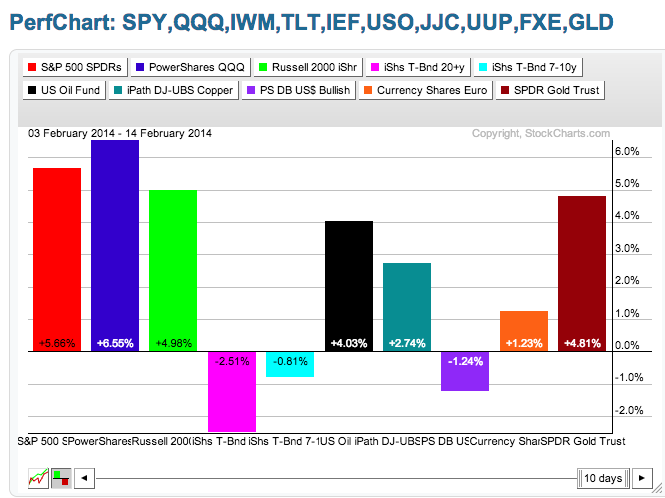

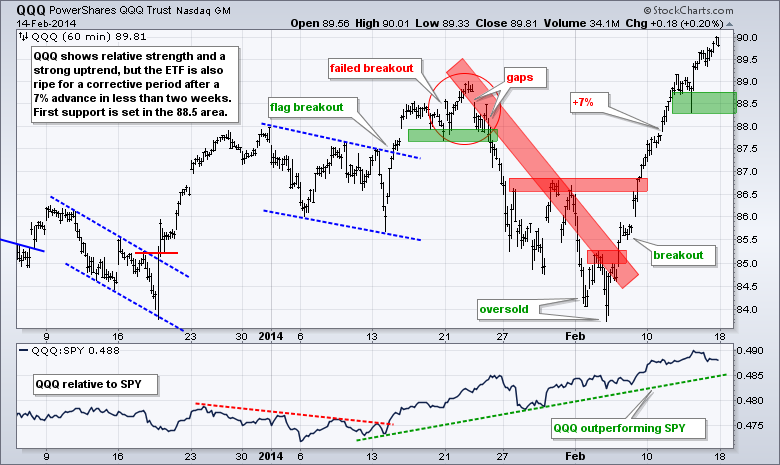

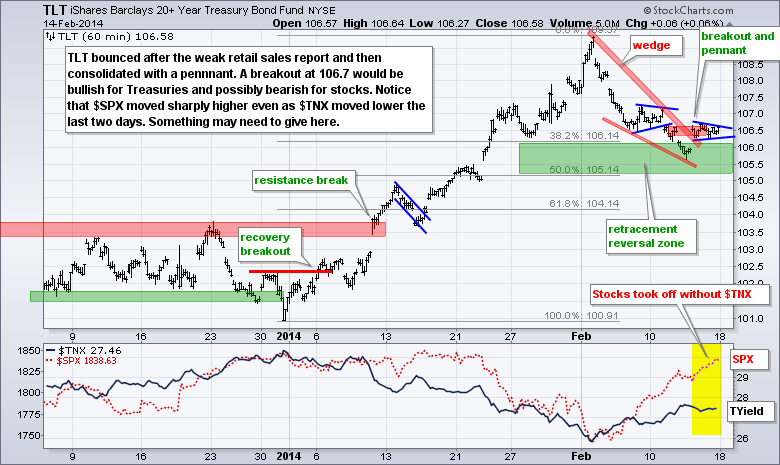

Stocks begin a four-day week in strong short-term uptrends that are quite extended. In just two weeks, SPY is up over 5.66%, QQQ is up 6.55% and IWM is up around 5%. Even though stocks are ripe for a short-term pullback or consolidation, the medium-term trends are up and SPY is challenging its January highs. In addition to short-term overbought conditions, I am also concerned with relative weakness in small-caps. IWM, however, also remains in a short-term uptrend and has yet to break down. My eyes will be on the 20+ YR T-Bond ETF (TLT) and 10-YR Treasury Yield ($TNX) for clues. Money moved out of Treasuries and into stocks over the last two weeks. After falling for seven days, TLT got a bounce after the weak retail sales report last week and held its gain. Further strength in TLT would be negative for stocks and this could trigger a correction. With IWM underperforming, it is possible that small-caps lead the way lower on any pullback.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Tue - Feb 18 - 08:30 - Empire State Manufacturing

Tue - Feb 18 - 10:00 - NAHB Housing Market Index

Wed - Feb 19 - 07:00 - MBA Mortgage Index

Wed - Feb 19 - 08:30 - Housing Starts/Building Permits

Wed - Feb 19 - 08:30 - Producer Price Index (PPI)

Wed - Feb 19 - 14:00 - FOMC Minutes

Thu - Feb 20 - 08:30 - Initial Jobless Claims

Thu - Feb 20 - 08:30 - Consumer Price Index (CPI)

Thu - Feb 20 - 10:00 - Philadelphia Fed

Thu - Feb 20 - 10:00 - Leading Economic Indicators

Thu - Feb 20 - 10:30 - Natural Gas Inventories

Thu - Feb 20 - 11:00 - Crude Oil Inventories

Fri - Feb 21 - 10:00 - Existing Home Sales

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.