Easy come, easy go. Stocks surged on Monday and then gave it back on Tuesday. Most sectors and industry groups were hit with selling pressure on Tuesday. Some interest-rate sensitive groups bucked the selling pressure as the 20+ YR T-Bond ETF (TLT) surged and the 10-YR Treasury Yield ($TNX) fell. Utilities, REITs, MLPs and Telecoms attracted some buying interest. Gold and silver bucked the selling pressure in other commodities and also bounced, perhaps as a safe haven.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Programming Note: There will be a change in Art's Charts next week. In short, I need to stop with the intraday short-term analysis that tries to catch every twist and turn in the markets. The bigger trends are more important and this is where I want to focus. Starting next week, Art's Charts will be published on Tuesday and Thursday. I will cover the major index ETFs, sectors, breadth, industry group ETFs, gold, oil, bonds and individual stocks.

Short-term Overview (Wednesday, 12-August-2015):

- Short-term breadth became overbought and plunged.

- Three of the five EW sector ETFs are in uptrends (RYT, RYF, RGI).

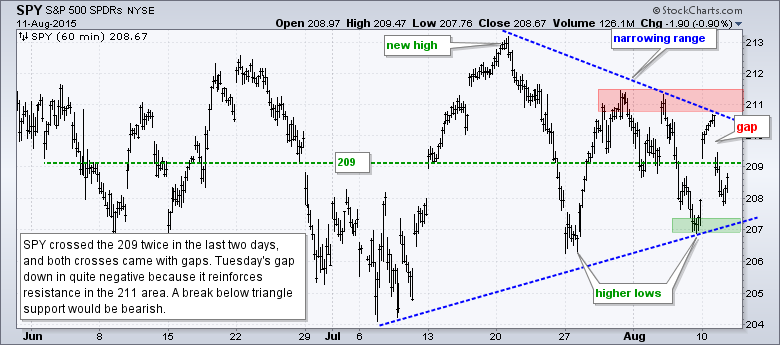

- SPY failed to hold its gap and fell back within its range.

- QQQ gave up its gap-surge and remains within a falling wedge.

- IWM failed at broken support and remains in a downtrend.

- TLT remains in an uptrend.

- UUP fell back, but remains in an uptrend overall.

- USO fell to new lows and extended its downtrend.

- GLD firmed for a few weeks and broke first resistance.

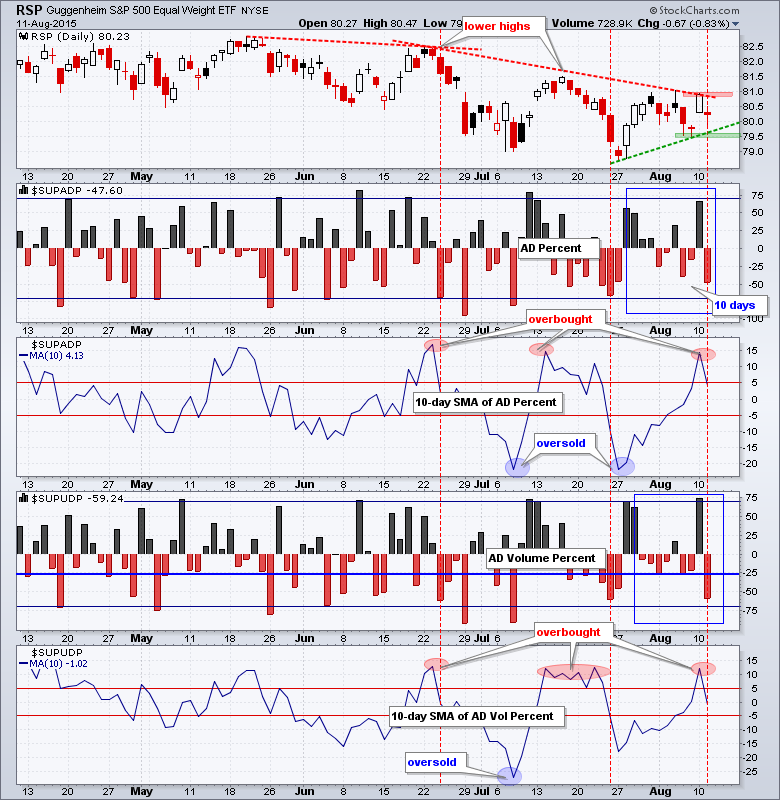

RSP gapped up and closed strong on Monday, and then gave most of it back on Tuesday. No bueno. This means another lower high is taking shape and the downtrend since June is dominating. There is support at 79.4 from the gap and last week's low, but it will likely be broken with a weak open today and this could usher in new lows for the move.

The red dashed vertical lines on the chart above mark instances when the 10-day SMAs for AD Percent and AD Volume Percent became overbought and broke back below +5%. I am highlighting these because the trend since June is down and overbought indicators can signal peaks within the downtrend. The 10-day SMAs became overbought on Monday and plunged back below +5% on Tuesday.

I still count three sectors in short-term uptrends, but lower highs formed in several sectors over the last few weeks. These lower highs point to weak buying pressure on the bounces. Consumer discretionary formed lower highs in late July and early August. A support break at 90 would be bearish. Healthcare formed lower highs as well in late July and early August. A support break at 160 would be bearish. Finance, technology and industrials are in short-term uptrends, but it would not take much to trigger support breaks.

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Aug 12 - 07:00 - MBA Mortgage Index

Wed - Aug 12 - 10:00 - JOLTS Jobs Report

Wed - Aug 12 - 10:30 - Crude Oil Inventories

Wed - Aug 12 - 14:00 - Treasury Budget

Thu - Aug 13 - 08:30 - Initial Jobless Claims

Thu - Aug 13 - 08:30 - Retail Sales

Thu - Aug 13 - 10:00 - Business Inventories

Thu - Aug 13 - 10:30 - Natural Gas Inventories

Fri - Aug 14 - 08:30 - Producer Price Index (PPI)

Fri - Aug 14 - 09:15 - Industrial Production

Fri - Aug 14 - 10:00 - Michigan Sentiment

Mon - Aug 17 - 08:30 - Empire Manufacturing

Mon - Aug 17 - 10:00 - NAHB Housing Market Index

Tue - Aug 18 - 08:30 - Housing Starts/Building Permits

Wed - Aug 19 - 07:00 - MBA Mortgage Index

Wed - Aug 19 - 08:30 - Consumer Price Index (CPI)

Wed - Aug 19 - 10:30 - Crude Oil Inventories

Wed - Aug 19 - 14:00 - FOMC Minutes

Thu - Aug 20 - 08:30 - Initial Jobless Claims

Thu - Aug 20 - 10:00 - Existing Home Sales

Thu - Aug 20 - 10:00 - Philadelphia Fed

Thu - Aug 20 - 10:00 - Leading Indicators

Thu - Aug 20 - 10:30 - Natural Gas Inventories

Tue - Aug 25 - 09:00 - Case-Shiller Housing Index

Tue - Aug 25 - 09:00 - FHFA Housing Price Index

Tue - Aug 25 - 10:00 - New Home Sales

Tue - Aug 25 - 10:00 - Consumer Confidence

Wed - Aug 26 - 07:00 - MBA Mortgage Index

Wed - Aug 26 - 08:30 - Durable Goods Orders

Wed - Aug 26 - 10:30 - Crude Oil Inventories

Thu - Aug 27 - 08:30 - Initial Jobless Claims

Thu - Aug 27 - 08:30 - GDP

Thu - Aug 27 - 10:00 - Pending Home Sales

Thu - Aug 27 - 10:30 - Natural Gas Inventories

Fri - Aug 28 - 08:30 - Personal Income & Spending

Fri - Aug 28 - 08:30 - PCE Prices

Fri - Aug 28 - 10:00 - Michigan Sentiment

Mon - Aug 31 - 09:45 - Chicago PMI

Tue - Sep 01 - 10:00 - Construction Spending

Tue - Sep 01 - 10:00 - ISM Manufacturing Index

Tue - Sep 01 - 17:00 - Auto/Truck Sales

Wed - Sep 02 - 07:00 - MBA Mortgage Purchase Index

Wed - Sep 02 - 08:15 - ADP Employment Report

Wed - Sep 02 - 10:00 - Factory Orders

Wed - Sep 02 - 10:30 - Crude Oil Inventories

Wed - Sep 02 - 14:00 - Fed's Beige Book

Thu - Sep 03 - 07:30 - Challenger Job Report

Thu - Sep 03 - 08:30 - Initial Jobless Claims

Thu - Sep 03 - 10:00 - ISM Services

Thu - Sep 03 - 10:30 - Natural Gas Inventories

Fri - Sep 04 - 08:30 - Employment Report

This commentary is designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.