Stocks were slightly higher on Tuesday with the Nasdaq 100 ETF (QQQ) leading the way (+.83%). The sectors were mixed with weakness coming from energy and utilities. Energy stocks were lower as oil hit another new low for the move. Utilities were lower because the 10-YR Treasury Yield ($UST10Y) closed at its highest closing level since the end of July (2.534%). Rising rates also weighed on the REIT iShares (-1.39%). The Regional Bank SPDR (KRE), however, got a big lift from rising rates. The chart below shows KRE moving above 39.5 as the 10-year Yield surged. The indicator window shows the Correlation Coefficient (KRE,$UST10Y) moving back into positive territory. Notice that correlation has been largely positive over the last six months. This means KRE rises and falls along with the 10-year yields. The breakout in the 10-year yield, therefore, is bullish for KRE.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

SPY has a series of lower lows and lower highs working over the last five days. It is a very short-term trend, but it is down until proven otherwise. The red lines show what could be a falling flag and I will mark first resistance at 200.60. I may be a bit early (i.e. wrong) on this call, but keep in mind that this is still viewed as a correction within a bigger uptrend. The indicator window shows SPY outperforming TLT since mid August.

**************************************************************

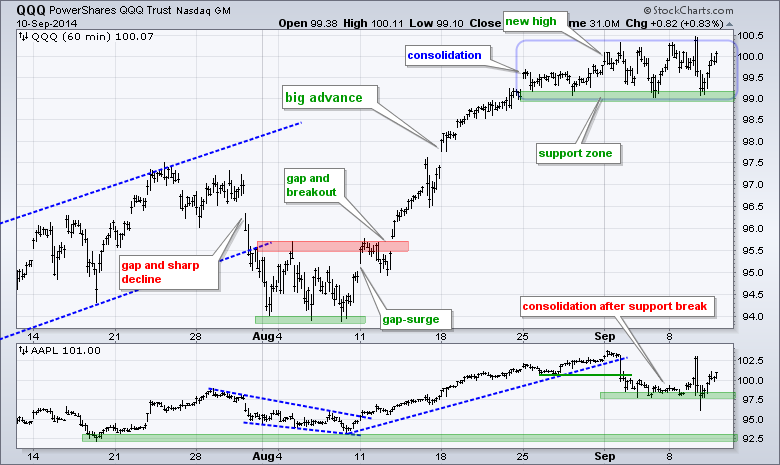

QQQ bounced off its support zone as Apple moved back above 100. These bounces reinforce both support zones. A move below 99 would be short-term bearish for QQQ and a move below 97.5 would be short-term bearish for Apple. At a 13% weighting, Apple holds an important key for QQQ. A break below 97.5 would target a move to 92.5, which would be around 5%. This would weigh on QQQ.

**************************************************************

No change. If we want to split hairs, IWM exceeded the late August low last week and exceeded last week's low on Tuesday. The ETF also broke the channel trend line and a downtrend is present in September. The red lines show a possible falling flag, but the trend is down as long as it falls. I will mark resistance at 116.7. Also notice that IWM has been underperforming this month.

**************************************************************

TLT broke support to fully reverse the two month uptrend. Similarly, the 5-year Treasury Yield ($FVX) and 10-YR Treasury Yield ($TNX) continued higher. Remember, yields move opposite of prices. The upside breakouts in yields are bearish for Treasuries. While this may weigh on stocks short-term, I think it will be long-term positive because the money moving out of Treasuries has to go somewhere. TLT resistance is set at 117.

**************************************************************

No change. Mark that date. On September 5th, 2014, the European Central Bank (ECB) embarked on quantitative easing. We have seen what happened to the Dollar during QE and it is not the Euro's turn (and the Yen). The US is winding down QE, while the other two are ramping up. The Euro Index ($XEU) plunged over 1% and hit a fresh 52-week low. Key support is set at 21.90.

**************************************************************

The USO Oil Fund (USO) broke yet another support level and hit a new low for the move. This week's high marks first resistance at 35. A quick move above this level would suggest a bear trap, but it would not be enough to reverse the overall downtrend. I am keeping key resistance at 36. Strength in the Dollar is contributing to weakness in oil.

**************************************************************

The Gold SPDR (GLD) moved below the lower trend line of a falling channel that extends back to mid July. This oversold condition is about the only positive for gold. Also note that the Euro is also oversold. Oversold conditions do not guarantee a bounce though. In fact, oversold conditions occur in strong downtrends and any bounce would be deemed temporary. Overall, I will stick to the channel and mark key resistance at 125.

***************************************************************

Key Reports and Events (all times Eastern):

Thu - Sep 11 - 08:30 - Initial Jobless Claims

Thu - Sep 11 - 10:30 - Natural Gas Inventories

Fri - Sep 12 - 08:30 - Retail Sales

Fri - Sep 12 - 09:55 - Michigan Sentiment

Thu - Sep 18 - 09:00 - Scottish Referendum

Chart Setups on Tuesday and Thursday.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.