Stocks struggled on Tuesday with the major index ETFs finishing mixed. The Dow Industrials SPDR (DIA) edged higher, but the Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQ) edged lower. Apple surged above 550 on the open, but closed below 445 as selling pressure hit. The market is wounded and the bulls are still wobbly on their feet. The sectors were also mixed with the consumer discretionary sector edging higher and the technology sector edging lower. Of note, the Home Construction iShares (ITB) failed to hold its breakout and moved sharply lower the last five days. This failed breakout amounts to a bull trap. ITB broke the June trend line and looks set to test key support at 19 soon.

There is not much change on the 60-minute chart for SPY. The ETF broke down in late October and established resistance with two peaks in early November. Last week's plunge created an oversold condition and the ETF consolidated over the last day and a half. Even though the lower trend line of the falling channel and oversold conditions may provide a bounce, any strength at this point is still viewed as a counter trend move. Broken support turns first resistance around 141 and key resistance remains in the 143.5 area.

**************************************************************************

No change. This is the spookiest move of all. The 20+ Year T-Bond ETF (TLT) broke channel resistance with a huge surge last week. Strength in TLT signals risk-off, economic weakness or worse. With this big move, treasuries are as overbought as stocks are oversold. Broken resistance turns first support in the 123-123.5 area. Key support remains at 121.7 for now.

**************************************************************************

No change. The US Dollar Fund (UUP) broke resistance with a big move in early November and edged higher the last few days. The breakout is bullish and holding. Broken resistance turns into first support in the 21.95 area. Key support remains at 21.85 for now. A pullback in the greenback could help gold, oil and stocks, but further strength would be bearish for all three.

**************************************************************************

No change. The US Oil Fund (USO) plunged along with stocks on Wednesday, but firmed on Thursday and actually bounced on Friday. Even though there is some support in the 31.5-32 area, the overall trend is down with key resistance at 33.10. Broken support, the September trend line and the early November high mark resistance here.

**************************************************************************

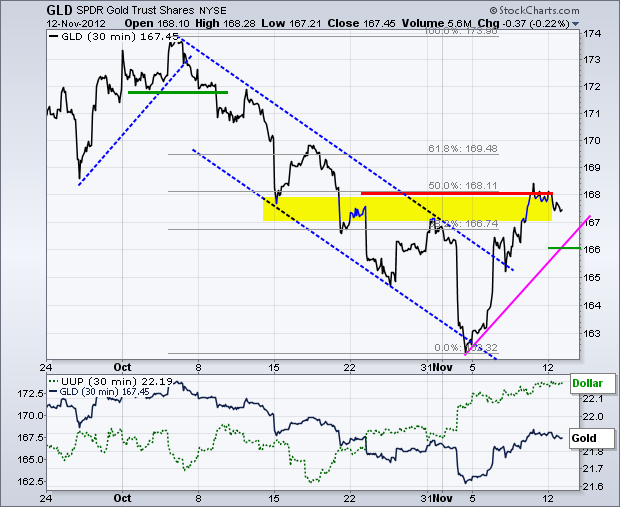

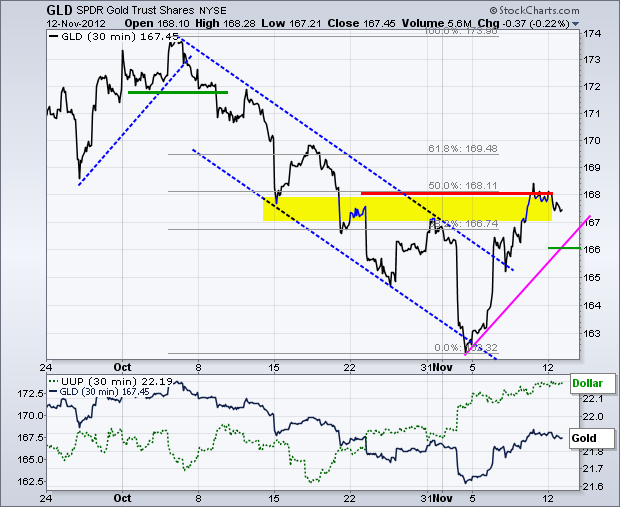

No change. This is a moment-of-truth for gold. The Gold SPDR (GLD) surged some 3% with a move back to 168. Broken support, the late October high and the 50% retracement combine to mark resistance here. Gold is currently short-term overbought as well. There is a clear up swing the last five days and I am marking swing support at 166. A break below this level would signal a failure at resistance and continuation lower.

**************************************************************************

Key Reports and Events:

Wed - Nov 14 - 07:00 - MBA Mortgage Index

Wed - Nov 14 - 08:30 - Retail Sales

Wed - Nov 14 - 08:30 – Producer Price Index (PPI)

Wed - Nov 14 - 10:00 - Business Inventories

Wed - Nov 14 - 14:00 - FOMC Minutes

Thu - Nov 15 - 08:30 – Jobless Claims

Thu - Nov 15 - 08:30 – Consumer Price Index (CPI)

Thu - Nov 15 - 08:30 - Empire Manufacturing

Thu - Nov 15 - 10:00 - Philadelphia Fed

Thu - Nov 15 - 11:00 - Crude Inventories

Fri - Nov 16 - 09:15 - Industrial Production

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

**************************************************************************

No change. This is the spookiest move of all. The 20+ Year T-Bond ETF (TLT) broke channel resistance with a huge surge last week. Strength in TLT signals risk-off, economic weakness or worse. With this big move, treasuries are as overbought as stocks are oversold. Broken resistance turns first support in the 123-123.5 area. Key support remains at 121.7 for now.

**************************************************************************

No change. The US Dollar Fund (UUP) broke resistance with a big move in early November and edged higher the last few days. The breakout is bullish and holding. Broken resistance turns into first support in the 21.95 area. Key support remains at 21.85 for now. A pullback in the greenback could help gold, oil and stocks, but further strength would be bearish for all three.

**************************************************************************

No change. The US Oil Fund (USO) plunged along with stocks on Wednesday, but firmed on Thursday and actually bounced on Friday. Even though there is some support in the 31.5-32 area, the overall trend is down with key resistance at 33.10. Broken support, the September trend line and the early November high mark resistance here.

**************************************************************************

No change. This is a moment-of-truth for gold. The Gold SPDR (GLD) surged some 3% with a move back to 168. Broken support, the late October high and the 50% retracement combine to mark resistance here. Gold is currently short-term overbought as well. There is a clear up swing the last five days and I am marking swing support at 166. A break below this level would signal a failure at resistance and continuation lower.

**************************************************************************

Key Reports and Events:

Wed - Nov 14 - 07:00 - MBA Mortgage Index

Wed - Nov 14 - 08:30 - Retail Sales

Wed - Nov 14 - 08:30 – Producer Price Index (PPI)

Wed - Nov 14 - 10:00 - Business Inventories

Wed - Nov 14 - 14:00 - FOMC Minutes

Thu - Nov 15 - 08:30 – Jobless Claims

Thu - Nov 15 - 08:30 – Consumer Price Index (CPI)

Thu - Nov 15 - 08:30 - Empire Manufacturing

Thu - Nov 15 - 10:00 - Philadelphia Fed

Thu - Nov 15 - 11:00 - Crude Inventories

Fri - Nov 16 - 09:15 - Industrial Production

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More