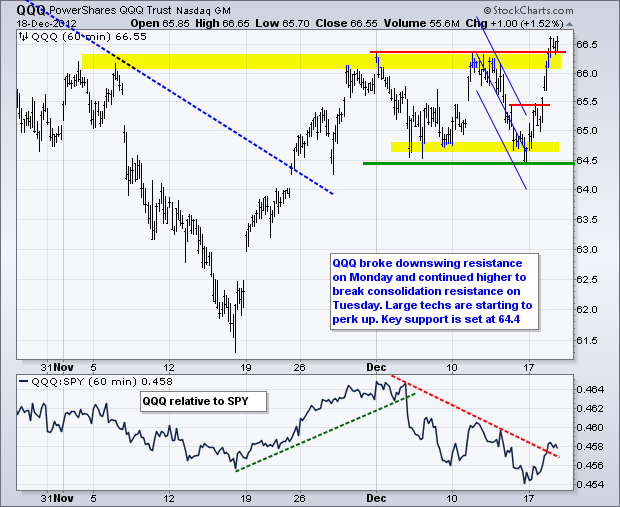

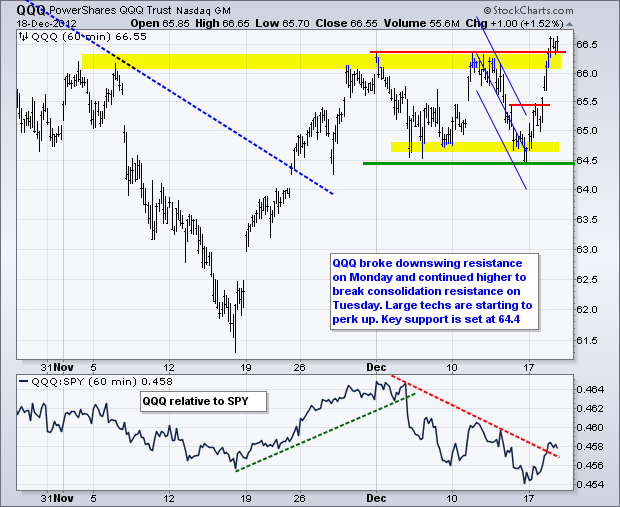

The market brushed off the fiscal cliff BS as the Santa bulls got into high gear on Tuesday. All of the major index ETFs advanced over 1% with the Nasdaq 100 Equal-Weight ETF (QQEW) leading the way (+1.52%). Small-caps were also strong with the Russell 2000 ETF (IWM) up 1.37% on the day. Eight of the nine sectors were higher with the Consumer Staples SPDR (XLP) providing the only loss. Relative weakness in this defensive sector is not too surprising with stocks clearly in risk-on mode. Energy stocks got a big boost as oil bucked gold and bounced off support.

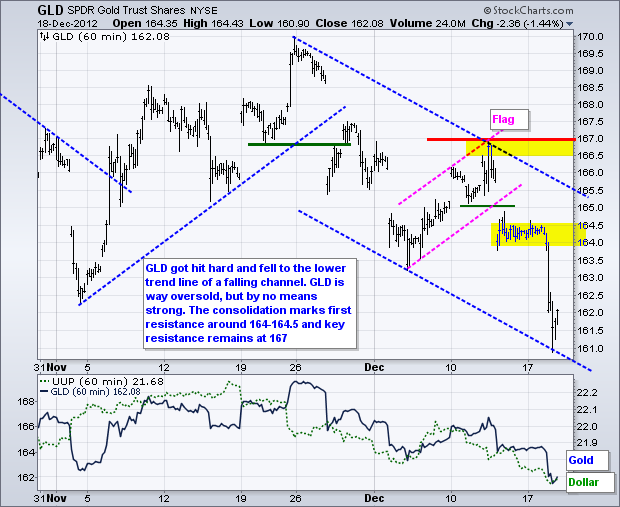

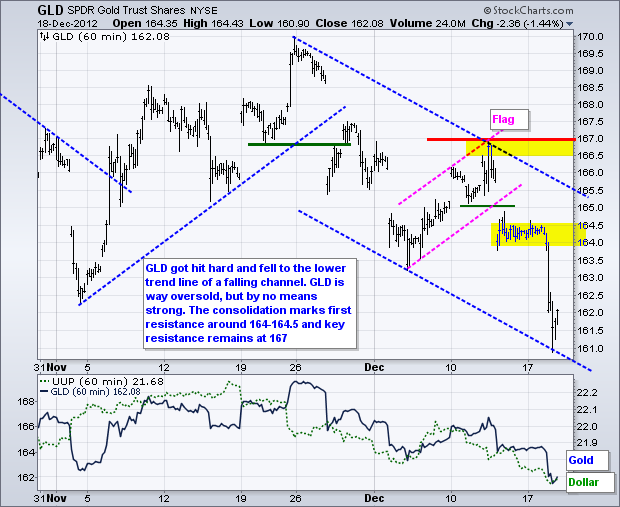

Weakness in Treasuries and strength in the Dollar fueled this rally. These two are falling sharply as the market moved to price in another trillion Dollars of quantitative easing next year. Money moving out of Treasuries needs to go somewhere and stocks are the major beneficiary. One of the Fed's objectives is to push money into riskier assets. Oil got a modest bounce off support. This bounce, however, looks rather tepid and should be watched closely. Even though more quantitative easing seems bullish for gold, the yellow metal got slammed again and remains under intense downside pressure.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Wed - Dec 19 - 07:00 - MBA Mortgage Index

Wed - Dec 19 - 08:30 - Housing Starts & Building Permits

Wed - Dec 19 - 10:30 - Oil Inventories

Thu - Dec 20 - 08:30 - Jobless Claims

Thu - Dec 20 - 08:30 - GDP

Thu - Dec 20 - 10:00 - Existing Home Sales

Thu - Dec 20 - 10:00 - Philadelphia Fed Report

Thu - Dec 20 - 10:00 - Leading Economic Indicators

Fri - Dec 21 - 08:30 - Personal Income & Spending

Fri - Dec 21 - 08:30 - Durable Good Orders

Fri - Dec 21 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Wed - Dec 19 - 07:00 - MBA Mortgage Index

Wed - Dec 19 - 08:30 - Housing Starts & Building Permits

Wed - Dec 19 - 10:30 - Oil Inventories

Thu - Dec 20 - 08:30 - Jobless Claims

Thu - Dec 20 - 08:30 - GDP

Thu - Dec 20 - 10:00 - Existing Home Sales

Thu - Dec 20 - 10:00 - Philadelphia Fed Report

Thu - Dec 20 - 10:00 - Leading Economic Indicators

Fri - Dec 21 - 08:30 - Personal Income & Spending

Fri - Dec 21 - 08:30 - Durable Good Orders

Fri - Dec 21 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More