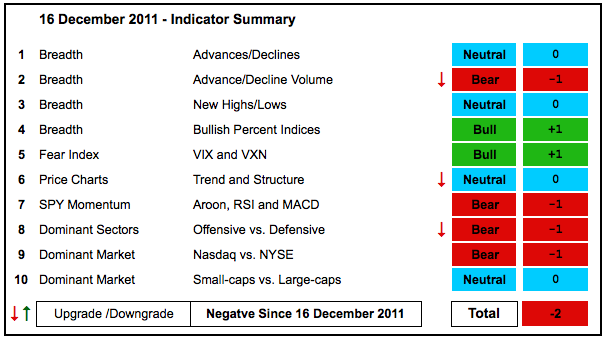

The market is about as mixed up as it can be right now. With a few downgrades this week, the indicator summary flipped back to negative territory (-2). There are still a few neutral readings out there that could go either way with a significant move. The AD Volume Lines were this week's big downgrade. Both formed lower highs in early December and the 125-day EMA of Net Advancing Volume moved into negative territory. As far as the November surge is concerned, the S&P MidCap 400 SPDR (MDY) and Nasdaq 100 ETF (QQQ) clearly filled the gaps from November 30th and broke their 50-day SMAs. Even though the Dow Industrials SPDR (DIA) is holding up, relative weakness in MDY and QQQ is not a good sign. I am also concerned with continued relative strength in the defensive sectors. This market is clearly not in the mood to embrace risk. Keep in mind that this indicator summary is simply an assessment of current conditions. It is NOT a market timing tool. I tally the indicators just to get an idea of the balance of power.

- AD Lines: Neutral. The Nasdaq AD Line hit a new low and remains in a strong downtrend. The NYSE AD Line formed lower highs in November and early December. A break below the late November low would turn this indicator bearish.

- AD Volume Lines: Bearish. The Nasdaq AD Volume Line is testing support from the late November low, a break of which would be bearish. Notice that the 125-day EMA of Nasdaq Net Advancing Volume moved below -2.5%. The NYSE AD Volume Line failed to hold the October breakout and formed a lower high in early December. The 125-day EMA of NYSE Net Advancing Volume turned negative again.

- Net New Highs: Neutral. Nasdaq Net New Highs remain negative and the Cumulative Net New Highs Line is below its 10-day EMA. NYSE Net New Highs are barely positive, but the Cumulative Net New Highs Line is still rising. A break below the trendline extending up from the October low.

- Bullish Percent Indices: Bullish. Seven of the nine BPIs remain above 50%. The Utilities BPI ($BPUTIL) is at a whopping 93.75%.

- VIX/VXN: Bullish. Surprisingly, the CBOE Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) are trending down and both broke below their late October lows this week.

- Trend Structure: Neutral. QQQ and MDY filled the gaps from November 30th and broke their 50-day SMA. SPY and IWM closed below their 50-day SMAs on Thursday, but remain in the gap zones. DIA held the gap and its 50-day SMA. The major index ETFs are quite mixed.

- SPY Momentum: Bearish. RSI has yet to break 60 to turn bullish. Aroon (20) has yet to break +50 to turn bullish. MACD(5,35,5) is barely positive territory.

- Offensive Sector Performance: Bearish. The defensive sectors (utilities, consumer staples and healthcare) are outperforming the offensive sectors (finance, consumer discretionary, technology and industrials). XLF, XLY and XLK broke below their 50-day SMAs.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio flattened from late October to mid December as the ratio held its late October low. It has yet to turn up though and a move above the mid November high is needed to show Nasdaq leadership.

- Small-cap Performance: Neutral. The $RUT:$OEX ratio surged in October and pulled back in late November. Overall, an inverse Head-and-Shoulders pattern has taken shape since August. A break above the August-November highs would show serious relative strength returning to small-caps.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight.

Previous turns include:

Positive on 11-Sept-09

Negative on 5-Feb-10

Positive on 5-March-10

Negative on 11-Jun-10

Positive on 18-Jun-10

Negative on 24-Jun-10

Positive on 6-Aug-10

Negative on 13-Aug-10

Positive on 3-Sep-10

Negative on 18-Mar-11

Positive on 25-Mar-11

Negative on 17-Jun-11

Positive on 30-Jun-11

Neutral on 29-Jul-11

Negative on 5-August-11

Positive on 28-October-11

Negative on 23-November-11

Positive on 3-December-11

Negative on 16-December-11