----- Video Link ----- Art's Charts ChartList (updated 29-Apr) -----

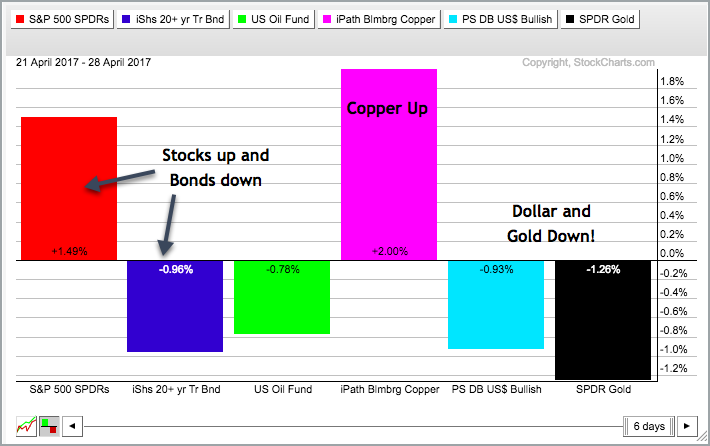

Stocks followed through this past week with further gains, but small-caps took a hit on Friday and underperformed for the week. Friday's hit was not enough to overshadow the breakouts in the S&P 500 SPDR and S&P MidCap SPDR, but I think we need to stay vigilant because the bond market may be sending a different message. Also note that banks are positively correlated to Treasury yields and negatively correlated to Treasury bonds. Thus, I will be watching the 20+ YR T-Bond ETF and 10-yr T-Yield quite closely next week because they could hold the key to the stock market. The PerfChart below shows SPY up last week and TLT down, which captures the inverse relationship at work. Mr. Bond (market) is one smart cookie so we best pay attention. Elsewhere, I am watching copper because it is in a potential reversal zone, as are the Copper Miners ETF and Metals & Mining SPDR. All this and more can be found in today's video, which is a companion to the written commentary, which was posted on Friday.

******************************************************

ETF Master ChartPack (click here to download)

300+ ETFs organized in a Master ChartList and in individual groups.

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************