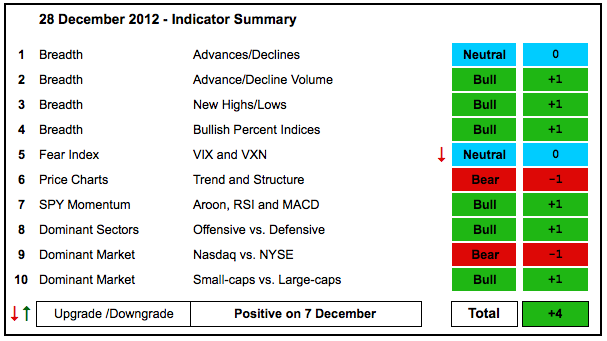

The bulk of the evidence remains bullish, but I am concerned that the major index ETFs may be forming lower highs. With the decline over the last six days, SPY and DIA peaked below their September highs and lower highs could be forming. Relative weakness in the Nasdaq is also a concern. These concerns are overshadowed by relative strength in the NYSE AD Line and AD Volume Line, and relative strength in small-caps. Also note that Net New Highs for the Nasdaq and the NYSE remain positive and the cumulative lines are above their 10-day EMAs.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More