The major index ETFs closed fractionally higher in listless trading. QQQ led with a .48% bounce. MSFT and GILD lifted QQQ and have bullish looking charts. The sectors were mixed with energy and consumer staples losing ground. The consumer discretionary, finance and materials sectors gained. Of note, the Home Construction iShares (ITB) advanced for the third day in a row and looks poised to break its June high.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Short-term Overview (Friday, 31-July-2015):

- Short-term breadth is bearish, but in the midst of an oversold bounce.

- The five sector ETFs are split: two up, two down and one flat.

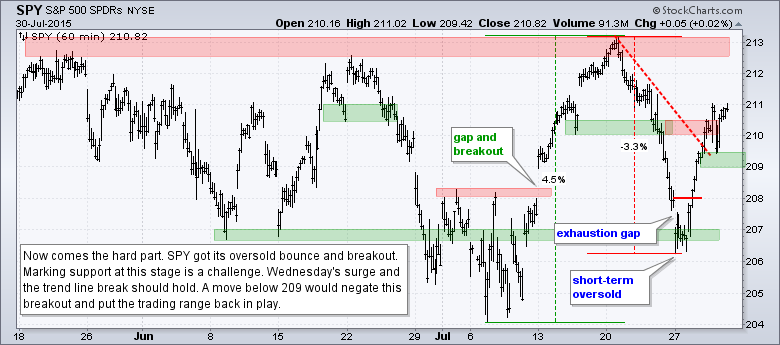

- SPY is holding its breakout and in a short-term uptrend.

- QQQ shows relative weakness, but remains in a three day upswing.

- IWM got a weak oversold bounce and shows relative weakness.

- TLT is in a short-term uptrend and testing support.

- UUP bounced off support and remains in an uptrend overall.

- USO is in a short-term downtrend.

- GLD is in a short-term downtrend.

The Equal-Weight S&P 500 ETF (RSP) surged Tuesday-Wednesday to reverse the short-term downtrend. There are, however, two challenges for the bulls. First, RSP remains in a downtrend overall with lower highs in late June and mid July. Second, SPY remains in a choppy trading range overall. It is still a choppy-flat environment that could be challenges to both bulls and bears.

Breadth is bearish overall because both 10-day SMAs remain in negative territory. AD Percent (+13%) and AD Volume Percent (-7%) finished mixed. At this point, breadth is in the middle of an oversold bounce. I say middle, but I mean somewhere between the beginning and the end of the oversold bounce. I know where the beginning is, but not where the end will be. It will end when it ends.

No change. The equal-weight sector ETFs are split: two in uptrends, two in downtrends and one flat. The Equal-Weight Consumer Discretionary ETF (RCD) got a strong bounce off support the last two days. The Equal-weight Finance ETF (RYF) and Equal-weight Healthcare ETF (RYH) remain in uptrends and are leaders overall. The Equal-weight Technology ETF (RYT) held its early June lows and bounced towards resistance. The Equal-weight Industrials ETF (RGI) got a big oversold bounce, but remains below resistance.

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Thu - Jul 30 - 08:30 - Initial Jobless Claims

Thu - Jul 30 - 08:30 - GDP

Thu - Jul 30 - 10:30 - Natural Gas Inventories

Fri - Jul 31 - 09:45 - Chicago PMI

This commentary is designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.