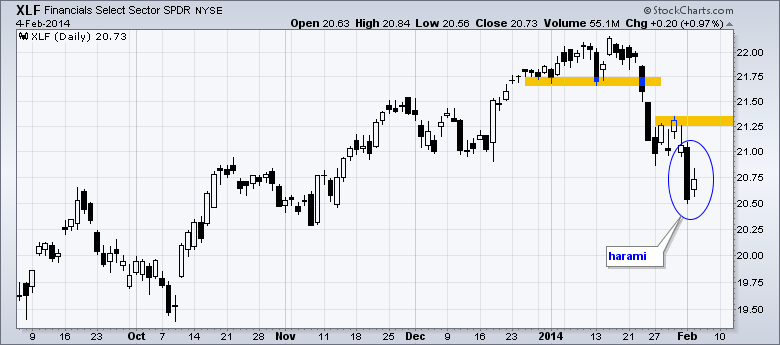

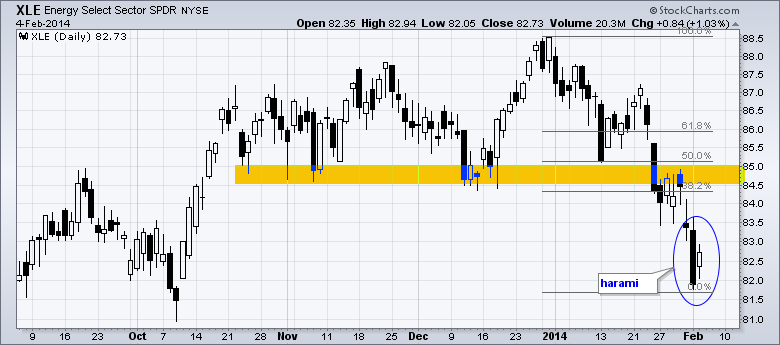

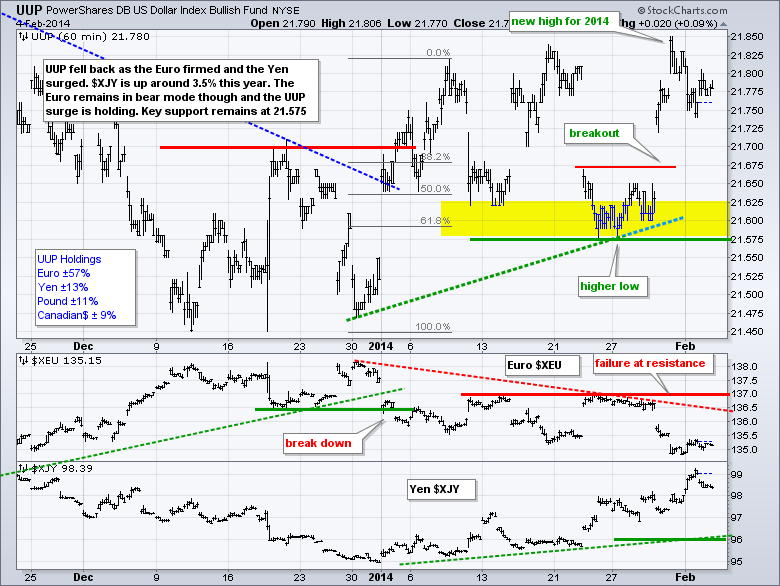

Stocks got a small bounce on Tuesday with mid-caps leading the way higher. All sectors were higher with the Consumer Discretionary SPDR (XLY), Finance SPDR (XLF) and Energy SPDR (XLE) gaining over 1%. All three were beaten down pretty good and were ripe for some sort of bounce. With a strong open and higher close, all three formed harami candlestick patterns on the day. The term "harami" means pregnant in Japanese. These candlesticks form when the current open-close range is within the prior open-close range. As such, the current candlestick appears to protrude out from the prior candlestick. Using the high-low range for both days, note that an inside day formed. Both inside days and harami signal indecision that can foreshadow a short-term reversal. While it appears that stocks may be setting up for a short-term oversold bounce, be careful because ISM Services will be reported today and the employment report is Friday. The market did not react well to Monday's ISM Manufacturing Index miss and last month's non-farm payroll miss. Estimates suggest that services account for over two thirds of GDP, which means a miss in the ISM Services Index would be bullish for bonds and bearish for stocks.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Feb 05 - 07:00 - MBA Mortgage Index

Wed - Feb 05 - 08:15 - ADP Employment Report

Wed - Feb 05 - 10:00 - ISM Services Index

Wed - Feb 05 - 10:30 - Crude Inventories

Thu - Feb 06 - 07:30 - Challenger Job Report

Thu - Feb 06 - 08:30 - Initial Jobless Claims

Thu - Feb 06 - 10:30 - Natural Gas Inventories

Fri - Feb 07 - 08:30 - Employment Report

Tue - Feb 11 - 08:30 - Yellen Testimony

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.