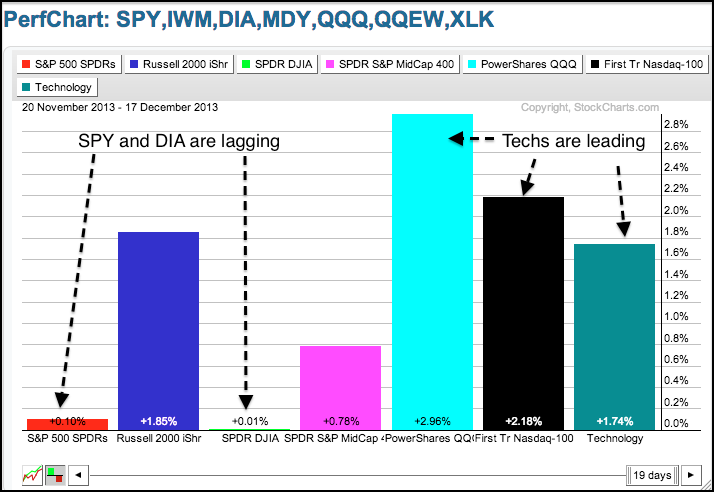

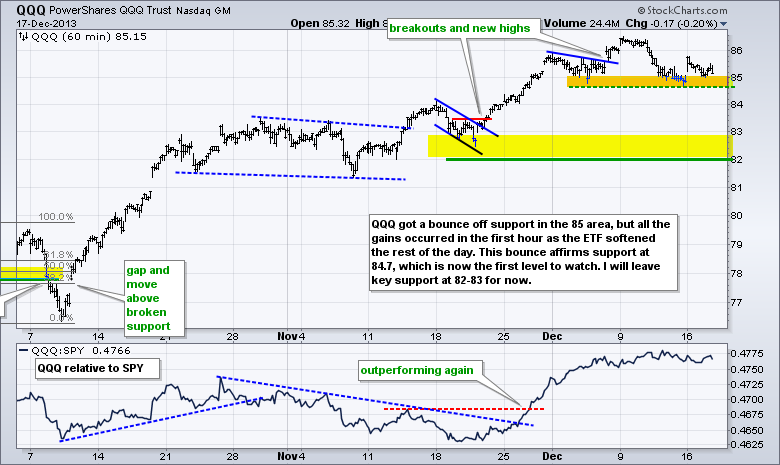

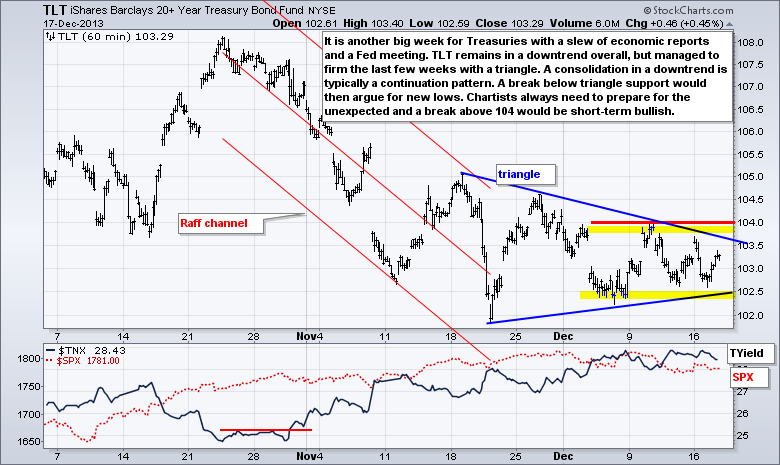

Today looks like a big day. First, we get housing starts and building permits before the open. Second, we get the Fed policy statement at 2PM ET. This is also Chairman Bernanke's last Fed meeting and last press conference, which will be at 2:30PM. Trading is likely to be volatile just before and after the announcement, and perhaps even during the pressy. Turning to stock market action, one cannot help but be impressed with relative strength in the tech sector, which started on November 20th. XLK, QQQ and QQEW have all outperformed SPY and DIA the last four weeks. In fact, notice that SPY and DIA are up fractionally since November 20th, while QQQ and QQEW are up over 2%. In addition, notice that IWM has been outperforming since November 20th. Even though SPY and DIA are limping along, relative strength in techs and small-caps is positive overall.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Dec 18 - 07:00 - MBA Mortgage Index

Wed - Dec 18 - 08:30 - Housing Starts-Sep&Oct

Wed - Dec 18 - 08:30 - Housing Starts/Building Permits-Nov

Wed - Dec 18 - 10:30 - Crude Oil Inventories

Wed - Dec 18 - 14:00 - FOMC Policy Statement

Thu - Dec 19 - 08:30 - Initial Jobless Claims

Thu - Dec 19 - 10:00 - Existing Home Sales-Nov

Thu - Dec 19 - 10:00 - Philadelphia Fed

Thu - Dec 19 - 10:00 - Leading Indicators

Thu - Dec 19 - 10:30 - Natural Gas Inventories

Fri - Dec 20 - 08:30 - GDP - Third Estimate

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.