Stocks took a breather with techs leading the market lower on Tuesday. Relative weakness in techs may not last long because the Technology SPDR (XLK) and the Nasdaq 100 ETF (QQQ) are poised to open sharply higher on the heels of Facebook and Apple. Elsewhere, the Home Construction iShares (ITB) was hit rather hard with a 1.56% decline and moved deeper into its support zone. Chartists can lower first resistance to 24 and look for a break above this level for the early signal. Overall, the short-term trends for SPY and QQQ are up with the breakout zones marking short-term support. The AD Lines and AD Volume Lines pulled back, but I am not seeing any warning signs, such as bearish divergences, in these breadth indicators.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

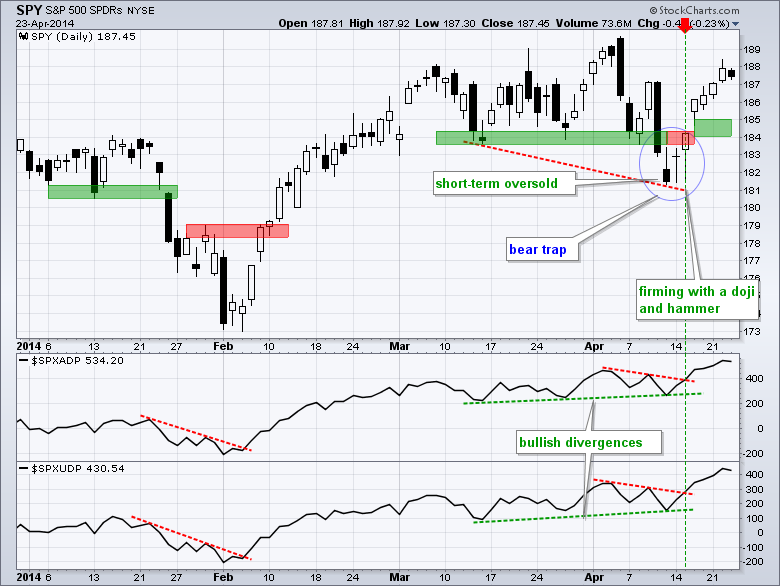

No change: SPY has been pretty flat since late February with several moves above/below the 185 level. The swings, however, widened in April with a downswing from 189.6 to 181.2 and an upswing back up to the 188 area. Basically, SPY failed to hold the support break at 184 and broke resistance with a gap up last week. I will reset support in the 184-185 area.

**************************************************************

No change: QQQ has been trending lower since early March with a series of lower highs. The ETF, however, broke out last week and surged above 87.5 this week. Resistance could come soon from the 9-Apr high and 62% retracement, but I would pay more attention to the current upswing and mark upswing support at 85.5 for now. Note that AAPL, BIIB and QCOM report today.

**************************************************************

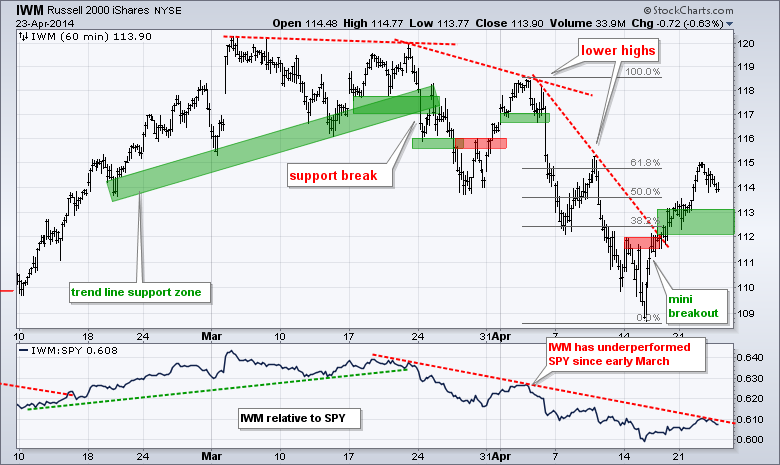

No change: IWM surged from 109 to 115 over the past week and has now retraced 62% of the early April decline. The ETF is getting a little overbought and near resistance from the 9-Apr high, but the swing here is clearly up with support near the breakout at 112. Relative weakness in small-caps remains at concern overall.

**************************************************************

The 20+ YR T-Bond ETF (TLT) got a pretty good bounce over the last two days and moved back above broken support, which turned first resistance in the 110.3-110.6 area. The bounce in Treasuries is potentially negative for stocks. I will leave key support at the channel trend line and mid April lows (108.5).

**************************************************************

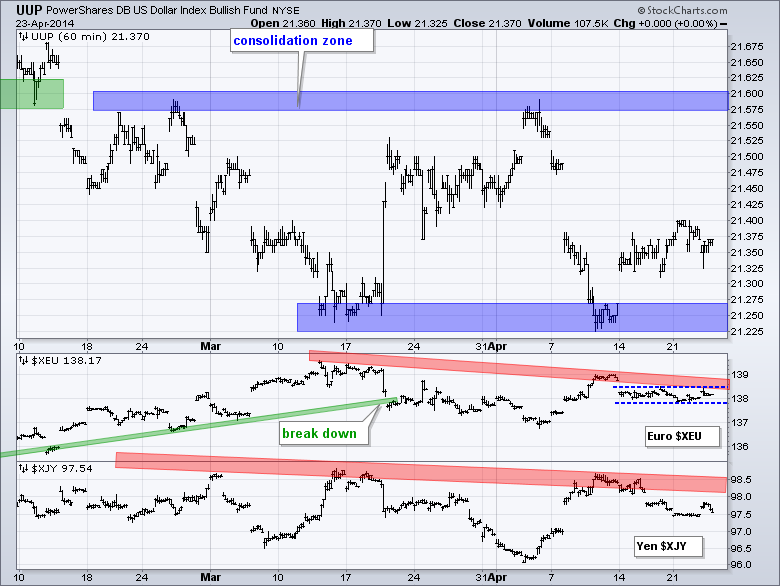

No change. The US Dollar ETF (UUP) surged above 21.55 in early April, but failed to hold these gains and fell back to the mid March lows on 10-April. The Euro Index ($XEU) holds the key to the Dollar. XEU fell to 138 last week and then consolidated. A break below 137.9 would be Euro negative and Dollar positive. Watch out though. The Euro is one resilient currency and a break above 139 would be bullish.

**************************************************************

No change: The USO Oil Fund (USO) formed a triangle in early April and broke triangle resistance with a surge the second week of April. After stalling in the 37.5-37.75 area last week, the ETF fell sharply on Tuesday and is nearing its first support zone. Broken resistance and the trend line zone extending up from mid March mark support in the 36.5-36.8 area.

**************************************************************

No change: Gold continues to follow the Euro. Or maybe the Euro is following gold. Either way, these two are positively correlated. Notice how both rose into mid March, fell in the second half of March, bounced in early April and then fell over the last seven days. GLD hit resistance at broken support and the 50% retracement. The channel support break reversed the April upswing and gold is short-term bearish right now.

***************************************************************

Key Reports and Events (all times Eastern):

Thu - Apr 24 - 08:30 - Initial Jobless Claims

Thu - Apr 24 - 08:30 - Durable Goods Orders

Thu - Apr 24 - 10:30 - Natural Gas Inventories

Fri - Apr 25 - 09:55 - Michigan Sentiment

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.