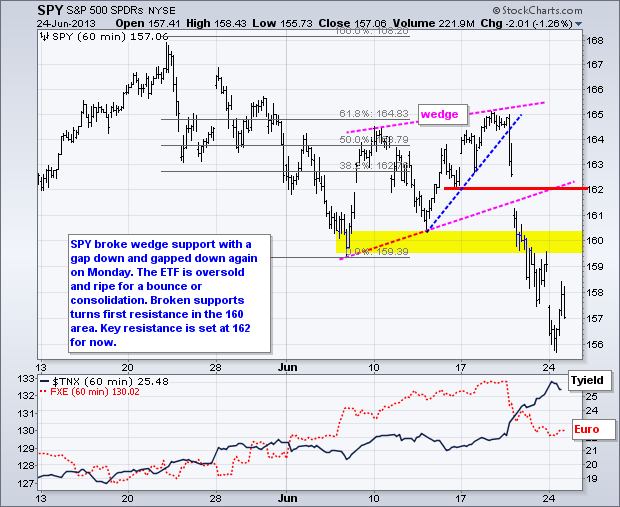

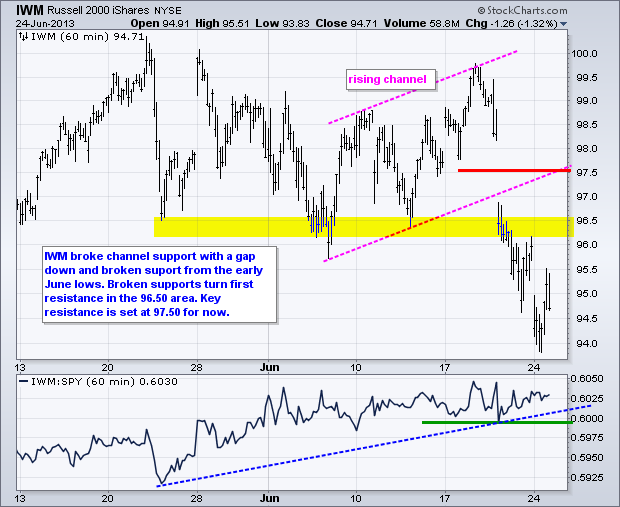

Stocks moved lower again on Monday with broad-based selling pressure. The decline was, however, contained because the major index ETFs gapped down, bounced and then moved lower in the final hour. All sectors were down with the Industrials SPDR (XLI) and Finance SPDR (XLF) leading the way. The defensive sectors held up the best with the smallest declines. Note that the Equal-weight Consumer Staples ETF (RHS) closed with a small gain. Industry groups within the materials sector were hammered because the Shanghai Composite was down over 5% and emerging markets are in the dumps. A surging Dollar is not helping either. As negative as things were the last few days, stocks are short-term oversold and ripe for a bounce or consolidation as we hit turnaround Tuesday. Any bounce would be considered just an oversold bounce within a medium-term downtrend though.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Tue - Jun 25 - 08:30 - Durable Orders

Tue - Jun 25 - 09:00 - Case-Shiller 20-city Index

Tue - Jun 25 - 09:00 - FHFA Housing Price Index

Tue - Jun 25 - 10:00 - Consumer Confidence

Tue - Jun 25 - 10:00 - New Home Sales

Wed - Jun 26 - 07:00 - MBA Mortgage Index

Wed - Jun 26 - 08:30 - GDP - Third Estimate

Wed - Jun 26 - 10:30 - Crude Inventories

Thu - Jun 27 - 08:30 - Initial Claims

Thu - Jun 27 - 08:30 - Personal&Spending

Thu - Jun 27 - 10:00 - Pending Home Sales

Thu - Jun 27 - 10:30 - Natural Gas Inventories

Fri - Jun 28 - 09:45 - Chicago PMI

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More