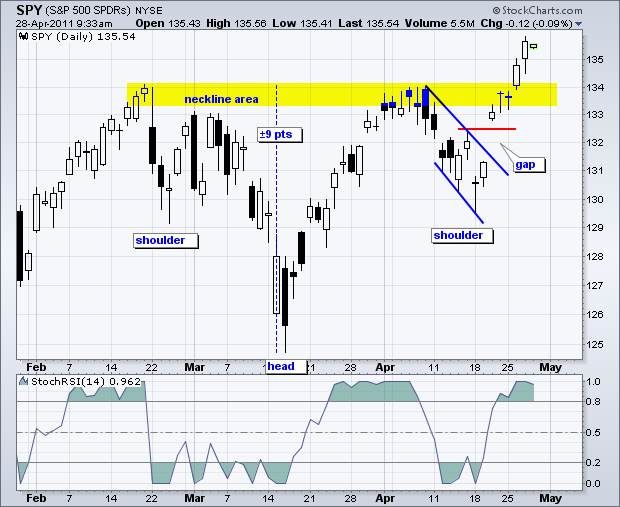

There is no change on the daily chart. The S&P 500 ETF (SPY) broke above neckline resistance that extends from late February to early April. This is another 52-week high that simply re-affirms the long-term uptrend. Traditionally, broken resistance turns into support. This suggests that the 133-134 area will mark the first support zone to watch on any pullback. Based on classical technical analysis, the head-and-shoulders projection is above 140. The height of the pattern is added to the neckline breakout for a target. The ongoing health of the uptrend is more important than the target. I will stay bullish until there is evidence to the contrary.

On the 60-minute chart, SPY broke above flag resistance with a gap up and never looked back. After a rest on Friday, the index continued higher on Tuesday-Wednesday. Classical technical analysis also has a methodology for upside targets on flags, which are said to fly at half-mast. The pole extends from 125 to 134 (9 points). We can add this to the flag low for a target around 138.5 (129.5 + 9). This is not as high as the head-and-shoulders target, but flags are usually smaller patterns. Regardless of the targets, the first support zone resides around 132-132.5 and RSI remains bullish as long as it holds above 35.

Key Economic Reports/Events:

Thu - Apr 28 - 08:30 - GDP

Thu - Apr 28 - 08:30 - Jobless Claims

Thu - Apr 28 - 10:00 - Pending Home Sales

Fri - Apr 29 - 08:30 - Personal Income and Spending

Fri - Apr 29 - 09:45 - Chicago PMI

Fri - Apr 29 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

Key Economic Reports/Events:

Thu - Apr 28 - 08:30 - GDP

Thu - Apr 28 - 08:30 - Jobless Claims

Thu - Apr 28 - 10:00 - Pending Home Sales

Fri - Apr 29 - 08:30 - Personal Income and Spending

Fri - Apr 29 - 09:45 - Chicago PMI

Fri - Apr 29 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More