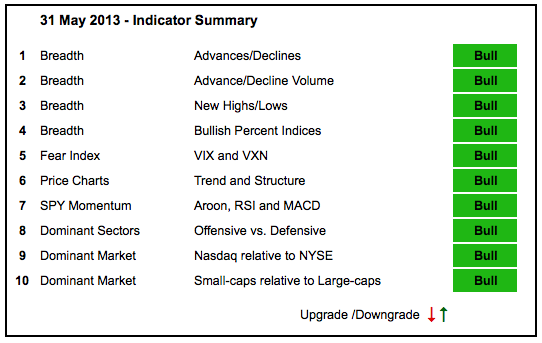

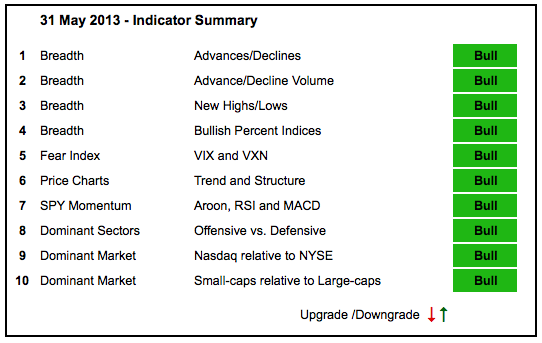

After hitting new highs in mid May, the major index ETFs moved into consolidation patterns the last two weeks. A little rest, or even a pullback, would be healthy for the uptrend. With this sideway movement, there is no change in the indicator summary. Of note, the Nasdaq is showing some strength as the Nasdaq AD Volume Line hit a new high this week and the $COMPQ:$NYA ratio hit a new high for 2013. Techs are leading the market and this suggests that the appetite for risk is strong. Also note that the Finance SPDR (XLF) is leading with many of the big banks hitting 52-week highs this week.

- AD Lines: Bullish. The Nasdaq AD Line stalled this week and the NYSE AD Line pulled back. Both remain in long-term uptrends, but are ripe for some sort of corrective period.

- AD Volume Lines: Bullish. The Nasdaq AD Volume Line hit a new high this week, but the NYSE AD Volume Line pulled back. Both remain in long-term uptrends, but also ripe for a corrective period.

- Net New Highs: Bullish. Nasdaq and NYSE Net New Highs remain firmly positive and their cumulative lines moved to new highs.

- Bullish Percent Indices: Bullish. All nine BPIs are above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) bounced, but remain in downtrends overall.

- Trend-Structure: Bullish. DIA, IWM, MDY, QQQ and SPY hit 52-week highs this month and remain in clear uptrends.

- SPY Momentum: Bullish. RSI has been in the bull zone (40-80) since mid December. MACD(5,35,5) has been positive since early December. The Aroon Oscillator has not been below -50 since late November.

- Offensive Sector Performance: Bullish. XLF, XLI, XLK and XLY hit new highs in May and show upside leadership over the last six weeks.

- Nasdaq Performance: Bullish. The $COMPQ:$NYC ratio is bullish as it broke above its January high at the beginning of May. The Nasdaq is outperforming the NY Composite year-to-date.

- Small-cap Performance: Bullish. The $RUT:$OEX ratio bottomed in mid April and has been moving higher the last six weeks.

- Breadth Charts (here) and Intermarket Charts (here) have been updated.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More