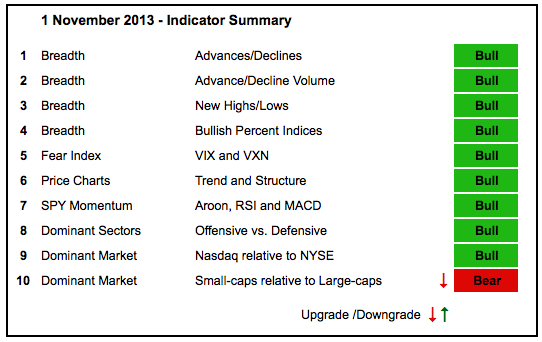

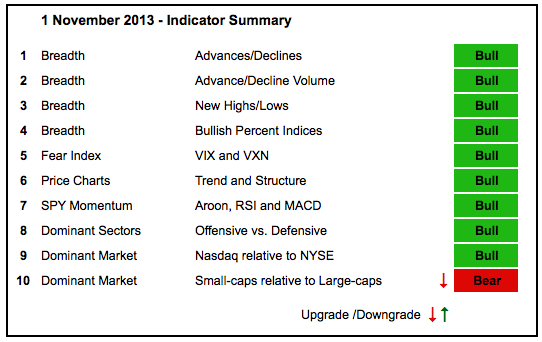

The indicator summary remains firmly positive, but stocks stumbled this week with small-caps and financials weighing on the market. After big runs the last three weeks, the major index ETFs are again short-term overbought. However, these runs produced new highs to affirm the overall uptrends. Also note that the AD Lines and AD Volume Lines confirmed with new highs. While the market certainly looks ripe for a correction, there is nothing in the tealeaves to suggest a major top.

- AD Lines: Bullish. The Nasdaq AD Line hit a new high in mid October and remains in a strong uptrend. The NYSE AD Line recorded a new high in late October and the summer lows mark key support.

- AD Volume Lines: Bullish. The Nasdaq AD Volume Line hit a new high in mid October and remains in a strong uptrend. The NYSE AD Volume Line edged above its September high and hit a new high in October.

- Net New Highs: Bullish. Net New Highs on both the Nasdaq and the NYSE surged this month and the cumulative High-Low Lines moved to new highs.

- Bullish Percent Indices: Bullish. All nine sector Bullish Percent Indices are above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) fell back to the low end of their 2013 range.

- Trend-Structure: Bullish. The five major index ETFs hit new highs in October (DIA, SPY, MDY, IWM and QQQ).

- SPY Momentum: Bullish. RSI bounced off the 40-50 zone and MACD (5,35,5) turned up near the zero line in early October. The Aroon Oscillator turned up and moved above +50 last week.

- Offensive Sector Performance: Bullish. All four offensive sectors hit new highs this month (XLK, XLF, XLI and XLY). XLF, however, is showing relative weakness the last two weeks.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio is in an uptrend, but remains below its early October high as the Nasdaq lagged a little over the last four weeks.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio formed a lower high in mid October and broke support with a sharp decline this week. Small-caps are underperforming and this is negative.

- Breadth charts (here) and intermarket charts (here) have been updated.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More