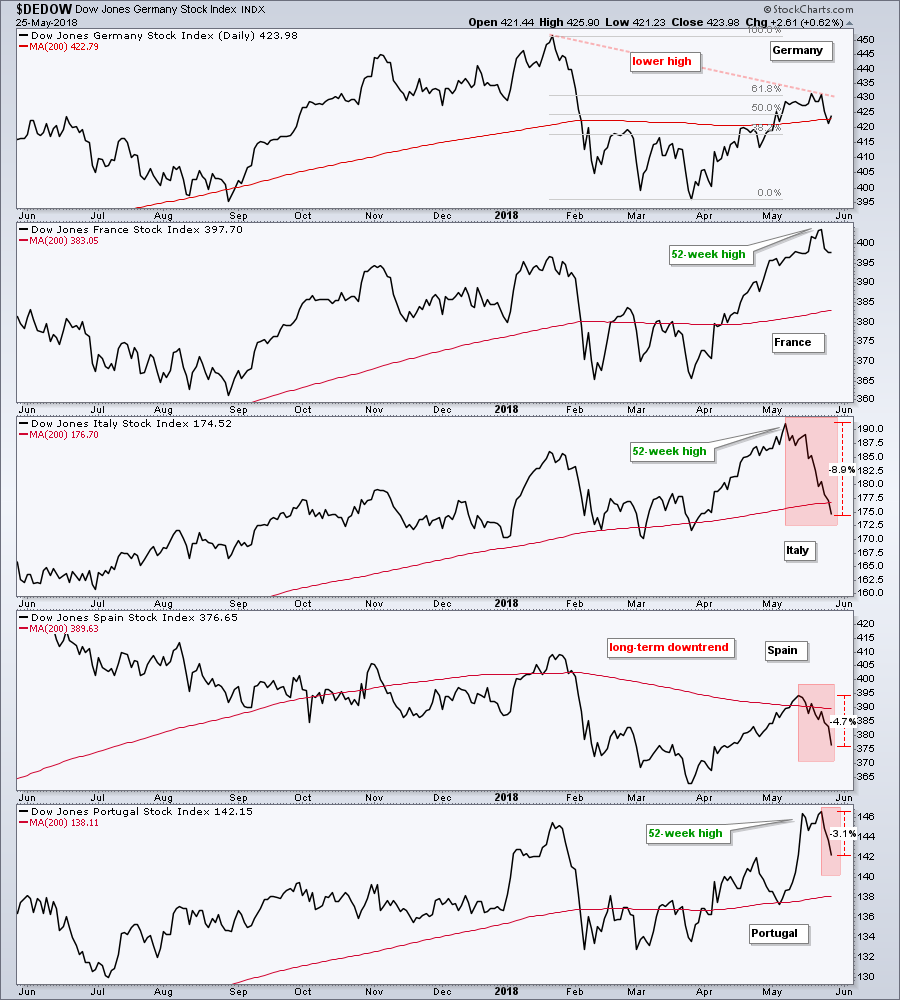

The next chart shows the Dow Jones indexes for Germany, France, Italy, Spain and Portugal. Germany is forming a lower high and reversing near the 61.8% retracement. France hit a new high and remains stronger than Germany. I think the lower high in the German index is more telling than the new high in the French index.

The trouble starts when we look at Italy, which fell over 8% the last three weeks, and Spain, which fell over 4% the last two weeks. Spain is also in a long-term downtrend and the weakest of the group. Weakness in Italy and Spain could be weighing on the Euro and the German 10-yr Yield.

Looking for International Indexes?

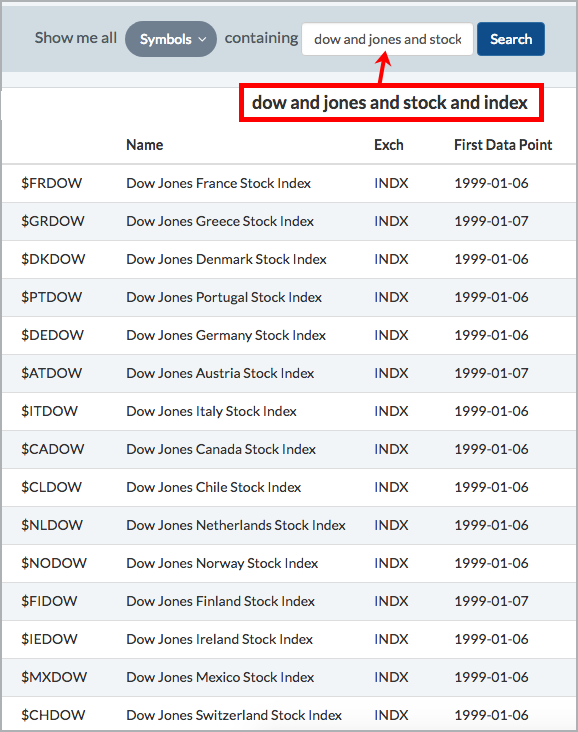

Chartists looking for a wide array of country indexes can use the Dow Jones stock indexes. I searched for the term "dow and jones and stock and index" to get the results below. These are country indexes based on the local currency, as opposed to US-based ETFs, which are priced in Dollars and reflect currency movements. There is nothing wrong with ETFs, but I think the local currency indexes provide a "purer" picture of the country's stock market performance.

On Trend: Tuesdays at 10:30 AM ET

Today's show, On Trend, will cover the topics above plus the following:

- What do Trendlines Actually Measure

- Watching Consolidation in SPY

- XLF Weighs as XLV Hits moment-of-truth

- Click here for the Youtube recording

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill