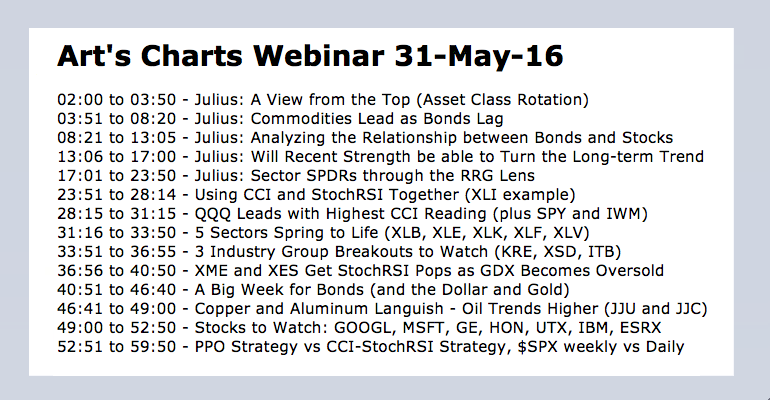

Art's Charts May 31, 2016 at 08:00 AM

4 AD Lines Hitting New Highs // SPY Surges with Gaps // Using CCI and StochRSI Together (XLI example) // QQQ Leads with Highest CCI Reading // 5 Sectors Spring to Life // 3 Industry Group Breakouts to Watch // XME and GDX Become Short-term Oversold // Oil & Gas Equip & Services S... Read More

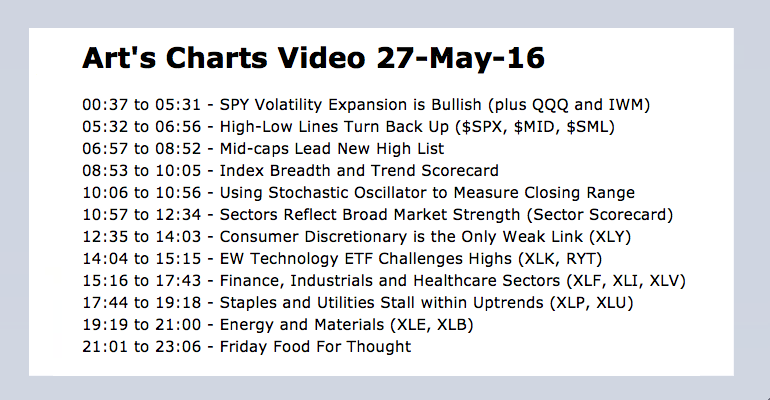

Art's Charts May 27, 2016 at 10:48 AM

SPY Volatility Expansion is Bullish // High-Low Lines Turn Back Up // Mid-caps Lead New High List // Sectors Reflect Broad Market Strength // Consumer Discretionary is the Only Weak Link // EW Technology ETF Challenges Highs // Staples and Utilities Stall within Uptrends // Frida... Read More

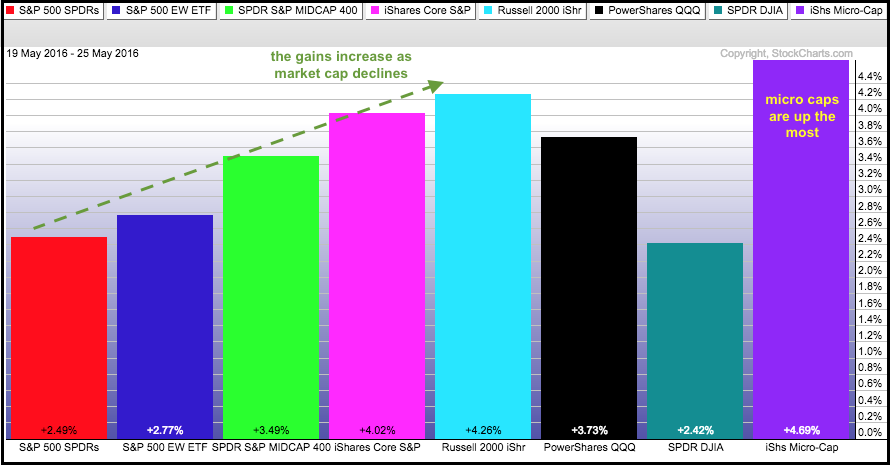

Art's Charts May 26, 2016 at 07:16 AM

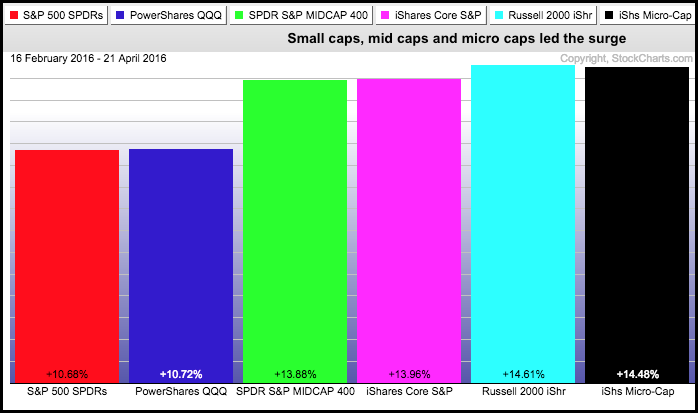

Small and Micros Lead the Way // Sector Performance Says Risk On // Gaps Fuel the Breakouts in QQQ, SPY and IWM // Materials and Finance Lead Sector SPDRs // Equal-weight Finance Leads with Higher High // Metals & Mining SPDR Gets Momentum Pop // Oil & Gas Equip & Services SPDR S... Read More

Art's Charts May 24, 2016 at 08:58 AM

ÂÂ Small Gaps Could Signal End to Pullbacks // When to Pull the Trigger? // Money Moves out of Safe-haven Bonds // Finance Remains in the Spotlight // Regional Banks Take the Lead // Webinar Preview //// ............. Read More

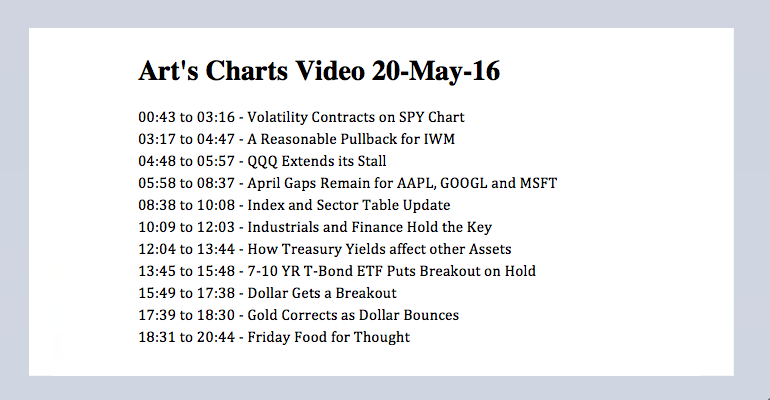

Art's Charts May 20, 2016 at 09:45 AM

Volatility Contracts on SPY Chart // QQQ Extends its Stall // April Gaps Remain for AAPL, GOOGL and MSFT // A Reasonable Pullback for IWM // Index and Sector Table Update // Industrials and Finance Hold the Key // How Treasury Yields affect other Assets // 7-10 YR T-Bond ETF Puts... Read More

Art's Charts May 19, 2016 at 08:42 AM

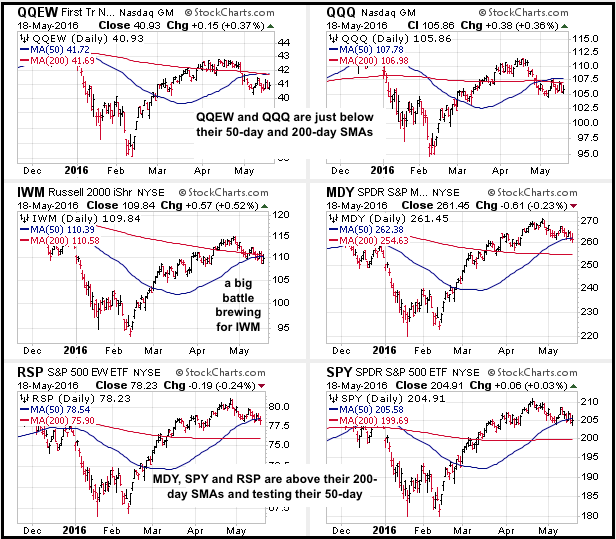

Small-caps Gear Up for Big Test // Using %B to Identify Oversold Conditions // Indicators Overshoot for QQQ // IWM Remains with a Bullish Setup // Intraday or End-of-day Signals? // Treasuries Signal Risk On // XLF Surges as KRE and IAI Break Out //// ............. Read More

Art's Charts May 17, 2016 at 09:15 AM

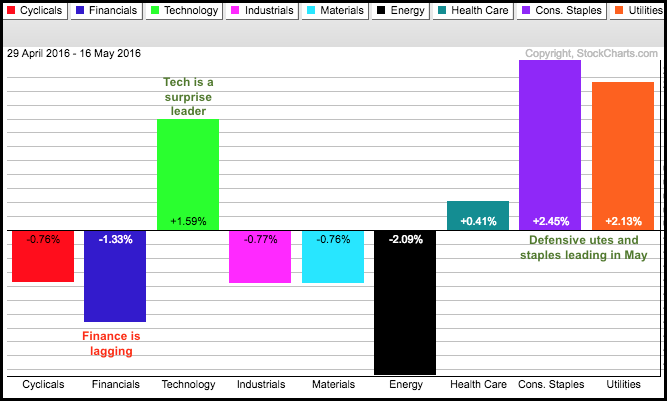

Mixed Up May as Tech offsets Finance // Mild Correction Extends for SPY // QQQ Reflects Strength in Tech // Watching Bonds for Clues on Risk Appetite // Adding an Exit Strategy to the PPO Signals // Watching Regional Banks, Semis and Homebuilders // Finance Sector Fails to Pop //... Read More

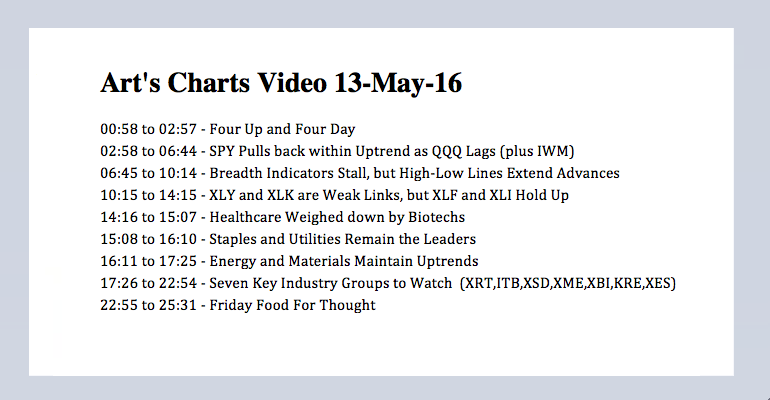

Art's Charts May 13, 2016 at 09:41 AM

SPY Pulls back within Uptrend // QQQ Battles Support and Lags // Breadth Indicators Stall // High-Low Lines Extend Advances // Sector Table Remains Bullish // Consumer Discretionary and Technology are the Weak Links // Finance and Industrials are Holding Up // Healthcare Weighed ... Read More

Art's Charts May 12, 2016 at 07:39 AM

SPY Tests the Gap // Giving QQQ a Little Wiggle Room // Broad Selling in Finance and Consumer Discretionary // XLF and XLI Test Breakout Resolve // Treasuries Reflect Risk-off Mode // Seven Stocks with Bullish Setups to Watch //// ............. Read More

Art's Charts May 10, 2016 at 07:31 AM

SPY Firms within Bull Flag // Treasuries Could hold the Key for Stocks // Mind the 13-April Gaps // Banks are Holding Up Well // XRT Reverses within Zigzag Pattern // Internet ETF Grinds Higher // Webinar Preview //// ......... Read More

Art's Charts May 09, 2016 at 06:05 AM

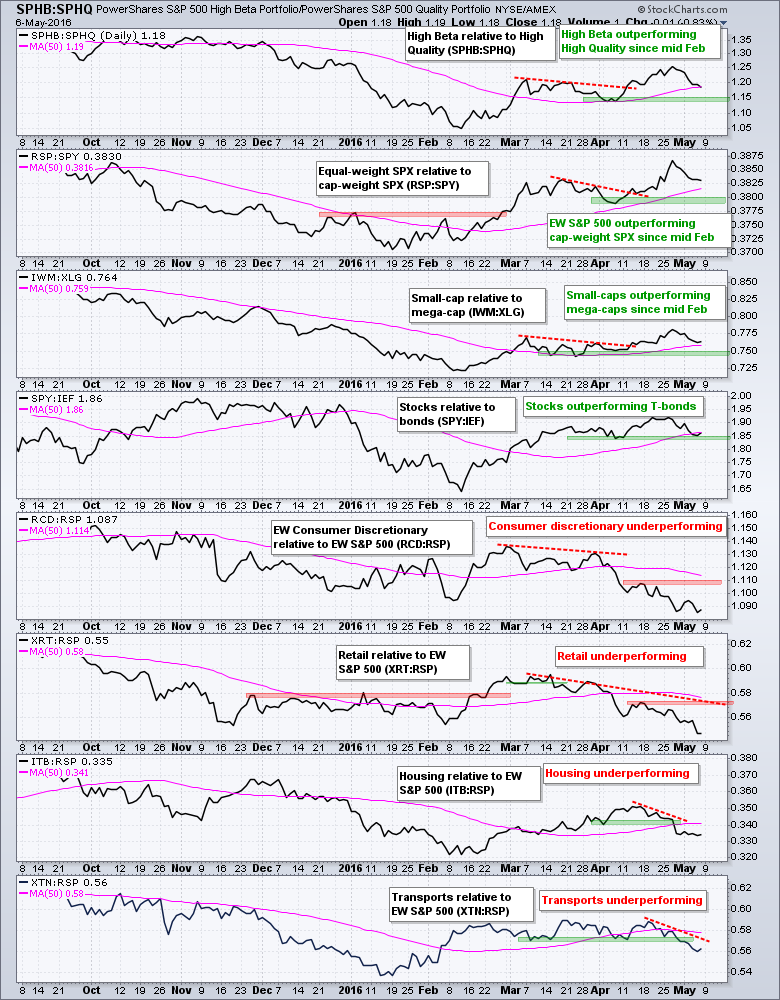

Consumer Discretionary Groups Underperforming // $SPX Pullback Nears first Support Zone // XLK Nears Broken Resistance and Key Retracement // Apple, Alphabet and Microsoft Firm at Support // Five Big Banks Tests their April Breakouts //// ......... Read More

Art's Charts May 06, 2016 at 12:10 PM

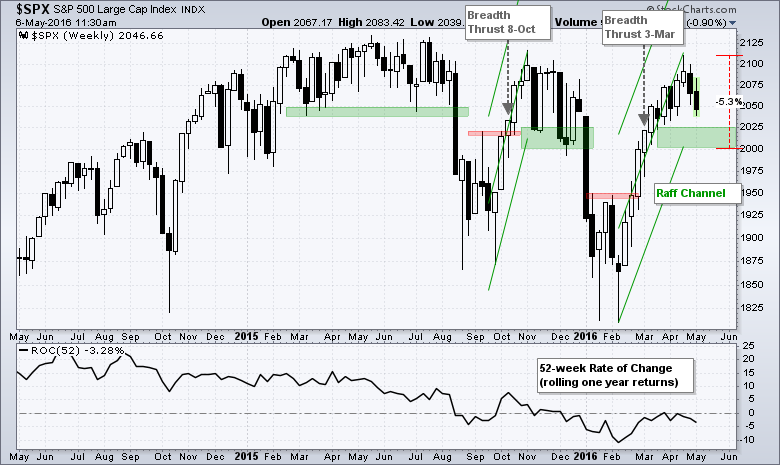

Isolating the Key Trend in the S&P 500 // Breadth Indicators Near Moment-of-truth // New Highs Still Outpacing New Lows // The Weight of the Evidence Is.... // Using Breadth and Price Action for Sectors // Sector Summary and Ranking Table // Friday Food for Thought //// ......... Read More

Art's Charts May 05, 2016 at 08:43 AM

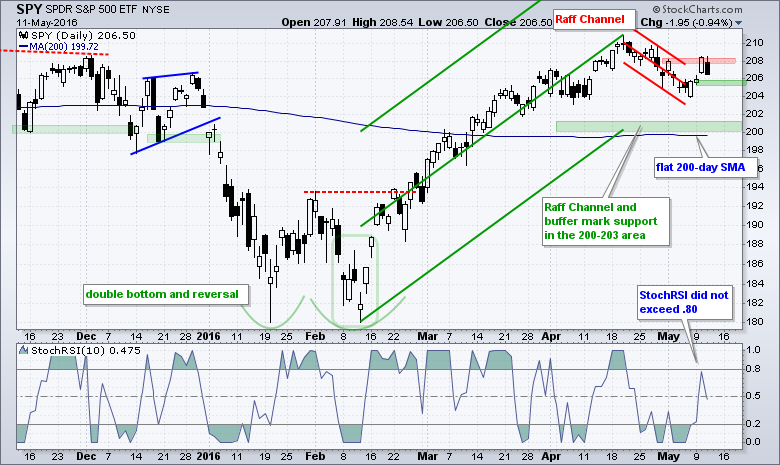

A Market Entitled to a Correction // Using StochRSI to Time Pops in QQQ // A Mild Correction for SPY // Big Techs and Biotechs Drive QQQ Lower // Breaking Down the Big Five - FAAAM // Apple is the Weakest of the Big Five, but...... Read More

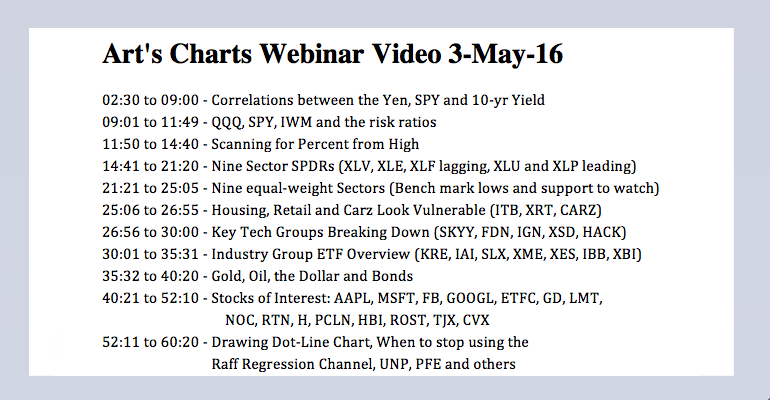

Art's Charts May 03, 2016 at 10:28 AM

SPDRs versus Equal-weight Sectors // Three Long-term Sector Laggards // Two Long-term Sector Leaders // Technology and Consumer Discretionary Weigh // Marking Key Support for Finance, Industrials and Healthcare // Staples and Utilities Still Leading on Price Charts // Materials i... Read More

Art's Charts May 02, 2016 at 06:07 AM

Putting the Pullback into Perspective // Breadth Softens, but Bullish Signals Remain // New Highs Dwindle, but Stay Net Positive // The Key Level for SPY is Obvious // A Battle Zone Brews for IWM // A Bull Flag for QQQ? //// ......... Read More