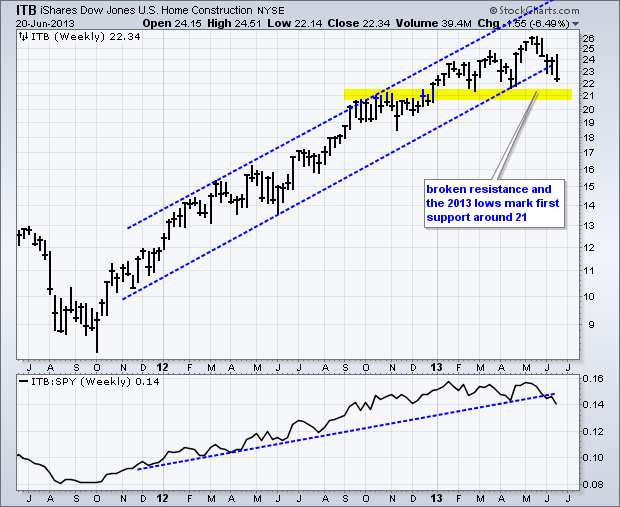

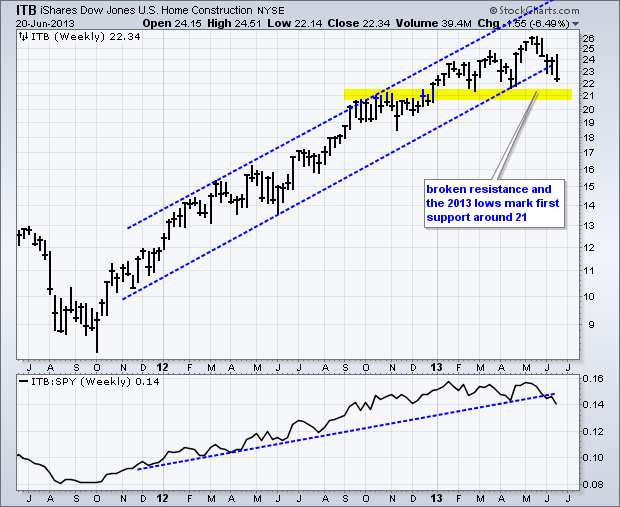

Stocks were hit hard with the major index ETFs falling over 2% on the day. Even though this decline looks massive on a short-term basis, it is relatively small on a six to twelve month timeframe. All sectors were down with the defensive sectors leading the way lower, which is weird. The Utilities SPDR (XLU), Consumer Staples SPDR (XLP) and Healthcare SPDR (XLV) were down around 3%. Housing stocks were pummeled with the Home Construction iShares (ITB) falling over 5% and the Real Estate iShares (IYR) fell over 4%. It is clear that these interest rate sensitive issues are making an adjustment for rising rates. The 10-year Treasury Yield ($TNX) surged to a 15 month high and may hit 3% before this is over. The front running rally ahead of the Fed turned out to be one big head fake. Traders thought Bernanke would soften his tone on QE, but this lame-duck chairman, with nothing to loose, stood his ground. Good for him. The Fed obviously has a plan and the plan is to wind down QE, which could not go on forever. Now it is time for the real economy to step up to the plate and carry the market.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Fri - Jun 21 - 08:30 – TGIF!

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More