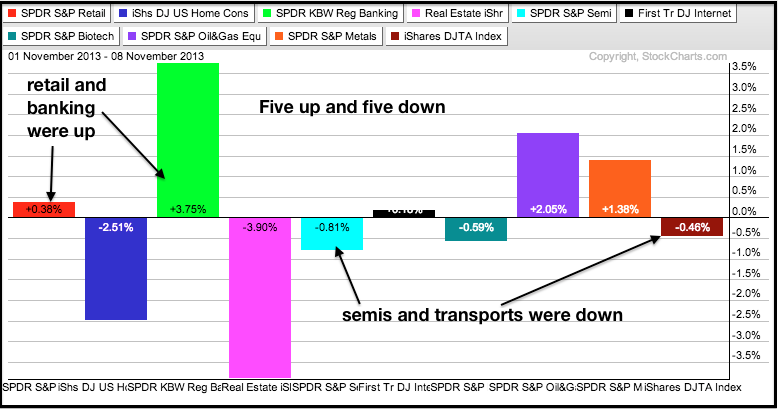

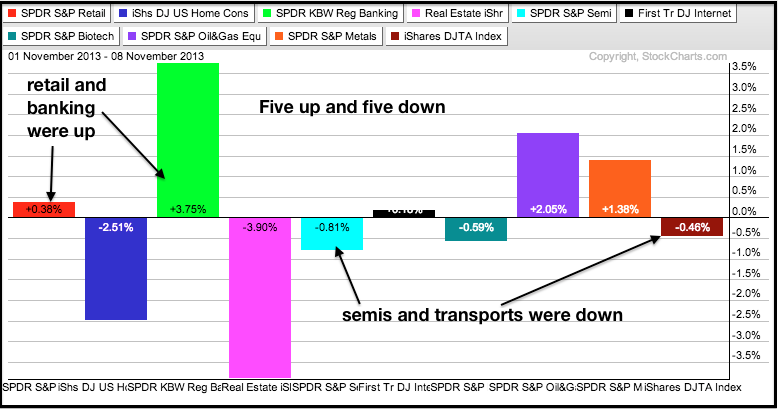

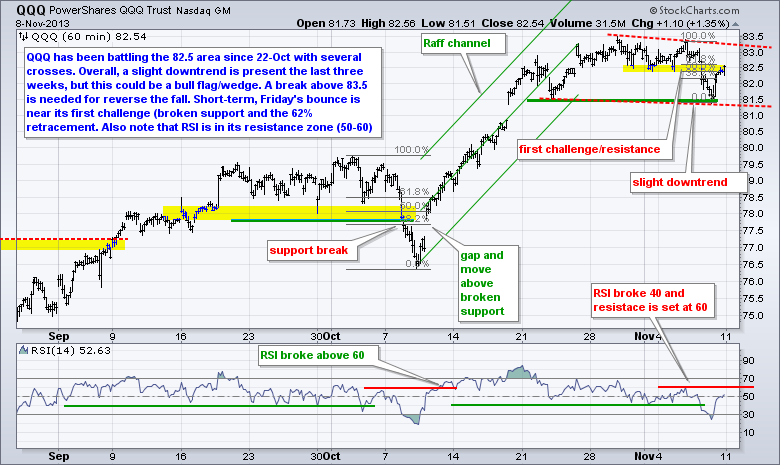

The bulls went on a run after non-farm payrolls beat expectations and prior months were revised higher. Strength in employment put tapering back on the agenda and weighed on bonds. Taper-talk also weighed on gold as the Dollar surged and held last week's breakout. Despite Friday's big advance, the short-term picture is mixed for the stock market. The S&P 500 ETF (SPY) held support and surged to consolidation resistance. The Russell 2000 ETF (IWM) also surged, but remains in a two week downtrend with lower lows and lower highs. This means small-caps are still showing relative weakness. QQQ is caught in the middle. This mixed message reflects the choppy trading we have seen since October 22nd. Even though stocks posted big gains on Friday, the Nasdaq 100 ETF (QQQ) and S&P Midcap SPDR (MDY) finished down for the week, and the gains in the Russell 2000 ETF (IWM) and S&P 500 ETF (SPY) were negligible. The Finance SPDR (XLF) delivered a most impressive performance on Friday as the ETF formed a massive white candlestick and surged above flag resistance (+2.33% on the day). The Regional Bank SPDR (KRE) also surged and recorded a 52-week high. The revival of the finance sector, however, was countered by weakness in the Home Construction iShares (ITB) and the REIT iShares (IYR). These two interest rate sensitive ETFs fell sharply on Friday and finished down for the week.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Nov 13 - 07:00 - MBA Mortgage Index

Wed - Nov 13 - 14:00 - Treasury Budget

Thu - Nov 14 - 08:30 - Initial Claims

Thu - Nov 14 - 08:30 - Trade Balance

Thu - Nov 14 - 10:30 - Natural Gas Inventories

Thu - Nov 14 - 11:00 - Crude Inventories

Fri - Nov 15 - 08:30 - Empire Manufacturing

Fri - Nov 15 - 09:15 - Industrial Production

Fri - Nov 15 - 09:15 - Capacity Utilization

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More