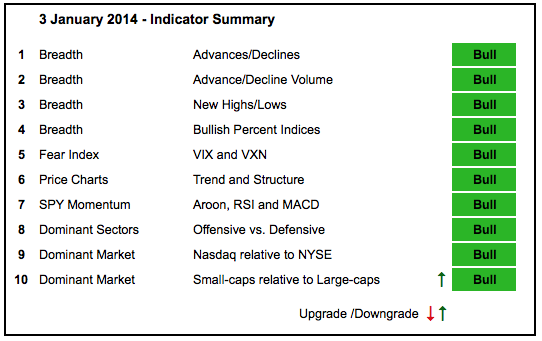

Stocks finished the year strong as the major index ETFs and offensive sector SPDRs hit new highs. These new highs were confirmed with new highs in the AD Lines and AD Volume Lines. Net New Highs also expanded as the High-Low Lines hit new highs. New highs all around can only mean one thing: uptrend. The current upswing started on December 16th and stocks are short-term overbought. This is really the only negative out there right now. The new highs affirm broad market strength and there are no signs of underlying weakness.

- AD Lines: Bullish. The Nasdaq AD Line hit another new high at yearend to extend its progression of higher highs and higher lows. The NYSE AD Line finally broke out and hit a new high to catch up with the NY Composite.

- AD Volume Lines: Bullish. The Nasdaq and NYSE AD Volume Lines also hit new highs at yearend to confirm the new highs in the underlying indices.

- Net New Highs: Bullish. The cumulative Net New Highs lines for the Nasdaq and NYSE hit new highs at yearend. Net New Highs did weaken and briefly dipped into negative territory in early December, but surged in the second half as new highs expanded again.

- Bullish Percent Indices: Bullish. All nine sector Bullish Percent Indices are above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) bounced off the lower end of its 2013 range (12 to 22), but remains at very low levels overall. The Nasdaq 100 Volatility Index ($VXN) also bounced off range support (13 to 23), but also remains at low levels overall.

- Trend-Structure: Bullish. DIA, IWM, MDY, QQQ and SPY hit new highs this week and remain in uptrends overall. No weakness here.

- SPY Momentum: Bullish. RSI surged above 70 on strong upside momentum. MACD(5,35,5) has been positive since early October. The Aroon Oscillator is lagging because it dipped below -50 in mid December and has yet to cancel this bearish signal with a surge above +50.

- Offensive Sector Performance: Bullish. XLI, XLK, XLF and XLY all hit new highs this week and remain in uptrends overall. The offensive sectors are leading the market and this shows a healthy appetite for risk.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio stalled from mid October to mid November and then surged to new highs in December as the Nasdaq resumed its outperformance.

- Small-cap Performance: Bullish. The $RUT:$OEX ratio bottomed in mid November and then zigzagged higher the last six weeks. I will call this an uptrend as long as the December low holds.

- Breadth charts (here) and intermarket charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios