Stocks ended their meandering ways with some downside direction on Tuesday. The Nasdaq 100 ETF (QQQ) and Russell 2000 ETF (IWM) led the way lower with losses around 1.4%. All nine sectors were lower with the Technology SPDR (XLK) and Finance SPDR (XLF) leading the way. The defensive sectors held up the best as money remained in relative safety (healthcare and utilities).

Keep in mind that the major index ETFs are up substantially since early June and third quarter earning season is kicking in. Reports so far have been less than stellar and a continuation of this trend could translate into a correction over the next few weeks. Caterpillar (CAT) was the latest to cut its forecast and warn of a sluggish global economy.

Keep in mind that the major index ETFs are up substantially since early June and third quarter earning season is kicking in. Reports so far have been less than stellar and a continuation of this trend could translate into a correction over the next few weeks. Caterpillar (CAT) was the latest to cut its forecast and warn of a sluggish global economy.

The biggest losses occurred within the materials sector as steel, mining and coal stocks were hit exceptionally hard. Note that the Steel ETF (SLX) failed to hold its breakout. SLX attempted to firm around 46, but moved back through the resistance break like a hot knife through butter. Even though this pullback could evolve into a 61.80% retracement of the September surge, it looks like a failed breakout right now.

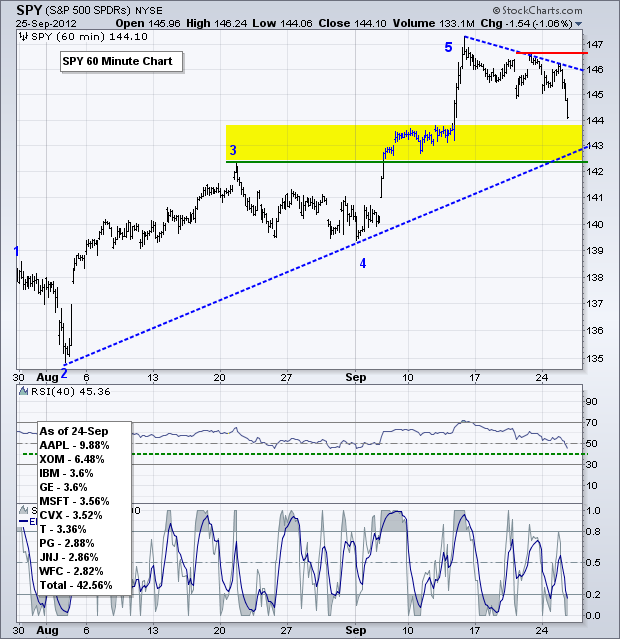

After meandering lower since the peak above 147, the decline accelerated as SPY fell over 1% with a decisive move below 145. This is a mini support break that sets up a test of short-term support in the 143 area. Support here stems from the early August trend line, broken resistance and the mid September consolidation. A move below 142.4 would break short-term support and reverse the short-term uptrend that has been in place for several weeks now. RSI is also setting up for a support test in the 40-50 zone.

**************************************************************************

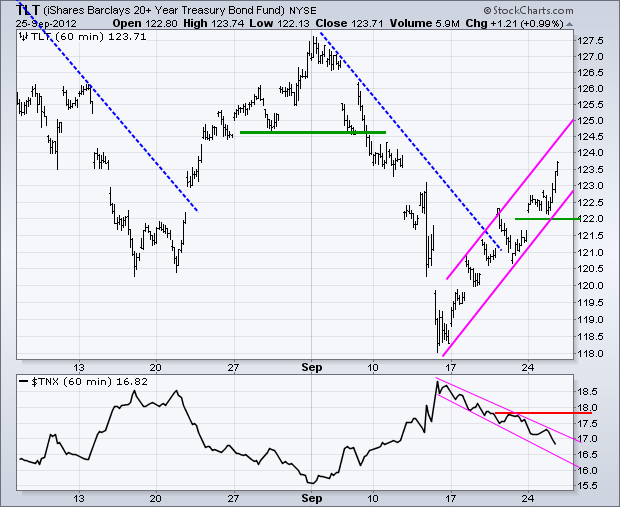

The 20+ Year T-Bond ETF (TLT) flashed the warning sign last week with a fairly sharp advance back above 121. This uptrend continued this week as TLT surged above 123.50 on Tuesday. Money moving into treasuries is money that is not available for stocks and other riskier assets. Moreover, the decline in treasury yields points to weakness in the economy (perhaps third quarter earnings). I am marking support at 122 for TLT.

**************************************************************************

No change. The US Dollar Fund (UUP) has been positively correlated with US Treasuries. This makes sense because both rise when the risk trade is on and both fall when the risk trade is off. The risk trade has been off since mid September as UUP bottomed and bounced from oversold levels. The overall trend remains down with resistance marked in the 2.10 area. With last week's rise, I can mark short-term support at 21.68, a break of which would signal a continuation of the downtrend.

**************************************************************************

No change. The US Oil Fund (USO) broke down last week, bounced on Thursday-Friday and continued lower this week. An overall trend is clearly down, but oil is getting short-term oversold after an 8% decline in one week. Broken support turns into first resistance in the 35-35.5 area. RSI resistance is set in the 50-60 area.

**************************************************************************

No change. The Gold SPDR (GLD) fell back into its consolidation with support at 170. While a break below this level would be short-term negative, I would not consider this a bearish development because there is a bigger support zone in the 167-168 area. A lot will depend on the Dollar (Euro) and stock market. Gold is positively correlated to stocks and the Euro. A correction in these two would likely produce a correction in gold.

**************************************************************************

Key Reports and Events:

Wed - Sep 26 - 07:00 - MBA Mortgage Index

Wed - Sep 26 - 10:00 - New Home Sales

Wed - Sep 26 - 10:30 - Oil Inventories

Thu - Sep 27 - 08:30 - Jobless Claims

Thu - Sep 27 - 08:30 – Durable Goods Orders

Thu - Sep 27 - 08:30 – GDP

Thu - Sep 27 - 10:00 - Pending Home Sales

Fri - Sep 28 - 08:30 - Personal Income & Spending

Fri - Sep 28 - 09:45 - Chicago PMI

Fri - Sep 28 - 09:55 - Michigan Sentiment

Sat – Oct 06 – 09:00 – EU Summit

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More