Stocks clearly broke down with a broad-based decline on Tuesday. Even though the short-term trend is now down, keep in mind that stocks are already short-term oversold and the medium-term trend is still up. On the S&P 500 ETF (SPY) chart, the ETF broke the support zone with a gap below 136 and close below 135. Broken support and the Monday afternoon high mark the first resistance zone in the 136.40-137 area. RSI broke below 40 on Monday for the early warning and moved below 30 for the first time since mid December. The 50-60 zone now becomes resistance.

**************************************************************************

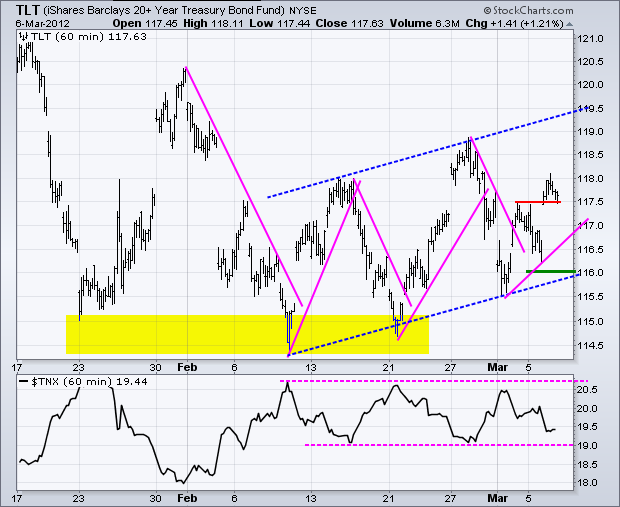

The 20+ Year T-Bond ETF (TLT) surged above 117.50 as money moved into relative safety. The blue trendlines show a zigzag higher over the last four weeks or so. The pink trendlines show the swings within this zigzag higher. The 4-week trend is up and the swing within that trend is up. I am marking support at 116 and a break below this level would be bearish.

**************************************************************************

The US Dollar Fund (UUP) surged and consolidated again. This time resistance from the mid February highs is coming into play. Also note that the Dollar is short-term overbought after a surge the last four days. RSI moved into bull mode with a break above 60 and the 40-50 zone becomes support. Greek bondholders are in the process of accepting or rejecting the terms of their haircut. The deadline is Thursday and successful resolution could provide a boost for the oversold Euro.

**************************************************************************

Oil declined along with the stock market and the Euro. Strength in the Dollar weighed on commodities across the board on Tuesday, but the US Oil Fund (USO) finished the day right at support. I am tempted to draw through the spike above 42 because this is based on false rumors of a Saudi pipeline explosion. Overall, it looks like a falling wedge is taking shape with resistance at 41. A break above this level would signal a continuation higher.

**************************************************************************

The Gold SPDR (GLD) fell further as strength in the Dollar and weakness in the stock market took their toll. GLD failed to hold the flag breakout, broke support and is now in a freefall. Broken support in the 166-167 area turns into the first resistance zone to watch. I am setting key resistance at 168 for now.

**************************************************************************

Key Economic Reports:

Wed - Mar 07 - 07:00 - MBA Mortgage Index

Wed - Mar 07 - 08:15 - ADP Employment Change

Wed - Mar 07 - 10:30 - Oil Inventories

Wed - Mar 07 - 15:00 - Consumer Credit

Thu - Mar 08 - 07:30 – Deadline for Greek Debt Holders

Thu - Mar 08 - 07:30 - Challenger Job Cuts

Thu - Mar 08 - 08:30 - Jobless Claims

Fri - Mar 09 - 08:30 - Employment Report

Charts of Interest: Tuesday and Thursday in separate post.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More