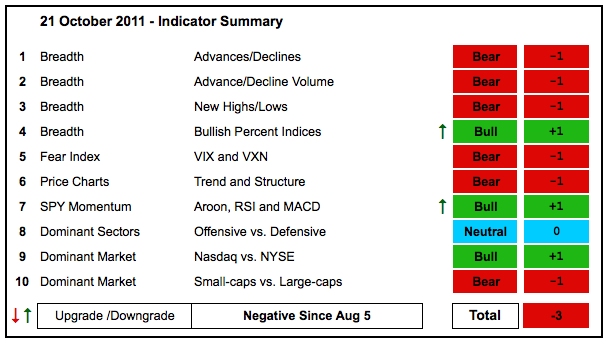

The October rally stalled over the last few days and many charts show that this stall is occurring at important levels. The S&P 500 ETF (SPY) and Dow Industrials SPDR (DIA) are both stalling at resistance from the late August highs. The NYSE AD Line and Nasdaq AD Volume Line are also at resistance. The Cumulative Net New Highs lines flattened out over the last two weeks and any strength would push them above their 10-day EMAs. This means a strong move next week would trigger breakouts in a number of indicators. For now, the bulk of the evidence remains bearish until proven other wise.

Keep in mind that this is an equal weighed numerical summary of 10 indicator groups. It is not designed as a market timing tool. It is designed to ascertain current market conditions. Bullish conditions favor trades involving support tests, retracement pullbacks and/or bullish corrective patterns (falling flags, wedges or channels). Bearish conditions favor trades involving resistance failures, retracement bounces or bearish corrective patterns (rising flags, wedge or channels). General conditions provide the trading bias. Patterns provide the setups and define the risk-reward ratio.

- AD Lines: Bearish. The Nasdaq AD Line surged after hitting a 52-week low on 3-Oct, but remains in a downtrend overall. The NYSE AD Line formed a bullish divergence from August to October and surged into its resistance zone. This is a moment-of-truth.

- AD Volume Lines: Bearish. The Nasdaq AD Volume Line is challenging resistance, but the NYSE AD Volume Line remains below resistance. No clear breakouts yet.

- Net New Highs: Bearish. New lows dried up over the last week, but we have yet to see a significant increase in new highs. The Cumulative Net New Highs Lines remain in downtrends and below their 10-day EMAs.

- Bullish Percent Indices: Bullish. Eight of the nine Bullish Percent Indices are above 50%. Only the HealthCare BPI ($BPHEAL) is below 50% (31.37%). The BPI is above 50% when more than half of the sector components are on P&F Double Top Breakout signals.

- VIX/VXN: Bearish. The CBOE Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) both dipped below 30 and below their September lows, but bounced back above 30 over the last few days. There is still a relatively high level of fear and this is negative.

- Trend Structure: Bearish. QQQ broke above resistance, but the other major index ETFs have yet to confirm. SPY and DIA stalled at their late August highs, while MDY and IWM fell short.

- SPY Momentum: Bullish. The momentum indicators are all in bull mode. RSI is rising and above 50 (watch support at 40). MACD(5,35,5) is in positive territory. Aroon moved to 50. This could quickly change, but it is bullish until it actually changes.

- Offensive Sector Performance: Neutral. The Technology ETF (XLK) and the Consumer Discretionary SPDR (XLY) are leading the market, but the Finance SPDR (XLF) and the Industrials SPDR (XLI) remain laggards.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio remains in an uptrend overall, but formed a lower high in October. A break below the prior trough would show relative weakness in Nasdaq stocks and this would be negative for the overall market.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio hit a new 52-week low in early October and surged back to its August lows. This is still just an oversold bounce within a bigger downtrend. Small-caps show relative weakness overall.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight.

Previous turns include:

Positive on 11-Sept-09

Negative on 5-Feb-10

Positive on 5-March-10

Negative on 11-Jun-10

Positive on 18-Jun-10

Negative on 24-Jun-10

Positive on 6-Aug-10

Negative on 13-Aug-10

Positive on 3-Sep-10

Negative on 18-Mar-11

Positive on 25-Mar-11

Negative on 17-Jun-11

Positive on 30-Jun-11

Neutral on 29-Jul-11

Negative on 5-August-11