It was a rather strange week on the intermarket front. Stocks and oil moved higher, which is normal. However, treasuries also moved higher, which is not normal. Strength in stocks and oil should be offset by weakness in treasuries. Strength in treasuries could signal that some traders are taking a more defensive stance, as stocks remain quite overbought. Also note that small-caps are still underperforming because the Russell 2000 ETF (IWM) remains below its 3-Feb high and stuck in a trading range. In contrast, SPY and QQQ moved above their corresponding high. The warning signs continue, but we have yet to see any kind of breakdown on the price charts or sustained selling pressure. On the S&P 500 ETF (SPY) chart, the lows of the last two weeks turn into the first support zone around 134-135. RSI continues to hold its bull zone (40-80). A break below 134 in SPY and 40 in RSI would reverse the current uptrend, which is now entering its 11th week. As noted last week, be careful with the first support break because pent-up demand could trigger a decent bounce in the first pullback.

**************************************************************************

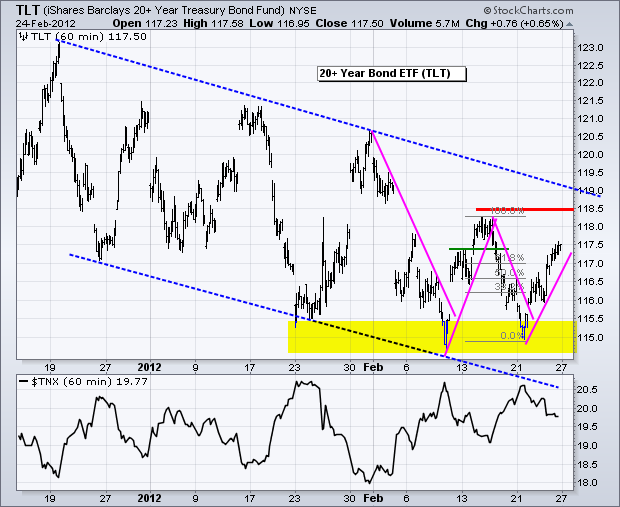

Even though several negative factors area working against treasuries right now, the 20+ Year T-Bond ETF (TLT) and the 7-10 year T-Bond ETF (IEF) moved higher last week. Rising in the face of negative news is bullish. Technically, TLT remains in a downtrend overall, but bounced off support in the 115 area for the third time in five weeks. Overall, the decline from 19-Dec to 24-Feb looks like a big falling flag on the daily chart. A break above the upper trendline would signal a continuation of the prior advance (27-Oct to 19-Dec). It is hard to image treasuries breaking out with oil so strong, but stranger things have happened. Perhaps a correction in stocks and oil would facilitate a breakout in TLT. Traders should also keep an eye on the overbought Euro. A decline in the Euro and advance in the Dollar would be positive for treasuries.

**************************************************************************

The US Dollar Fund (UUP) is short-term oversold after a plunge from 22.30 to 21.80 last week. The ETF broke below the early February low and remains in a downtrend since 13-Jan. Admittedly, I have a bearish bias towards the Euro, but price action is not supporting this bias right now. Sentiment towards the Euro was quite bearish a few weeks ago and a lot of short positions were surely squeezed with last week's surge. On the UUP chart, the ETF is near the lower trendline of a small channel. A quick surge above 22 would break the upper trendline and possibly put in a low. Key resistance is set at 22.30 and RSI resistance at 60.

**************************************************************************

The perfect storm fueled a sharp rise in oil the last few weeks. This storm included speculators, Middle East tensions, a strong stock market, improving economic stats and a weak Dollar. The US Oil Fund (USO) is quite overbought after a surge from 37 to 42 (13.5%) in 3-4 weeks. Note that this move broke falling flag resistance on the daily chart. Nevertheless, the ETF is ripe for a pullback or consolidation. Broken resistance marks first support in the 38.5-39 area.

**************************************************************************

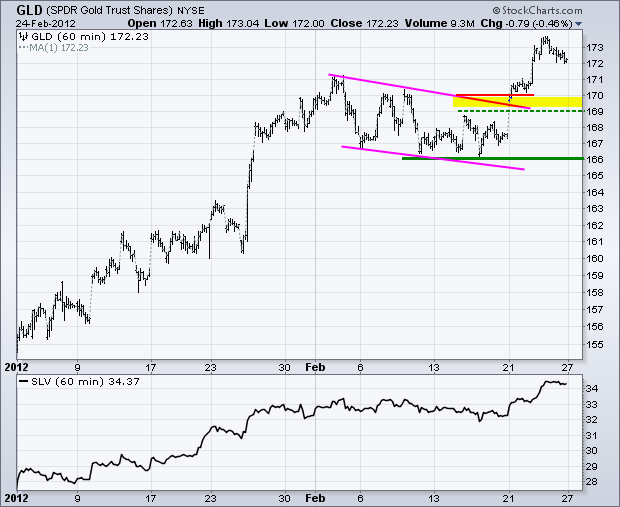

Gold is also benefitting from a strong stock market and weak Dollar. The Gold SPDR (GLD) broke flag resistance on Monday and held this break the entire week. Broken resistance turns first support in the 169-170 area. Key support remains at 166.

**************************************************************************

Key Economic Reports:

Mon - Feb 27 - 10:00 - Pending Home Sales

Tue - Feb 28 - 08:30 - Durable Orders

Tue - Feb 28 - 09:00 - Case-Shiller 20-city Index

Tue - Feb 28 - 10:00 - Consumer Confidence

Wed - Feb 29 - 07:00 - MBA Mortgage Index

Wed - Feb 29 - 08:30 – GDP Estimate

Wed - Feb 29 – 08:00 - Second LTRO round for EU Banks

Wed – Feb 29 – 08:00 – Italian bond auction

Wed - Feb 29 - 09:45 - Chicago Purchasing Manufacturers Index

Wed - Feb 29 - 10:30 - Oil Inventories

Wed - Feb 29 - 14:00 - Fed's Beige Book

Thu - Mar 01 - 08:30 - Jobless Claims

Thu - Mar 01 - 08:30 - Personal Income & Spending

Thu - Mar 01 - 10:00 – ISM Manufacturing Index

Thu - Mar 01 - 10:00 - Construction Spending

Thu - Mar 01 - 14:00 - Auto & Truck Sales

Charts of Interest: Tuesday and Thursday in separate post.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.