It was a volatile and mixed day on Monday. The Dow Diamonds (DIA) closed a half percent higher to lead the major index ETFs, while the Russell 2000 ETF (IWM) closed .58% lower on the day. The sectors were mixed with technology, healthcare and consumer staples leading on the upside. Finance and materials led on the downside. Internet names weighed on the market as the Internet ETF (FDN) lost around 2%. Money continues to rotate from expensive stocks to more moderately priced stocks. Amazon, LinkedIn, Yelp, Facebook and Netflix moved lower, while Cisco, Comcast, Microsoft, IBM, Apple and Intel moved higher. On Fast Money, Anthony Scarmucci suggested that we are moving from a monetary driven market to a fundamentally driven market. This is why the momentum names are being re-priced and money is rotating into names with lower multiples.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

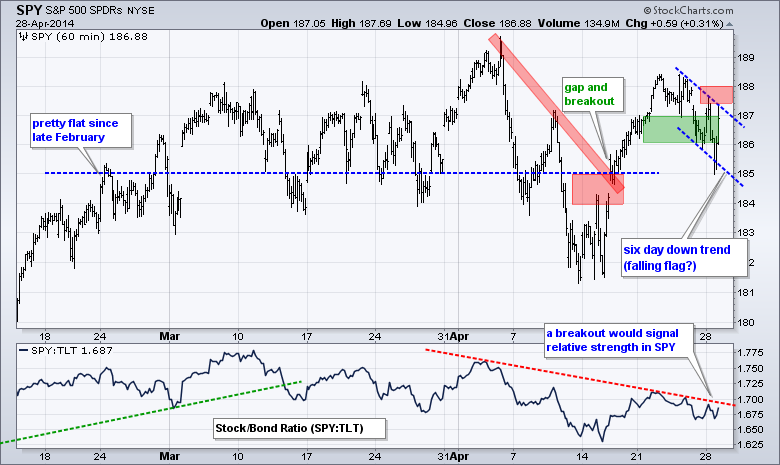

Trading has turned quite volatile as SPY chopped its way lower over the last six days. The decline could be a bull flag after a sharp advance. The bears get the edge as long as the flag falls. A break above 188 would end the flag and signal a continuation of the mid April surge.

**************************************************************

QQQ is holding up better than IWM because of Apple, which is up over 13% the last seven days. The trend since early March is down, but the ETF managed a bounce near the 62% retracement on Monday afternoon. Also notice that a falling flag is taking shape. A break above Monday's high would be the first sign of strength. A break above key resistance at 88 would reverse the overall downtrend.

**************************************************************

Not much change here. IWM peaked in early March, formed a lower high in mid March and zigzagged lower in April. The ETF peaked twice near 115 this month and is now nearing the mid April low with the decline over the last six days. The April trend line marks resistance at 114.

**************************************************************

The 20+ YR T-Bond ETF (TLT) surged to a new reaction high with the intraday move to 112 on Friday. This move extends the uptrend in Treasuries as we head into the employment report on Friday. The bond market is pricing in bad economic news this week so anything positive would likely weigh on Treasuries. On the price chart, last week's lows and the lower trend line of the rising channel mark uptrend support at 109.

**************************************************************

The Dollar may also cue off this week's economic reports. Strength would increase the propensity to taper and this would be Dollar positive. UUP bounced off support and then consolidated the last two weeks. A break above 21.4 would be bullish here. The Euro Index ($XEU), however, is making a breakout bid with the move above 138.5 on Monday.

**************************************************************

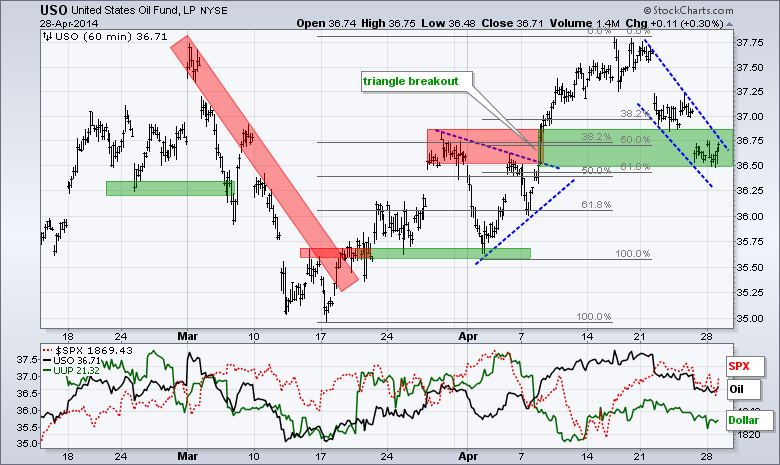

No change. The USO Oil Fund (USO) extended its correction with a move to the big support zone (36.50-36.75). Broken resistance and the Fibonacci cluster marks support here as the ETF forms a falling wedge. A break above wedge resistance (call it 37) would be bullish here.

**************************************************************

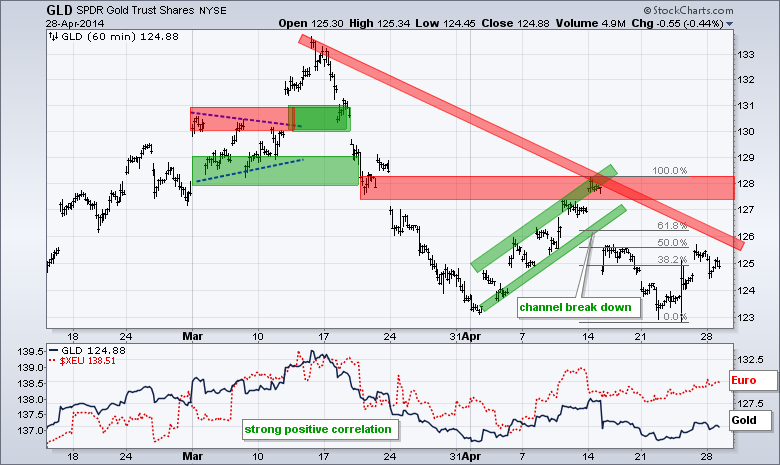

No change. Gold got a surge last week as stocks fell and Treasuries rose. Maybe this was the Ukraine premium. In any case, the overall trend remains down and GLD is nearing its first resistance area. The 50-62% retracement zone and mid March trend line mark resistance in the 126 area. Watch the Euro because an upside breakout in $XEU would be positive for gold.

***************************************************************

Key Reports and Events (all times Eastern):

Tue - Apr 29 - 09:00 - Case-Shiller 20-city Index

Tue - Apr 29 - 10:00 - Consumer Confidence

Wed - Apr 30 - 07:00 - MBA Mortgage Index

Wed - Apr 30 - 08:15 - ADP Employment Report

Wed - Apr 30 - 08:30 - GDP

Wed - Apr 30 - 09:45 - Chicago PMI

Wed - Apr 30 - 10:30 - Crude Oil Inventories

Wed - Apr 30 - 14:00 - Fed Policy Statement

Thu - May 01 - 07:30 - Challenger Job Report

Thu - May 01 - 08:30 - Initial Jobless Claims

Thu - May 01 - 08:30 - Personal Income & Spending

Thu - May 01 - 10:00 - ISM Manufacturing Index

Thu - May 01 - 10:00 - Construction Spending

Thu - May 01 - 10:30 - Natural Gas Inventories

Thu - May 01 - 14:00 - Auto-Truck Sales

Fri - May 02 - 08:30 - Employment Report

Fri - May 02 - 10:00 - Factory Orders

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.