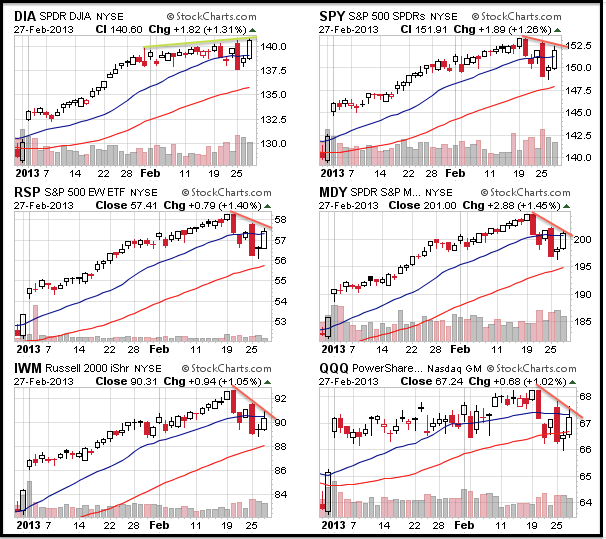

The Dow led the market on Wednesday with a surge above 14000. Despite some sizable moves in the major index ETFs, only the Dow SPDR (DIA) cleared its prior highs and closed at its highest level for the month. Note that SPY, RSP, MDY, IWM and QQQ have yet to exceed Monday's high. In fact, Monday's highs are below last week's highs for all five of these ETFs. Thirty stocks drive the Dow and this is a price-weighted average, which means the highest priced stocks carry the most weight. IBM surged 1.6% and closed at 202.33, which makes it the biggest factor by far. Chevron surged 1.47% and closed at 116.65, while MMM surged 1.23% and closed at 103.57 on the day. These three stocks accounted for the lion's share of the Dow's big move.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Thu - Feb 28 - 08:30 - Jobless Claims

Thu - Feb 28 - 08:30 - GDP

Thu - Feb 28 - 09:45 - Chicago PMI

Thu - Feb 28 - 10:30 - Natural Gas Inventories

Fri - Mar 01 - 08:30 - Personal Income & Spending

Fri - Mar 01 - 09:55 - Michigan Sentiment

Fri - Mar 01 - 10:00 - ISM Index

Fri - Mar 01 - 10:00 - Construction Spending

Fri - Mar 01 - 14:00 - Auto Sales/Truck Sales

Fri – Mar 01 - 23:59 – Sequester Takes Effect (unless...)

Wed – Mar 27 - 23:59 – Government Shut Down Deadline

Wed – May 15 - 23:59 – New Debt Ceiling Deadline

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More