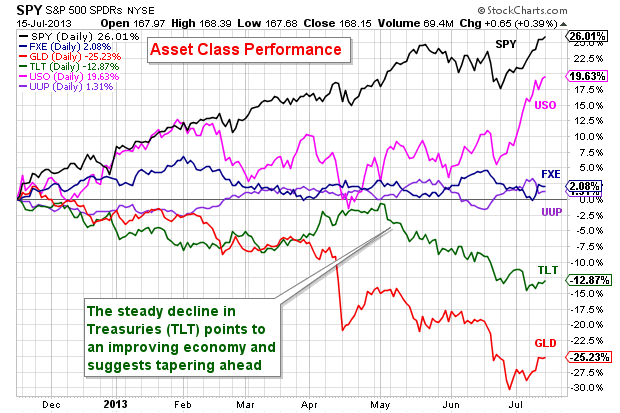

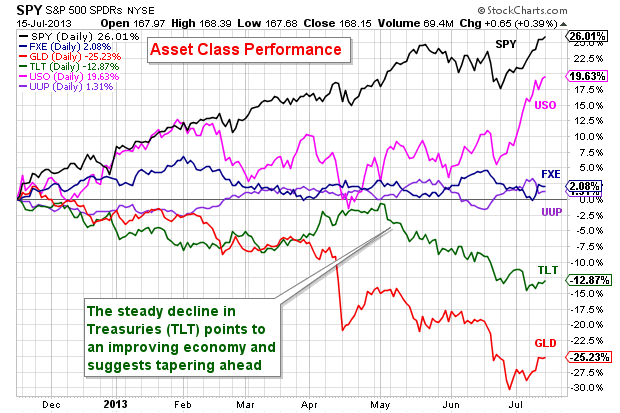

Trading turned a bit mixed on Monday as stocks digested recent gains ahead of earnings and testimony from Fed Chairman Bernanke. This is a big week for earnings with Goldman Sachs, Coca-Cola and Yahoo! reporting on Tuesday. Wednesday and Thursday are the biggest days though. Bank of America, IBM, Intel and Ebay report on Wednesday, while Morgan Stanley, Google and Microsoft report on Thursday. Stocks will of course be affected by the reaction to these earnings reports. While I expect these reports to be mostly positive, stocks are still short-term overbought after big advances the last three weeks and we could see a buy-the-rumor and sell-the-news scenario evolve. In addition, we have Fed Chairman Bernanke testifying before Congress on Wednesday and Thursday. Bonds and the Dollar will hang on every word from Chairman Bernanke. Instead of hanging on every word, I would watch non-farm payrolls, jobless claims, the economic stats and the banking stocks for clues on tapering. The employment picture is steadily improving, the economic stats favor growth over recession and banking stocks are strong. This suggest to me that the Fed will start to taper in the coming months. Keep in mind that taper is not the same as tighten. Taper simply means a little less quantitative easing.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Tue - Jul 16 - 08:30 - Consumer Price Index (CPI)

Tue - Jul 16 - 09:15 - Industrial Production & Capacity Utilization

Tue - Jul 16 - 10:00 - NAHB Housing Market Index

Wed - Jul 17 - 07:00 - MBA Mortgage Index

Wed - Jul 17 - 08:30 - Housing Starts & Building Permits

Wed - Jul 17 - 10:00 – Chairman Bernanke Testifies before Congress

Wed - Jul 17 - 10:30 - Oil Inventories

Wed - Jul 17 - 14:00 - Fed Beige Book

Thu - Jul 18 - 08:30 - Jobless Claims

Thu - Jul 18 - 10:00 – Chairman Bernanke Testifies before Congress

Thu - Jul 18 - 10:00 - Philadelphia Fed

Thu - Jul 18 - 10:00 - Leading Economic Indicators

Thu - Jul 18 - 10:30 - Natural Gas Inventories

Fri - Jul 19 - 10:00 – Happy Friday!

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More