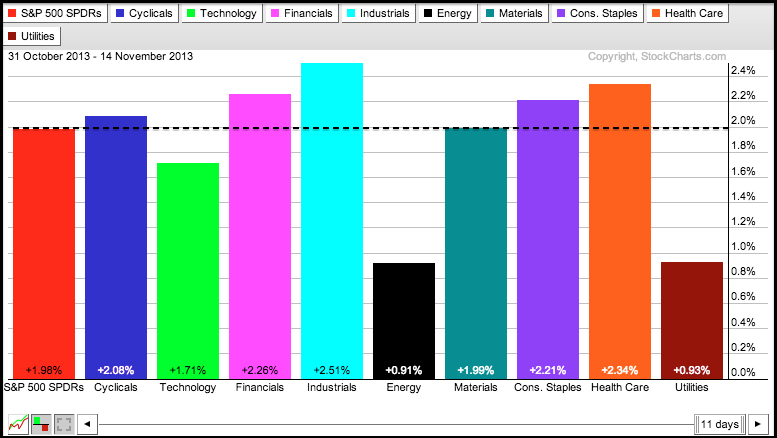

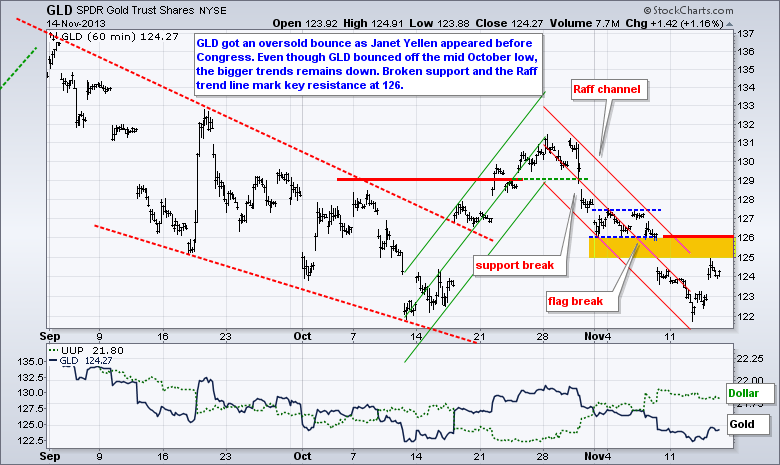

Stocks got a bounce, but there were some pockets of weakness in the market. Get this. The Russell 1000 iShares (IWB) moved higher, but the Russell 2000 ETF (IWM) edged lower. We can blame this on the growth component because the Russell 2000 Value iShares (IWN) was up .22%, but the Russell 2000 Growth iShares (IWO) finished down .35%. Eight of the nine sectors were up. Weakness in the networking (CSCO) and semiconductors weighed on the Technology SPDR (XLK). Interest rate sensitive shares moved higher as the 10-year Treasury Yield ($TNX) fell. Treasuries got an oversold bounce after hearing the dovish Janet Yellen. The Home Construction iShares (ITB) surged over 2% and the Utilities SPDR (XLU) advanced .88%. Despite today's bounce, XLU is the second weakest sector month-to-date. XLE is the weakest with a .91% gain since October 31st. While their gains are not shabby, they are underperforming because the stock market is in risk-on mode right now.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Fri - Nov 15 - 08:30 - Empire Manufacturing

Fri - Nov 15 - 09:15 - Industrial Production

Fri - Nov 15 - 09:15 - Capacity Utilization

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.