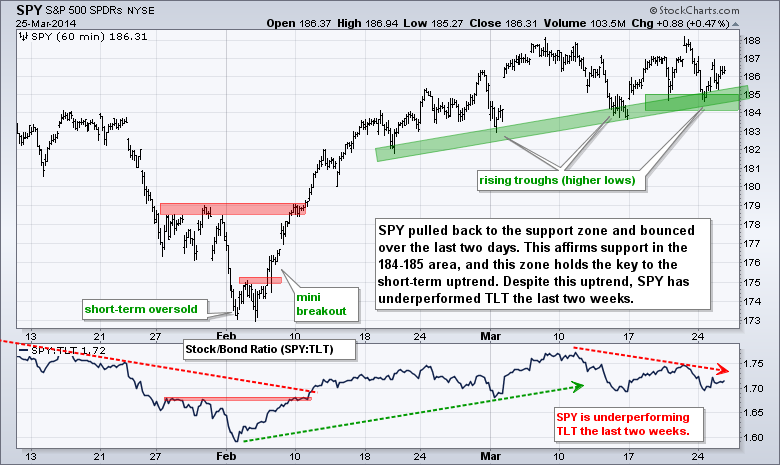

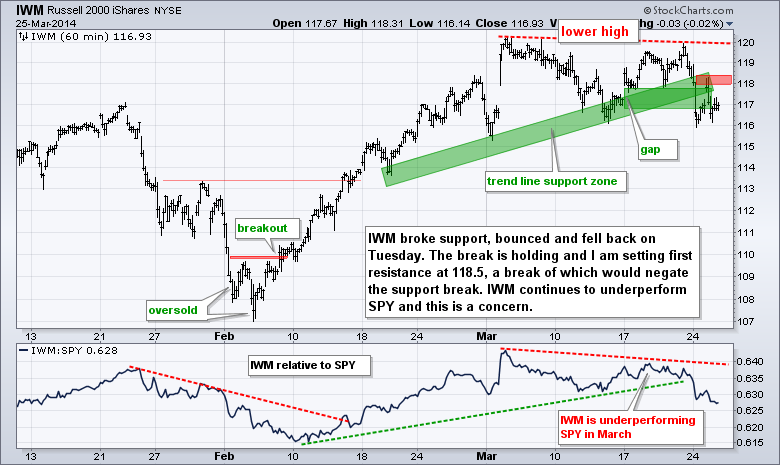

Stocks put in a mixed performance on Tuesday with the S&P 500 SPDR (SPY) edging higher and the Russell 2000 ETF (IWM) closing fractionally lower. Seven of the nine sector SPDRs were up with industrials and energy leading. The consumer discretionary and finance sectors lost ground. While I am concerned with relative weakness in the Consumer Discretionary SPDR (XLY) and the Retail SPDR (XRT), other parts of the market are holding up fine and this has kept the breadth indicators for SPY slightly positive. The 20-day EMAs for the AD Line and AD Volume Line broke support zones on 11-March and moved into negative territory a few days later. This dip did not last long as the EMAs turned positive again with last week's bounce. Stock market breadth has a bullish bias as long as these two remain positive. Notice that SPY has moved above/below the 186 level each of the last six trading days. This consolidation is part of a bigger consolidation for the month of March.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Mar 26 - 07:00 - MBA Mortgage Index

Wed - Mar 26 - 08:30 - Durable Orders

Wed - Mar 26 - 10:30 - Crude Inventories

Thu - Mar 27 - 08:30 - Initial Claims

Thu - Mar 27 - 08:30 - GDP

Thu - Mar 27 - 10:00 - Pending Home Sales

Thu - Mar 27 - 10:30 - Natural Gas Inventories

Fri - Mar 28 - 09:55 - Michigan Sentiment

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.