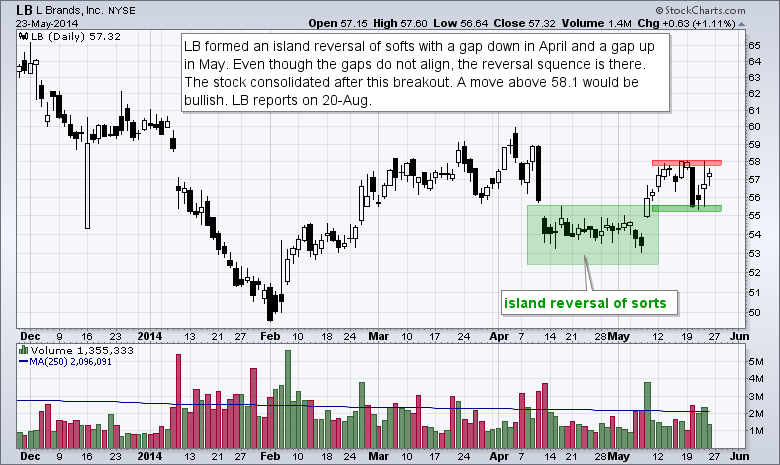

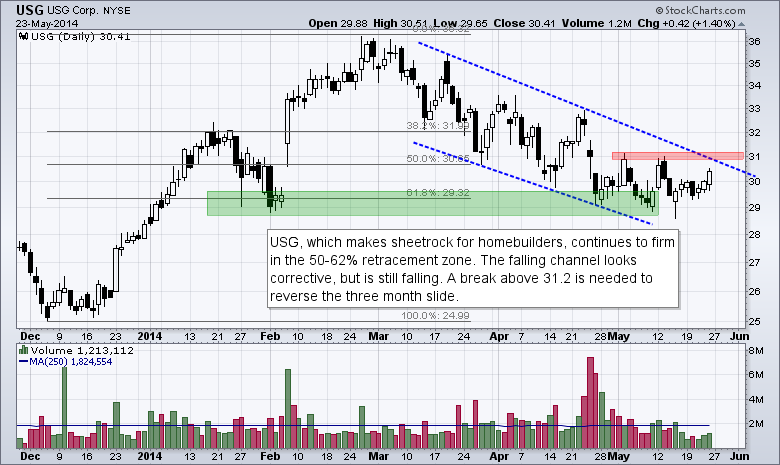

Today's charts feature five setups in various groups. We start with a semiconductor stock making a breakout on high volume. Next, there are two retailers with bullish continuation patterns forming. Both broke out with gaps and are now consolidating. Fourth, we have another semiconductor stock bouncing off support with huge volume. And finally, there is a homebuilding supplier firming in a key retracement zone.

Video is not available at the moment because we moved to a new blogging platform recently. We are working on the technical issues required to incorporate videos again. Thanks for your understanding.

**This chart analysis is for educational purposes only, and should not be construed as a recommendation to buy, sell or sell-short said securities**

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.