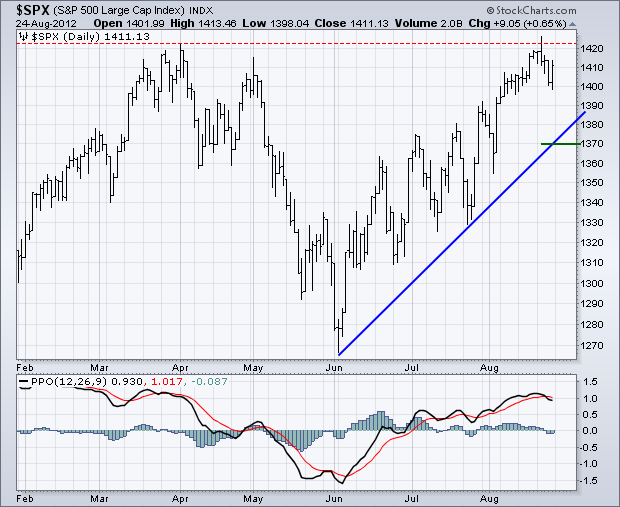

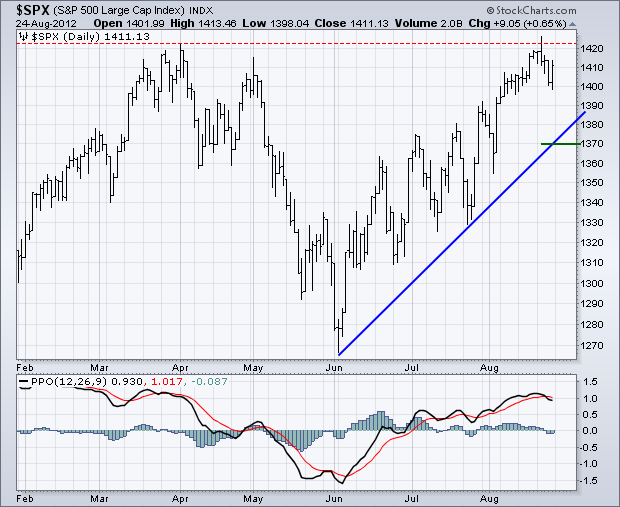

Comments from Fed chairman Bernanke boosted stocks on Friday as the major index ETFs closed with modest gains. Despite Friday's bounce, the major index ETFs closed lower for the week. This is not surprising because stocks were overbought to start the week and a few indices hit new 52-week highs intraday on Tuesday. The S&P 500, Nasdaq 100 and S&P 100 all hit new highs Tuesday and then backed off Wednesday-Thursday. Even though the bears will suggest that the inability to hold these highs is bearish, I think simply fact that these three indices are trading within spitting distance of 52-week highs is a testament to underlying strength and the overall uptrend.

It is going to be a pretty big week or two for the markets. First, the economic docket is quite full with the Fed's beige book, GDP, jobless claims and factory orders. Economic reporting will take center stage next week with the employment report on Friday, September 7th. Second, stocks were overbought and some of the major indices hit resistance last week. While the uptrends are not in jeopardy, we could see some flat trading as stocks digest the gains since early June. Third, Europe is coming back to the forefront as vacations end and leaders jawbone about the next stage. Mario Drahgi has made it clear that the printing presses at the European Central Bank (ECB) are ready to go. This may explain the rally in precious metals over the last few weeks. And finally, China remains in the spot light as the Shanghai Composite ($SSEC) hit a new 52-week low again this morning. This may explain continued weakness in industrial metals and steel stocks.

The S&P 500 ETF (SPY) pulled back and formed a bull flag from Tuesday morning to the close on Thursday. With a surge on Friday, the ETF broke flag resistance to signal a continuation higher. The correction or pullback was less than three days, which is actually typical for a strong uptrend. At this point, the flag breakout needs to hold. A quick move back below 140.80 would negate the breakout and put the ETF back in corrective mode. I am setting key support in the 138.5-139 area. The Raff Regression Channel extends up from the mid July low to the late August high. The lower line of this channel ends at 138.50 to mark support. There is also support in this area from broken resistance.

**************************************************************************

Treasuries are going to have to give up their rally if stocks are to continue theirs. After becoming oversold near 121, the 20+ Year T-Bond ETF (TLT) surged above channel resistance and this breakout is holding. I am marking resistance in the 126.50 area. First support is set at 124.5 and a break below this level would suggest a move towards the risk-on trade.

**************************************************************************

The US Dollar Fund (UUP) became very oversold last week as 30-period RSI on the 60-minute chart moved below 30 for the first time this year and 14-day RSI moved below 30 for the first time since February. The ETF bounced on Friday, even as stocks rallied. Even though I still consider the bigger trend up, the short-term trend remains down with first resistance at 22.60.

**************************************************************************

There is not much change in oil. The US Oil Fund (USO) started the week overbought with a surge above 36.25 and then corrected with a choppy decline. The big trend remains up and last week's choppy decline is viewed as a corrective process. Broken resistance marks first support in the 35-32.25 area. RSI is trading in its support zone now (40-50).

**************************************************************************

The Gold SPDR (GLD) broke resistance with a big move on Tuesday and surged above 162. GLD is short-term overbought after a 4.5% surge in less than two weeks. Also note that weakness in the Dollar helped gold and a bounce in the Dollar could hurt. Broken resistance turns into the first support zone in the 157-158 area. Key support remains at 153.50.

**************************************************************************

Key Reports and Events:

Tue - Aug 28 - 09:00 - Case-Shiller Housing Index

Tue - Aug 28 - 10:00 - Consumer Confidence

Wed - Aug 29 - 07:00 - MBA Mortgage Index

Wed - Aug 29 - 08:30 - GDP

Wed - Aug 29 - 10:00 - Pending Home Sales

Wed - Aug 29 - 10:30 - Oil Inventories

Wed - Aug 29 - 14:00 - Fed's Beige Book

Thu - Aug 30 - 08:30 - Jobless Claims

Thu - Aug 30 - 08:30 - Personal Income & Spending

Fri - Aug 31 - 09:45 - Chicago Purchasing Managers Index (PMI)

Fri - Aug 31 - 09:55 - Michigan Sentiment

Fri - Aug 31 - 10:00 - Factory Orders

Fri – Aug 31 – 09:00 – Jackson Hole Central Bank Symposium

Tue – Sep 11 – 09:00 – Troika to Greece

Wed – Sep 12 – 09:00 – German Constitutional Court Ruling

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More