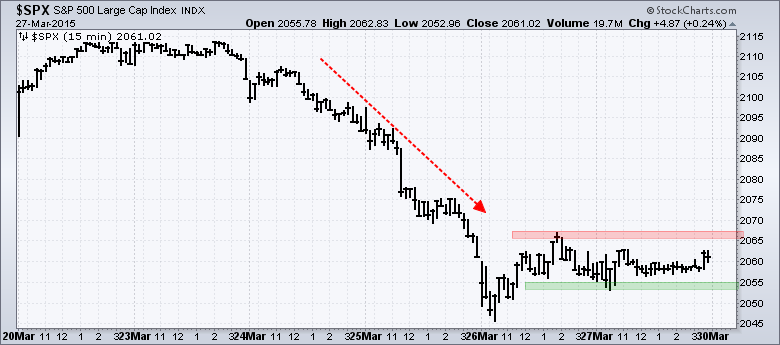

Stocks got slammed on Tuesday-Wednesday and firmed on Thursday-Friday. The S&P 500 fell from the 2110 area to the 2050 area and then moved into a rather tight trading range in the 2060 area. The resolution of this trading range could provide the next short-term signal. Either another shoe drops or the S&P 500 bounces off support from the mid March lows. Even though large-caps are lagging, I am encouraged with short-term strength in small-caps, the consumer discretionary sector, housing stocks and retail stocks. Semiconductors, which were pounded on Wednesday-Thursday, rebounded as the Semiconductor SPDR (XSD) surged over 3%.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Short-term Overview (Monday, 30-March-2015):

- AD Percent was positive on Friday, but not very strong and remains weak overall.

- Four of the five risk indicators are negative.

- SPY and QQQ reversed their upswings with sharp declines last week, but ended the week near potential support zones.

- IWM also broke down, but shows relative strength and firmed in the 50-62% retracement zone.

- TLT reversed near the 62% retracement, but held support with a bounce on Friday.

- UUP corrected over the last few weeks and firmed near the 62% retracement.

- USO reversed in the 50-62% retracement zone with a sharp decline on Friday.

- GLD got a counter-trend bounce the last few weeks, but is near a resistance zone and key retracement.

Breadth is a tough call right now. The 10-day SMA for S&P 1500 AD Percent ($SUPADP) moved back above zero, but the range has narrowed over the last few weeks. In contrast to January-February, the 10-day SMA oscillated between +18% and -18% in March. Choppy trading could be the order of the day. The daily readings show a negative breadth thrust last week (< -70%) and this has yet to be countered with a positive breadth thrust (> +70%).

Four of the five risk indicators are negative. The RCD:RHS ratio turned negative last week because consumer discretionary has started underperforming consumer staples. This may just be a temporary pullback in relative performance, but it is still short-term negative for stocks. The RSP:SPY ratio, however, moved higher as the average stock in the S&P 500 outperformed the large-caps in the S&P 500. This ratio has been rising since March 9th. Overall, this means the stock-specific indicators are split.

The three bond-specific indicators are negative. Stocks have been underperforming bonds because the SPY:IEF ratio has been in a downtrend since early March. The 5-year Treasury Yield ($FVX) has been falling since March 8th as money moves into short-term Treasuries. The HYG:LQD ratio firmed last week, but remains in a downtrend since early March and this means junk bonds (riskier) are underperforming investment-grade bonds (safer).

The short-term evidence for stocks is mixed and it is a difficult call right now. SPY and QQQ are at support from the mid March lows and trading ranges could evolve. IWM shows relative strength and finished near a key retracement zone, which could produce a reversal. The bigger trends are up and could pull trump. It could be a most interesting week because several securities are at important levels that could trigger reversals.

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Mon - Mar 30 - 08:30 - Personal Income & Spending

Mon - Mar 30 - 08:30 - PCE Prices

Mon - Mar 30 - 10:00 - Pending Home Sales

Tue - Mar 31 - 09:00 - Case-Shiller 20-city Index

Tue - Mar 31 - 09:45 - Chicago PMI

Tue - Mar 31 - 10:00 - Consumer Confidence

Wed - Apr 01 - 07:00 - MBA Mortgage Index

Wed - Apr 01 - 08:15 - ADP Employment Report

Wed - Apr 01 - 10:00 - ISM Manufacturing Index

Wed - Apr 01 - 10:00 - Construction Spending

Wed - Apr 01 - 10:30 - Oil Inventories

Wed - Apr 01 - 17:00 - Auto-Truck Sales

Thu - Apr 02 - 07:30 - Challenger Job

Thu - Apr 02 - 08:30 - Initial Jobless Claims

Thu - Apr 02 - 10:00 - Factory Orders

Thu - Apr 02 - 10:30 - Natural Gas Inventories

Fri - Apr 03 - 08:30 - Nonfarm Payrolls

Mon - Apr 06 - 10:00 - ISM Services Index

Tue - Apr 07 - 10:00 - JOLTS

Wed - Apr 08 - 07:00 - MBA Mortgage Index

Wed - Apr 08 - 10:30 - Oil Inventories

Wed - Apr 08 - 14:00 - FOMC Minutes

Thu - Apr 09 - 08:30 - Initial Jobless Claims

Thu - Apr 09 - 10:30 - Natural Gas Inventories

Tue - Apr 14 - 08:30 - Retail Sales

Tue - Apr 14 - 08:30 - Producer Price Index (PPI)

Wed - Apr 15 - 07:00 - MBA Mortgage Index

Wed - Apr 15 - 08:30 - Empire State Manufacturing

Wed - Apr 15 - 09:15 - Industrial Production

Wed - Apr 15 - 10:00 - NAHB Housing Market Index

Wed - Apr 15 - 10:30 - Oil Inventories

Wed - Apr 15 - 14:00 - Fed's Beige Book

Thu - Apr 16 - 08:30 - Initial Jobless Claims

Thu - Apr 16 - 08:30 - Housing Starts & Building Permits

Thu - Apr 16 - 10:00 - Philadelphia Fed

Thu - Apr 16 - 10:30 - Natural Gas Inventories

Fri - Apr 17 - 08:30 - Consumer Price Index (CPI)

Fri - Apr 17 - 10:00 - Michigan Sentiment

Fri - Apr 17 - 10:00 - Leading Economic Indicators

Wed - Apr 22 - 07:00 - MBA Mortgage Index

Wed - Apr 22 - 09:00 - FHFA Housing Price Index

Wed - Apr 22 - 10:00 - Existing Home Sales

Wed - Apr 22 - 10:30 - Oil Inventories

Thu - Apr 23 - 08:30 - Initial Jobless Claims

Thu - Apr 23 - 10:00 - New Home Sales

Thu - Apr 23 - 10:30 - Natural Gas Inventories

Fri - Apr 24 - 08:30 - Durable Goods Orders

Tue - Apr 28 - 09:00 - Case-Shiller Housing Index

Tue - Apr 28 - 10:00 - Consumer Confidence

Wed - Apr 29 - 07:00 - MBA Mortgage Purchase Index

Wed - Apr 29 - 10:00 - Pending Home Sales

Wed - Apr 29 - 10:30 - Oil Inventories

Wed - Apr 29 - 14:00 - FOMC Rate Decision

Thu - Apr 30 - 08:30 - Initial Jobless Claims

Thu - Apr 30 - 08:30 - PCE Prices

Thu - Apr 30 - 08:30 - Personal Income & Personal Spending

Thu - Apr 30 - 09:45 - Chicago PMI

Thu - Apr 30 - 10:30 - Natural Gas Inventories 0

Fri - May 01 - 08:15 - ADP Employment Report

Fri - May 01 - 10:00 - Construction Spending

Fri - May 01 - 10:00 - ISM Manufacturing Index

Fri - May 01 - 10:00 - Michigan Sentiment

Fri - May 01 - 17:00 - Auto-Truck Sales

This commentary is designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.